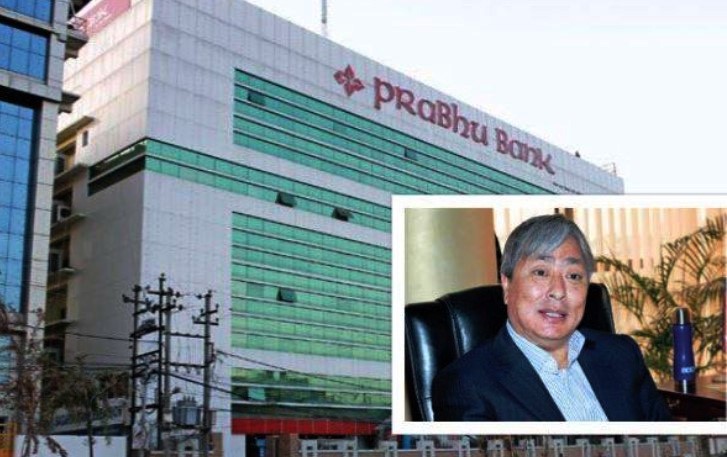

Devi Bhattachan, the Founder of Prabhu Bank, Entered the Insurance Sector by Selling Crores of Shares

In that program, Principal Khati informed that the library will be rebuilt with the financial support provided by the company for education and thanked the company and the CEO for providing financial support. Gan Bahadur Khati, chairman of the school management committee, was also present in the program.

Bhattachan, who is also the former chairman of Prabhu Bank, is going to exit after selling more than 20 million shares. It is understood that many of the shares he sold were agreed to be bought by Asian Life Insurance and its related persons. The company has bought 49 percent of Yeti Airlines, 40 percent of Mountain Glory Hotel, 50 percent of Hotel Crown Imperial and 7 million shares. It is understood that Bhattachan, who is very aggressive in mergers and acquisitions, is not satisfied with the returns given by the bank recently.

Bhattachan, who started his business with Prabhu Travel in 1990, is involved in businesses such as Prabhu Remittance Bank, Insurance, Cargo, Helicopter, Investment Company, Cooperative, Wallet Business, Television and Internet Service Provider. Prabhu Bank was merged to form ‘A’ class Agriculture Bank, ‘B’ class national level Prabhu Bikas Bank, Regional level Gaurishankar Bikas Bank and ‘C’ class Zenith Finance.

Although Prabhu Bank, which entered into an agreement to acquire the then Grand Bank on 15 January 2071, bought it in 2072 as per the agreement.

He also has investments in Prabhu Pay, Prabhu TV, Nepal Shipping Prabhu Bank, Prabhu Management, Prabhu Cooperative, Prabhu Insurance, Prabhu Helicopter. Bhattachan became a proportional member of parliament on behalf of UML in the 079 elections.

Asian Life has been established since February 15, 2064 and has launched life insurance services since March 2064.

The company’s paid-up capital is 3 billion 15 million 53 thousand rupees.

In which 60 percent of the founder shares, 40 percent of the common stock is owned. Among the founders are 93 promoter companies, 2 institutional founders and the remaining 91 individual founders.

After maintaining the paid-up capital of 5 billion rupees set by the Insurance Authority, the company is working to achieve the minimum capital. For this, the company has submitted a proposal to the authority to issue 58.45 percent rightful shares.