Key Sessions at the Inclusive Insurance Conference Explore Profitable Models, Gender Empowerment, and Innovation

Kathmandu- The International Conference on Inclusive Insurance (ICII) 2024 continues to advance discussions on expanding insurance access for underserved populations, with twelve key sessions taking place on its third day.

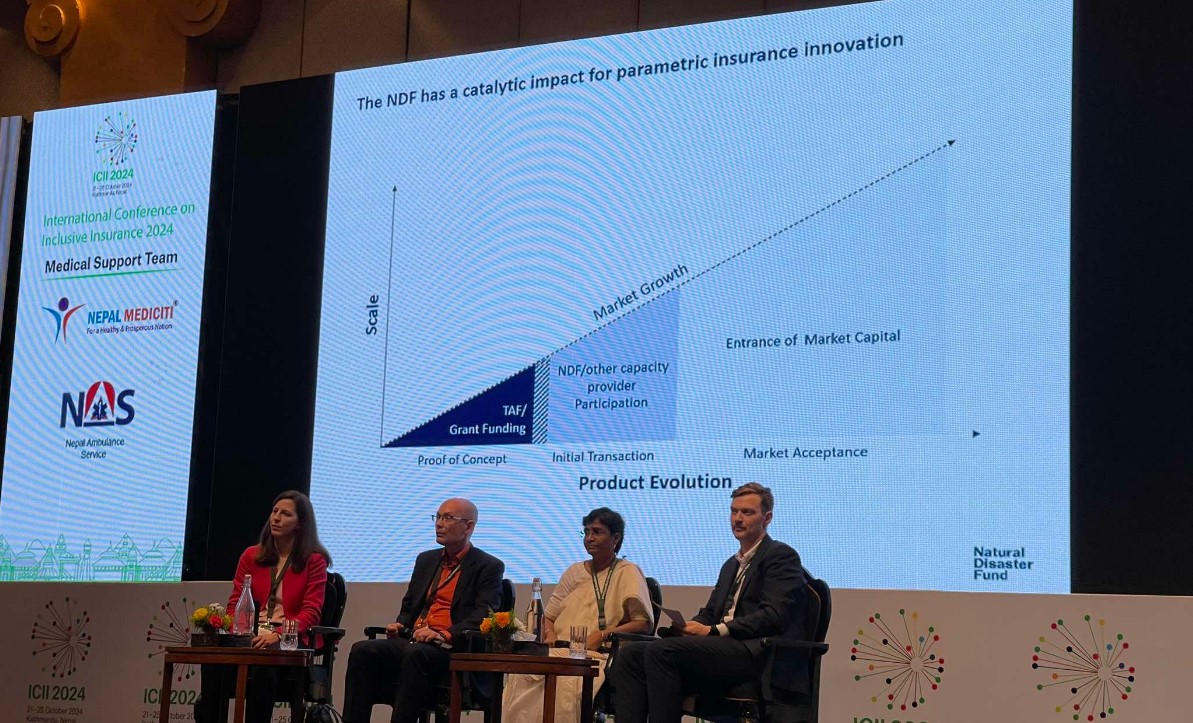

The key session highlighted strategies for balancing profitability and client value in inclusive insurance, featuring insights from executives at EFU Life Assurance and AXA EssentiALL. The session also addressed challenges with parametric insurance for smallholder farmers, emphasizing the need for payouts to match actual conditions.

The conference also focused on women’s empowerment through insurance, showcasing innovative solutions designed to close the gender protection gap. Additionally, research presented on Index-Based Livestock Insurance illustrated its long-term benefits for pastoral communities in the Horn of Africa.

Participants engaged in collaborative discussions within the Inclusive Insurance Innovation Lab, and mutual insurance models were highlighted for their effectiveness in serving low-income demographics. Startups also pitched their inclusive insurance projects, seeking partnerships and funding.

As ICII 2024 continues until Friday, these sessions underscore the potential of Inclusive insurance to foster financial resilience and social development worldwide.