Mumbai — India’s insurance sector is set to enter a phase of sustained expansion, with premium growth expected to outpace most major global markets over the next five years, according to a new outlook by global reinsurance major Swiss Re. Swiss Re projects that India’s insurance premiums will grow...

Kathmandu – National Life Insurance Company Limited has successfully completed its MDRT Honors and Training Program at Dusit Thani Himalayan Resort, Dhulikhel, under the chief hospitality of the company’s President, Prema Rajya Lakshmi Singh, and the chairmanship of Chief Executive Officer (CEO). During the program, a total of 83 agents—including 2 Top of the Table (TOT) members, 4 Court of the Table (COT) members,...

Kathmandu — The long-standing insurance dispute between apple farmers of Jumla and Shikhar Insurance Company has been resolved following tripartite discussions involving the government, the insurer, and farmers’ representatives. According to the agreement, apple farmers from Tatopani, Patarasi, and Kanakasundari rural municipalities will receive insurance compensation for crop losses. The decision was reached after a series of negotiations coordinated...

Editorial For the Nepal Insurance Authority (NIA), the past seven months have been marked not by regulatory breakthroughs, but by turmoil. The nation’s apex insurance watchdog has seen two of its most senior leaders fall under scrutiny—one acquitted, the other suspended—and now stands cautiously under interim leadership. These events, unfolding one after another, have exposed not just the fragility...

Kathmandu – There is intense competition in investment expansion between the two reinsurance companies operating in Nepal—government-owned Nepal Reinsurance Company and private sector–run Himalayan Reinsurance Company. Both companies are actively expanding their investments across various sectors, including fixed deposits in banks and financial institutions, ordinary shares of public companies, as well as projects related to solar energy, education, health,...

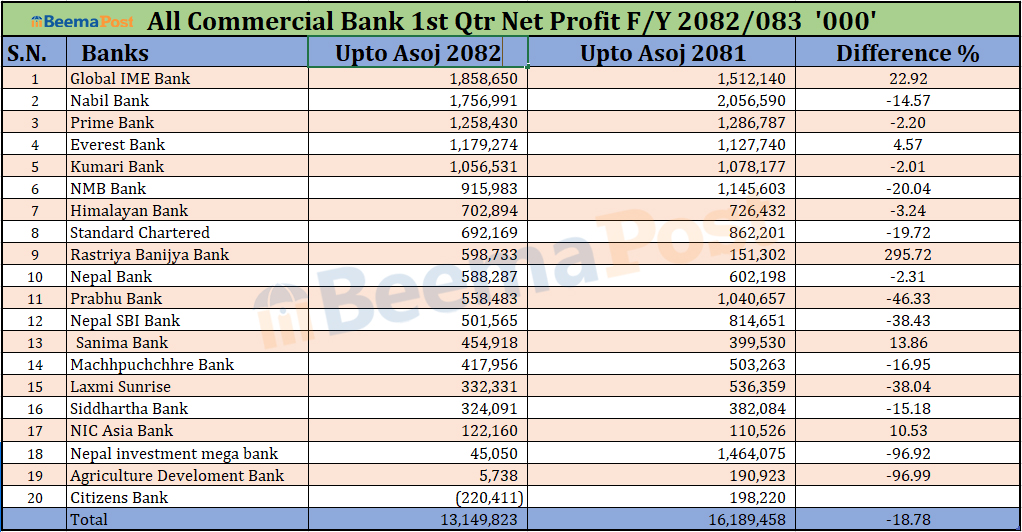

Kathmandu – Commercial banks in Nepal have earned a total profit of Rs 13.14 billion in the first quarter of the current fiscal year 2082/83, according to the financial statements made public by the banks. The figure represents a double-digit decline compared to the same period last fiscal year, when banks had earned Rs 16.18 billion. Out of the 20 commercial banks, the profits of 15 banks have decreased,...