Nepal’s Non-Life Insurers Face Profit Decline Due to Rising Claims

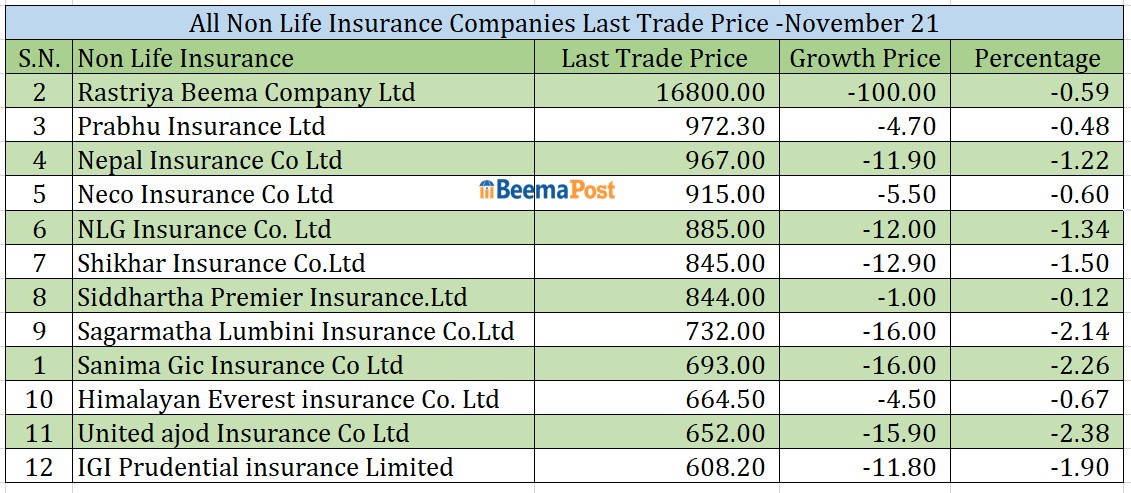

Kathmandu – The majority of non-life insurance companies in Nepal have reported a significant decline in profits for the first quarter of the current fiscal year, as revealed in their raw financial statements. This downturn has directly impacted the earnings per share (EPS) of many companies, consequently affecting their share prices.

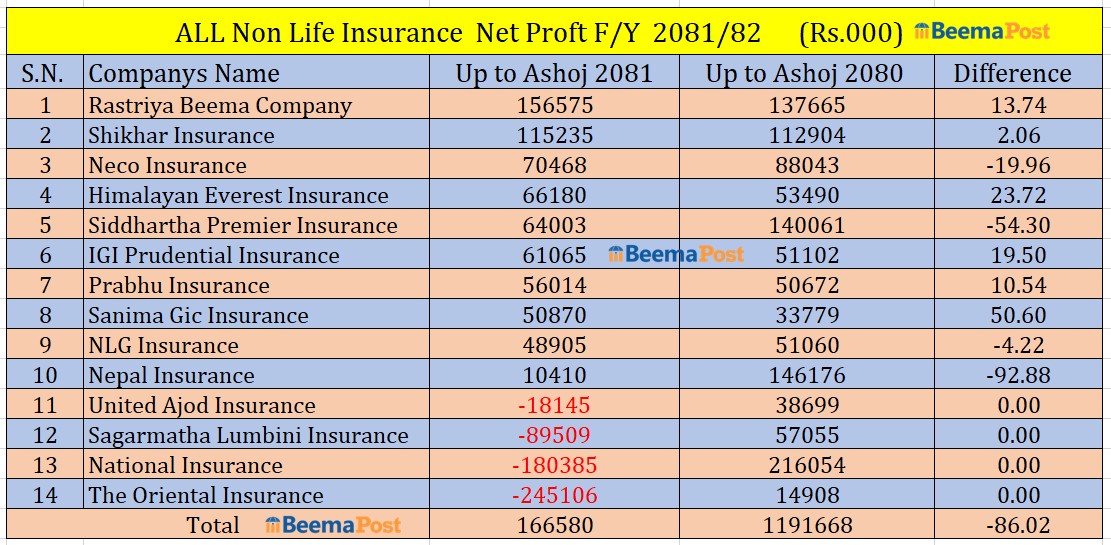

The decline in profits is largely attributed to the insurance claims arising from floods and landslides in the month of September, which resulted in claims worth billions of rupees. Industry experts note that companies have prioritized claim settlements, which has had a direct effect on their earnings. However, firms with strong recovery mechanisms have managed to limit the impact on their profits.

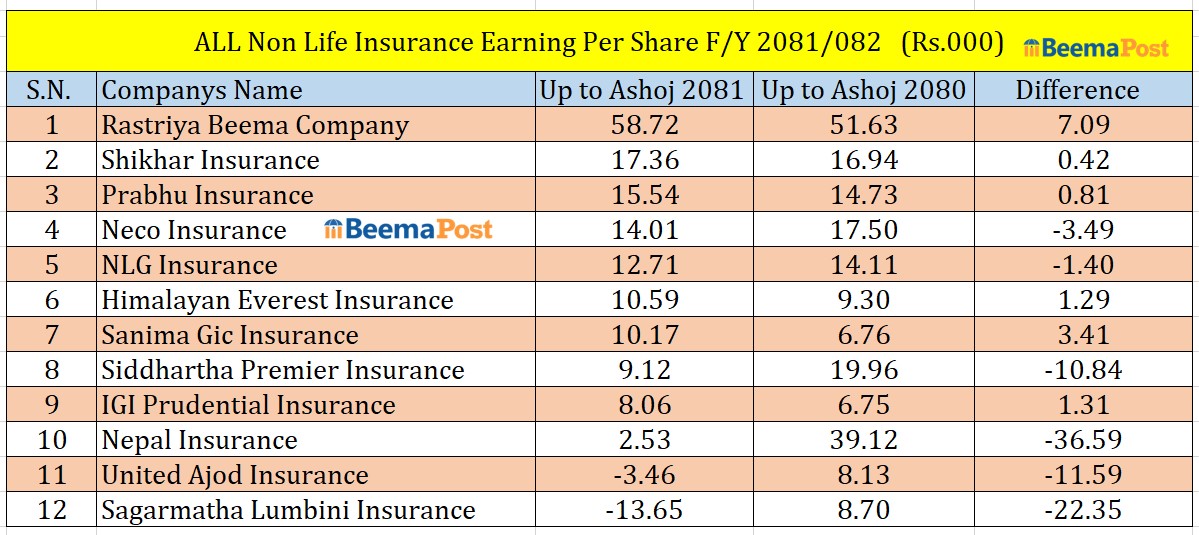

Among the 12 non-life insurance companies listed on the Nepal Stock Exchange (NEPSE), five reported modest decline in EPS, while six recorded increases during the review period. Sagarmatha Lumbini Insurance saw the steepest decline in both its EPS and profit.

In contrast, the government-owned Rastriya Beema Company stood out with the highest EPS during the review period, increasing by Rs 7.09 to Rs 58.72 compared to the previous year. The company also posted a 13% rise in profit. Shikhar Insurance, which paid the highest claims for flood and landslide victims, saw its EPS grow marginally to Rs 17.36. Its share price is currently at Rs 845, reflecting investor confidence in the company’s resilience.

Prabhu Insurance also showed robust performance, with a 10% profit increase, pushing its EPS to Rs 15.54. Similarly, Neco Insurance reported an EPS of Rs 14.1, followed by NLG Insurance at Rs 12.71, and Himalayan Everest Insurance at Rs 10.59. Sanima GIC Insurance posted an EPS of Rs 10.17, while Siddhartha Premier Insurance and IGI Prudential Insurance recorded EPS figures of Rs 9.12 and Rs 8.06, respectively.

Meanwhile, Nepal Insurance’s EPS stood at Rs 2.53, reflecting its struggle during this period. United Ajod Insurance recorded an EPS of Rs 3.46, whereas Sagarmatha Lumbini Insurance’s EPS was Rs 13.65, despite a sharp decline in its overall profit.