Giving an Insurance Policy as a Gift on Dashain Without Spending a Fortune?

Rajan Kathayat

Kathmandu: In recent times, the tendency to spend extravagantly in the name of festivals and various other original and cultural programs is not discouraged anymore. It is necessary to increase the practice of saving insurance for the future of yourself and your loved ones by reducing unnecessary expenses in the name of festivals and celebrations.

Insurance is the process of transferring the financial burden of the risk to the insured’s life, property or liability to the insurer.

There are many possibilities of disasters and risks in life, everywhere. Disaster can happen in human life at any time. Insurance is the appropriate means of transferring such uncertain risks and getting compensation.

People of any age can get insurance easily. Insurance companies are ready to take the risk of as much money as the insured wants based on his income. However, for that, it is necessary to develop a culture of insurance.

Recently, the insurance market is growing in Nepal. Due to its importance and the role played by insurance in financial shortages, people are attracted towards insurance. The opinion that insurance is necessary is also increased because a small investment carries various risks for a long time. The practice of gifting insurance policy as a special gift on special days like wedding, pasni, bratabandh, birthday, Dashain, Tihar is increasing day by day. People of any age group can purchase insurance policies that suit them, so insurance can be taken as life insurance.

Since you can get insurance even by reducing the expenses a little, you can easily get insurance by saving the amount that is spent on frivolous expenses during festivals like Dashain Tihar. For this reason, instead of consuming things like food, alcohol, cigarettes and playing games like Juwa Tas, instead of wasting money during Dashain, the amount can be deducted and insured.

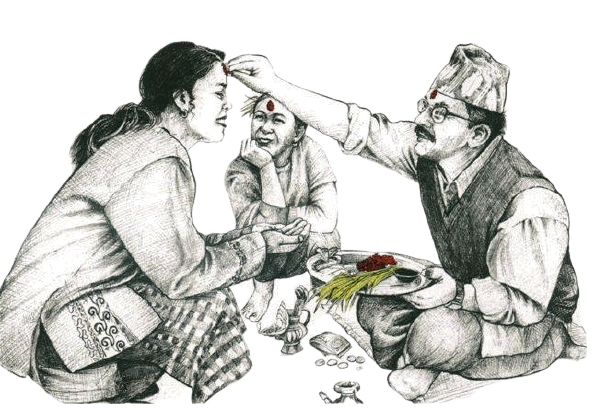

On Dashain we take Dakshina from our relatives by tapping ‘Tika’. We will use the money received from the Dakshina (A kind of Donation) from greatest by spending it in the name of purchasing various goods or services. In the same way, we used to buy expensive clothes etc.

in Dashain to show our appearance and luxurious splendor. Which does no long-term benefit except momentary happiness. Instead of living a lavish and ostentatious life like this, if you have life insurance, tomorrow’s future will definitely be better. Agents suggest that the amount collected in the form of Dakshina (A kind of Donation) (A kind of Donation) from greatest during insurance in this way will also facilitate the payment of insurance fees. Also, instead of depositing the money coming from Dakshina (A kind of Donation) in the bank, experts suggest to guarantee a bright future by insuring it.

During the 15-year insurance period, paying an annual insurance fee of Rs.6,000 to Rs.7,000, you can get insurance equivalent to 100,000 insurance marks. After the expiry of the insurance period, the company provides about 2 lakhs with bonus to the insured. Pundits in the education sector say that this amount will greatly help in meeting basic needs including higher education.

Now the investment in life insurance sector is also giving returns in addition to the risk. Investments in this area encourage mandatory savings and also provide the facility of taking loans by pledging the insurance policy even before the insurance period.

Therefore, experts in the insurance sector say that it is essential to insure risk-free and high-return investments. Non-life insurance works to reduce risk. It protects against huge potential losses as the insurance is equivalent to a large sum insured at a very low fee.

Any insurance policy has a limited maturity period. It can be 5 years, 10 years or more. After purchasing the policy according to the desired period, the company bears the responsibility of various risks until the policy matures.

For example, this policy is useful in financial crises arising from future accidents. Also, if the insured dies prematurely, the family of the deceased will receive double the sum assured, so the insurance is not only for the insured but for the entire family.

From taking care of future economic crisis with insurance, taking out a loan, if something happens to the insured, the family will receive a lump sum amount, after the policy matures, you can receive a lump sum amount twice as much as the sum insured. If you insure in this way, saving habit will be further developed, so it is very appropriate to insure instead of spending frivolously using the festival as an excuse.