‘Banking Offense’: 30 Days Deadline to Prove Check Dishonour, Added to Settlement Letter

Kathmandu : Even though the court process has been made easier in the case of check dishonor, the culprits will be severely punished. This provision will come into effect after the Banking Offenses and Punishment Bill, 2080 presented in the House of Representatives is passed.

Amending Section 15 of the Basic Act, if it is proved that the check has been dishonored, the government has provided that not only the check holder will be fined 5% of the check, but also fined 5% of the check and imprisonment. The law provides for imprisonment for one month if the amount is up to five lakhs, three months for the amount up to ten lakhs, six months for the amount between ten to fifty lakhs and two years for the amount above fifty lakhs.

No one can issue a check knowing that there is no balance in his bank account and that there is not enough money for payment. It has been said that the bank or financial institution should return such check to the holder for payment and give a maximum of 30 days to prove that it has been dishonored.

If the payment cannot be made even after giving 30 days, the bank will have to prove the dishonor of the check within three days and return the check to the holder.

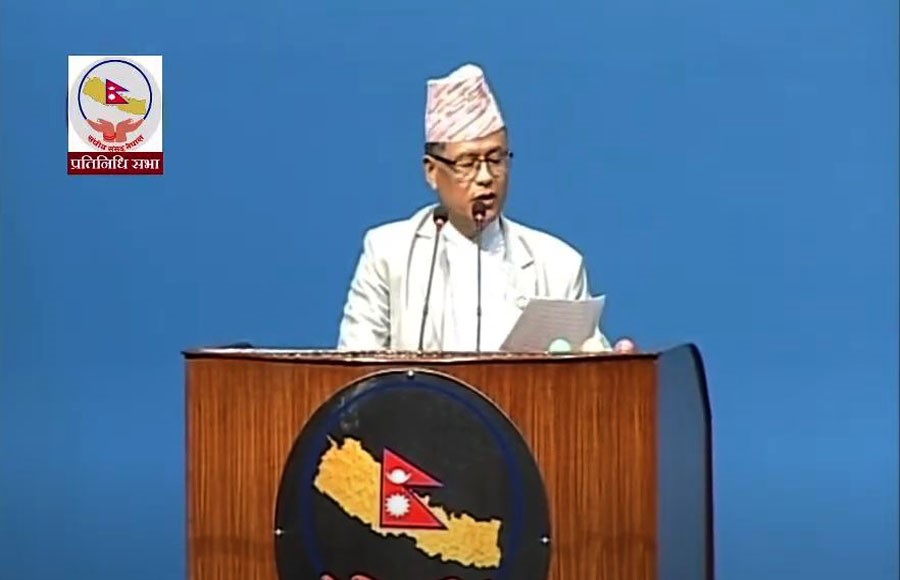

The amendment bill has made the court process easier. Law Minister Dhanraj Gurung himself has said that the court process has been made easier by providing a provision that a settlement can be reached in both cases, whether the case is under investigation or has been submitted to the court.

According to the law, in the event that a settlement is required in the course of the investigation, the public prosecutor can order the investigating officer to make a settlement between the two parties.

Similarly, even in cases where the court process has already gone through, the bill provides for a provision that a petition for settlement can be submitted to the court through the government attorney. It is said that if there is an agreement, the defendant will not be punished according to this Act.