Home Loans Drive Real Estate Revival in Nepal

Kathmandu – The demand for credit from banks and financial institutions for individual residential house construction has surged in recent years, revitalizing Nepal’s real estate sector. The availability of home loans of up to Rs 20 million, coupled with falling interest rates and increased liquidity in the banking system, has encouraged many citizens to build or purchase homes through bank financing.

The decrease in deposit interest rates has lowered banks’ operational costs, allowing them to offer loans at single-digit or fixed interest rates, making home loans more affordable. These attractive schemes have increased competition among banks, further expanding loan accessibility.

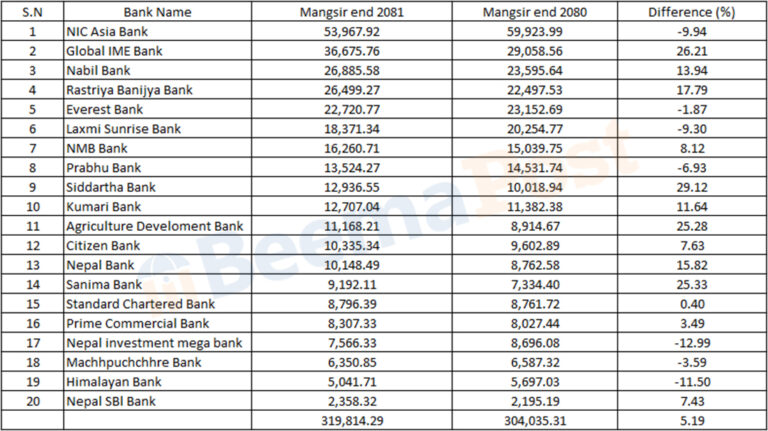

In the first five months of the current fiscal year, commercial banks disbursed loans worth Rs 319.81 billion for individual house construction, a 5.19 percent increase compared to Rs 343.53 billion in the same period of the last fiscal year.

Among banks, NIC Asia Bank led in lending for home construction, providing Rs 53.96 billion, though this was 9.94 percent less than the previous year. Global IME Bank followed, with its home loans increasing by 26.21 percent to Rs 36.67 billion. Nabil Bank disbursed Rs 26.88 billion, while Rastriya Banijya Bank’s home loans grew by 17.79 percent to Rs 26.49 billion.

Other notable contributors include Everest Bank, which lent Rs 22.72 billion (down 1.87 percent), Lakshmi Sunrise Bank at Rs 18 billion (down 9.30 percent), NMB Bank at Rs 16.26 billion (up 8.12 percent), and Prabhu Bank at Rs 13.52 billion (down 6.93 percent).

Smaller lenders such as Siddhartha Bank (Rs 12.93 billion), Kumari Bank (Rs 12.70 billion), and Krishi Bikas Bank (Rs 11.16 billion) also played a role in fueling the sector. Banks like Citizen Bank, Nepal Bank, and Sanima Bank contributed Rs 10.33 billion, Rs 10.14 billion, and Rs 9.19 billion, respectively, while Standard Chartered provided Rs 8.79 billion, and Prime Bank Rs 8.30 billion.