Deposits of Banks and Financial Institutions Increased by 2.8 Percent, a Significant Improvement in Foreign Exchange Reserves

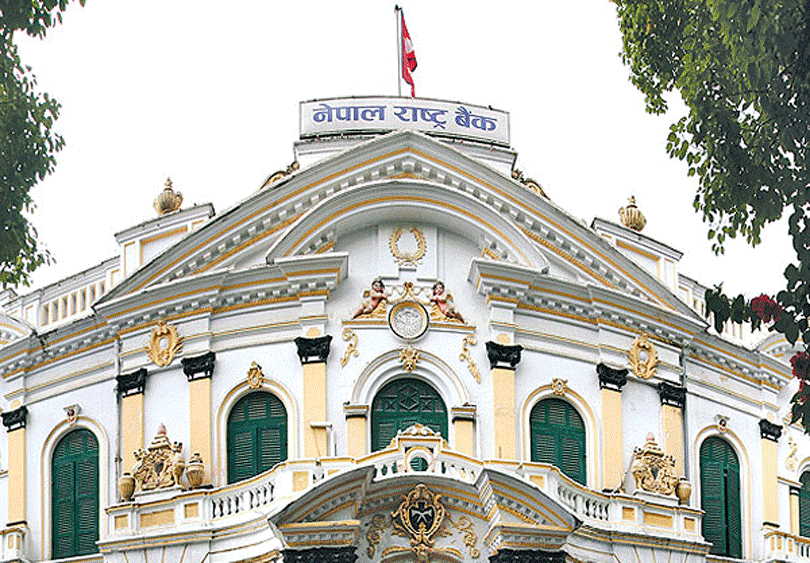

Kathmandu : Deposit collection of banks and financial institutions increased by 2.8 percent. According to the Central Bank, the deposit collection of banks and financial institutions increased by 2.8 percent in the first three months of the current financial year 2023/024.Central Bank has given this information while releasing the economic and financial status of the first three months of the current financial year.

According to the financial report of the National Bank of India for the first three months, the credit to the private sector has increased by 2.3 percent. On an annual point basis, the growth rate of deposits is 14.9 percent and the growth rate of loans in the banking sector is 4.8 percent.

According to the National Bank, the total foreign exchange reserves are 16 trillion 43 billion 90 million, i.e. 12 billion 33 billion US dollars. It is said that it increased by 6.7 percent.The foreign exchange reserves which were equal to 15 trillion 39 billion 36 crore rupees till the end of June increased to 16 trillion 43 billion 9 crore rupees till the end of October.

During this period, it seems that such reserves have increased by 5.3 percent in US dollars. The share of Indian currency in the total foreign exchange reserves is seen at 22 percent. Of the total foreign exchange reserves, Central Bank has Rs.14 trillion 33 billion 36 crores, while other banks and financial institutions have Rs.2 trillion 9 billion 73 crores.

According to the report of the National Bank, this foreign exchange reserve is enough to support 12.4 months of goods imports and 10.3 months of goods and services imports based on current imports. At this time, the import increased by 1.7 percent while the export decreased by 2.3 percent. The total merchandise trade deficit has increased by 2.1 percent.