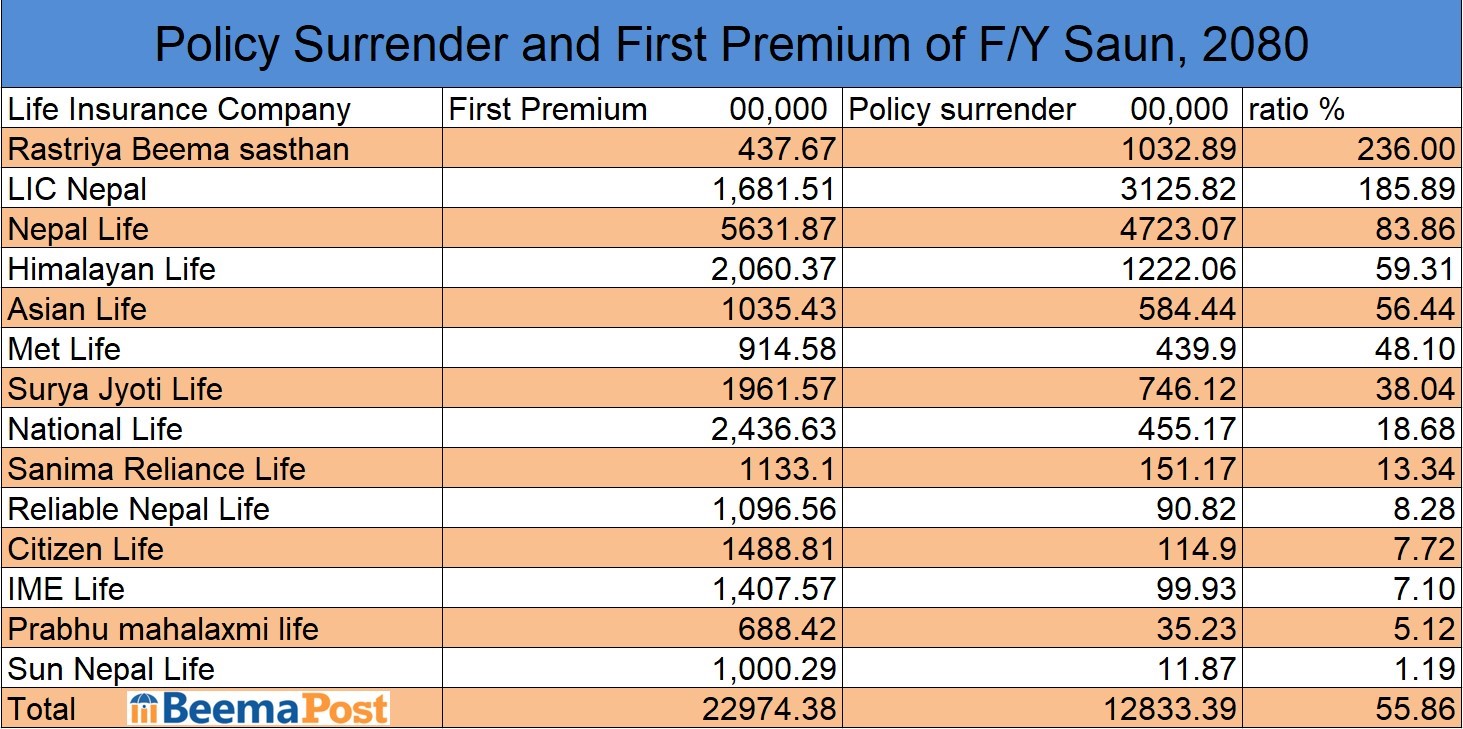

Life Insurance is having though Time on the Month of mid July 2023 According to the Data, 55% of Total New Business Insurance policies Get Surrendered

Statistics show that Nepal life insurance sector is about to reach a painful situation. In the month of July, half of the amount that life insurance companies brought in from new insurance business came out of the policy surrender due to which the situation in the life insurance sector has become alarming.

According to the data of Nepal Insurance Authority, 14 life insurance companies that are currently operating have brought in new insurance business worth 2.29 billion in the month of July, out of which around 1.28 million policies has been surrendered according to the data. This shows the bad impact in the sustainability of insurance companies in future.

This situation has been invited by several reasons, i.e; due to lack of skilled manpower in the regulatory Nepal Insurance Policy, inability to make correct insurance policy, economic crisis in the country and failure of insurance agents to properly explain to the insured when selling insurance policies, e.t.c. The regulator Nepal Insurance Authority has been claiming that this situation has arisen because the insurance agent has given wrong information.

Insurance expert Dr.Ranbir Ghimire says,” It is the right of the insured to surrender the insurance policy but a separate committee should be established to find out where other this situation will effect both the insured and insurance company as well.” He also added that reduction of 1st insurance premium has also become another serious situation along with the surrender of the policies. 18% of the total first insurance fee is spent on the insurance agent and 25% on the management, a total of 43% has been spent at the beginning. And Out of the remaining 57 %, it is seen that about 51% have surrendered in the statistics of July this year. Similarly another Insurance expert Bhojraj Sharma says ,”If the insurance policies get surrendered like this then both the insured and the insurance company faces losses.

” Looking at the data, there is a rush to bring in new business, but this problem has also been seen due to the declining interest of insurance agents in renewing old insurance. Recently, both insurance agents and new insurance businesses are decreasing in the life insurance sector. There is still a tendency for insurance agents to keep the Insured under surveillance due to the greed of getting good commissions in the early years but again neglecting them after the insurance plan gets old.

Whereas even the insured people also fully depend on insurance agent due to which the renewal process has been lacked . If the priority of the agent is reduced in the renewal, even if there is no problem for the time being, it can have a complex effect in the long run, according to insurance officials. In the life insurance business, surrender and earning of first insurance premiums plays the vital role. If the surrender amount increases more than the first insurance premium, the growth rate of the life insurance fund may decrease. Due to the interrelationship between the first premium earned and the surrender, the bonus rate that the insured will receive in the future may also be affected.

In the current situation, due to the impact of economic recession, the number of people interested in surrendering insurance policies has increased rapidly. Insurance companies have advised not to surrender the policy as much as possible. They provide loans by keeping the insurance as collateral until they meet. Some companies suggest to continue the policy even after reducing the sum assured according to the features in the policy. On the one hand, lack of finances, on the other hand, due to the mandatory situation of having to pay the renewal insurance fee ; these two reason are creating problems for insured people which has to be changed for better insurance policies.