Nepal’s Commercial Banks Report Rs 30.5 Billion Profit in Five Months

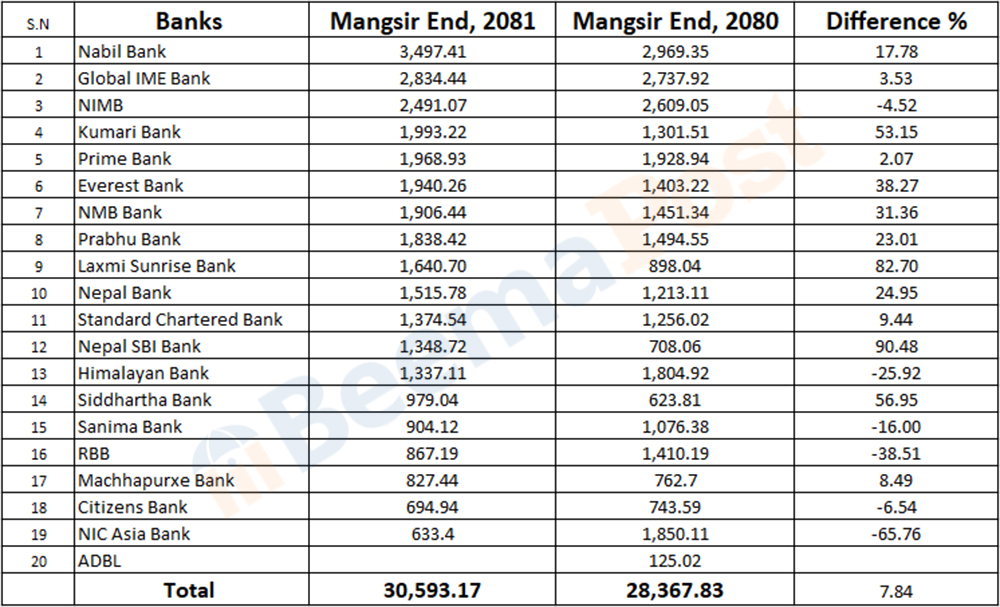

Kathmandu – Nepal’s commercial banking sector has reported a combined profit of Rs 30.5 billion by the end of Mangsir (mid-December, 2024) in the current fiscal year 2081/82. According to data from Nepal Rastra Bank, this figure marks a 7.84% increase compared to Rs 28.36 billion earned during the same period in the last fiscal year.

The steady recovery of Nepal’s banking sector, which faced challenges due to the economic slowdown, is reflected in the growth. Nabil Bank emerged as the top performer, reporting a profit of Rs 3.49 billion, an increase of 17.78% compared to the previous fiscal year.

Global IME Bank ranked second, with a profit of Rs 2.83 billion, marking a growth of 3.53%. Meanwhile, Laxmi Sunrise Bank and Nepal SBI Bank recorded the highest profit growth rates, with profits rising by 82.70% to Rs 1.64 billion and 90.48% to Rs 1.34 billion, respectively.

Despite the sector’s overall profitability, some banks experienced declines in their earnings. Nepal Investment Mega Bank, which ranked third in profitability, saw its profit drop by 4.52%, settling at Rs 2.49 billion. Similarly, Himalayan Bank reported a profit of Rs 1.33 billion, a decrease of 25.92%. Other banks, including Sanima Bank, Rastriya Banijya Bank, Citizens Bank, and NIC Asia Bank, also faced declines, with NIC Asia Bank’s profit plummeting by 65.76%.

Nevertheless, many banks demonstrated resilience with significant profit growth. Kumari Bank’s profit surged by 53.15% to Rs 1.99 billion, while Everest Bank recorded a 38% rise to Rs 1.94 billion. NMB Bank reported Rs 1.90 billion in profit, a 31% increase, and Prabhu Bank’s earnings grew by 23% to reach Rs 1.83 billion.