National Life Insurance: A Legacy of Strong Dividend Distribution

Kathmandu – National Life Insurance Company Limited has built a proud legacy of consistent and significant dividend distribution, achieving a maximum dividend of 75% in its one-and-a-half-decade history. The company has consistently provided fair returns to its shareholders, showcasing its robust financial management and dedication to investor satisfaction.

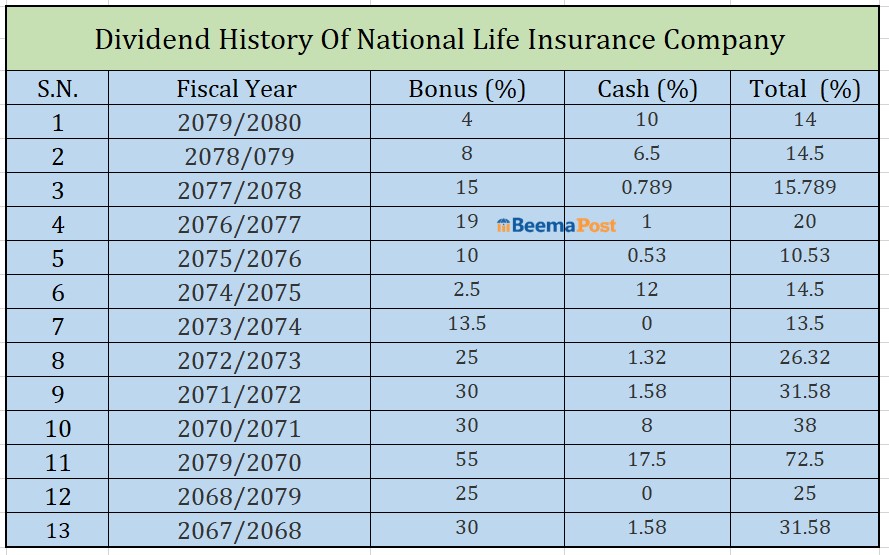

In the fiscal year 2079/080, National Life distributed a 14% dividend, comprising 4% bonus shares and 10% cash, from its distributable profit. This followed a 14.5% dividend in the fiscal year 2078/079, which included 8% bonus shares and 6.5% cash. The company has maintained a steady pattern of rewarding its investors, with a dividend of 15.789% recorded in the fiscal year 2077/078.

Notably, in the fiscal year 2076/077, National Life distributed a total dividend of 20%, including 19% bonus shares and 1% cash. Similarly, it provided a 10.53% dividend in 2075/076, which included 10% bonus shares and 0.53% cash. The fiscal year 2074/075 saw a distribution of 14.5%, consisting of 2.5% bonus shares and 12% cash.

The company’s highest dividend distribution was in the fiscal year 2069/070, when it rewarded its shareholders with a remarkable 72.5% dividend, including 55% bonus shares and 17.5% cash. National Life began its dividend distribution journey in the fiscal year 2067/068, with an initial dividend of 31.58%, comprising 30% bonus shares and 1.58% cash.

The company’s highest dividend distribution was in the fiscal year 2069/070, when it rewarded its shareholders with a remarkable 72.5% dividend, including 55% bonus shares and 17.5% cash. National Life began its dividend distribution journey in the fiscal year 2067/068, with an initial dividend of 31.58%, comprising 30% bonus shares and 1.58% cash.

Currently, the company’s paid-up capital stands at Rs. 5.21 billion. Its shares were traded at Rs. 596 per share on Monday. Under the leadership of CEO Suresh Prasad Khatri and Chairperson of the Board of Directors, Prema Rajya Lakshmi Singh, National Life Insurance is preparing for its upcoming annual general meeting for the fiscal year 2080/081.