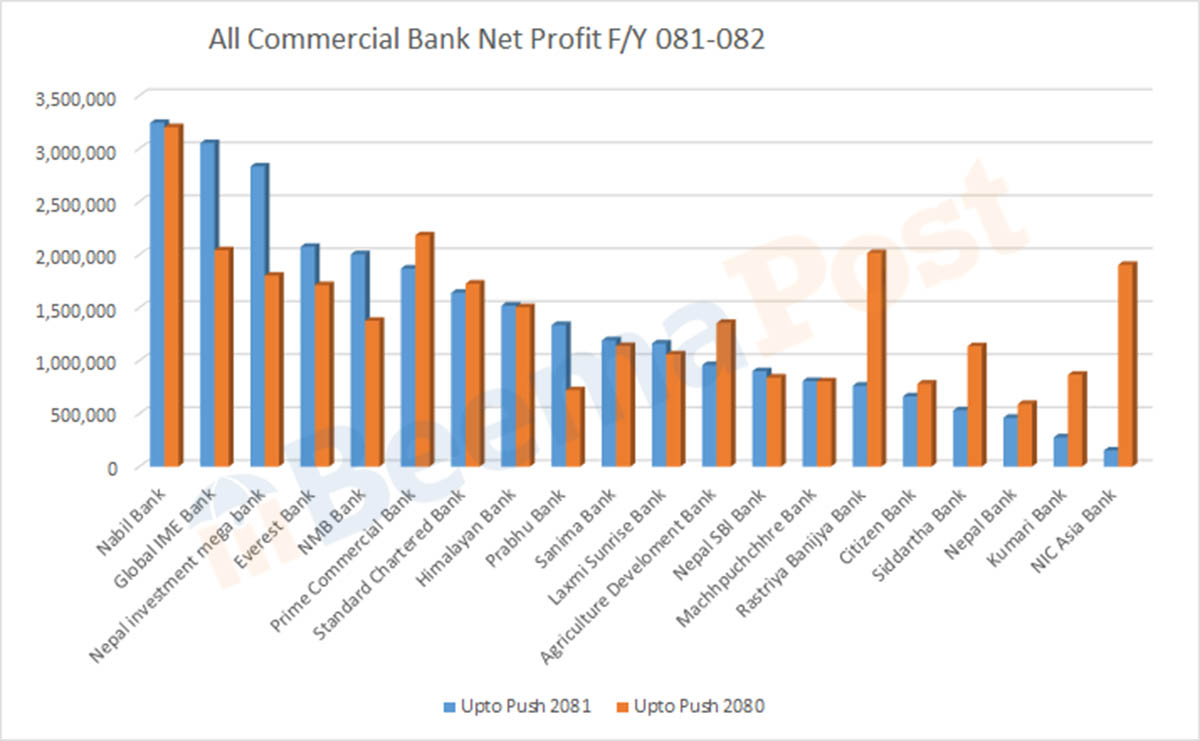

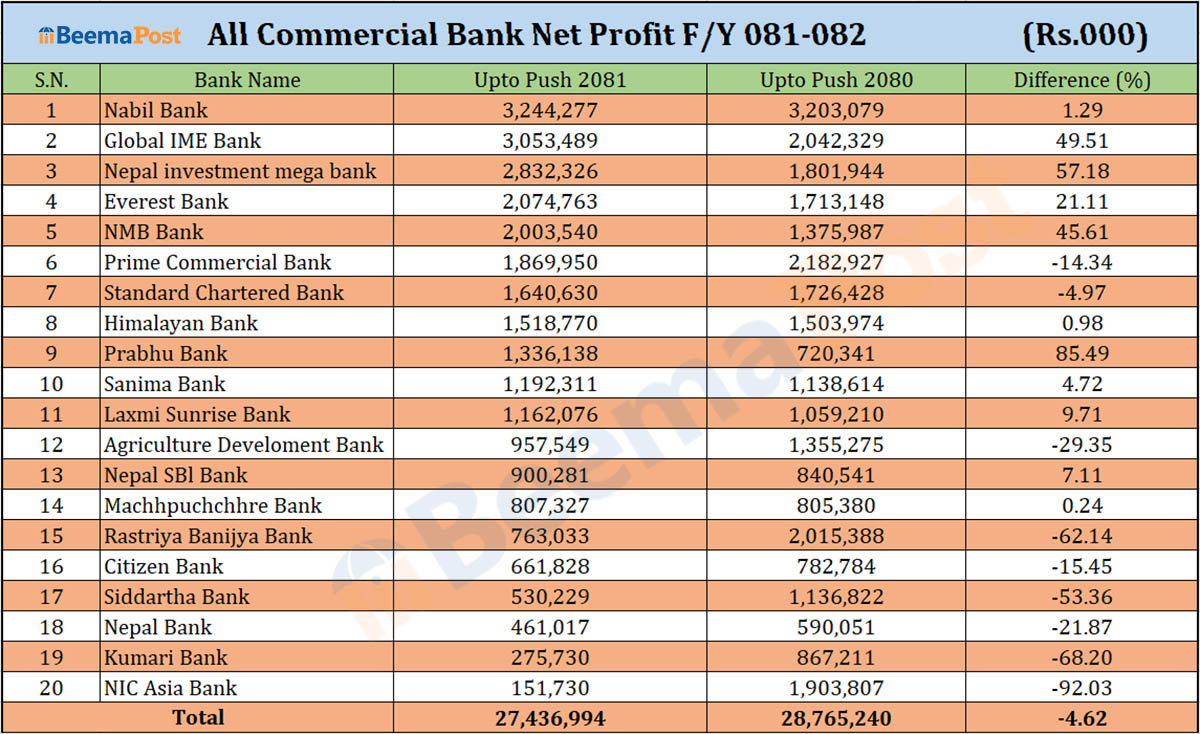

Commercial Bank Profits Decline in Second Quarter of the Fiscal Year

Kathmandu – The profits of Nepal’s commercial banks have declined in the second quarter of the current fiscal year, as revealed in the financial statements published by 20 banks. Collectively, their profits fell by 4.62 percent compared to the same period last fiscal year. In the first six months of this fiscal year, the banks earned Rs 27.43 billion, down from Rs 28.76 billion in the corresponding period last year.

Of the 20 banks, nine reported a decline in profits, while 11 managed to record growth. Nabil Bank maintained its position as the top earner, with a profit of Rs 3.24 billion by the end of the first half of the fiscal year. This represents a slight increase from Rs 3.20 billion in the same period last year.

Global IME Bank emerged as the second-highest profit earner, reporting a 49.51 percent increase in profits to Rs 3.05 billion. Last year, the bank had recorded Rs 2.42 billion in profits during the same period. Meanwhile, Nepal Investment Mega Bank and Prabhu Bank showed the most significant growth. Nepal Investment Mega Bank, ranked third in profit earnings, saw a 57.18 percent increase, reaching Rs 2.83 billion. Similarly, Prabhu Bank reported an 85.49 percent rise in profits, amounting to Rs 1.33 billion.

Other banks showed mixed results. Everest Bank reported a 21.11 percent rise in profits to Rs 2.07 billion, and NMB Bank posted a 45.61 percent growth, reaching Rs 2.35 billion. On the other hand, some banks experienced declines, including Prima Bank, whose profit fell by 14.34 percent to Rs 1.86 billion, and Standard Chartered Bank, which recorded a 4.97 percent drop, bringing its profit to Rs 1.64 billion.

The performance of banks varied widely, with nine banks earning less than Rs 1 billion in profits during this period.