Nepal’s Non-Life Insurance Companies Show Strong Solvency Ratios, Rises to 2.67

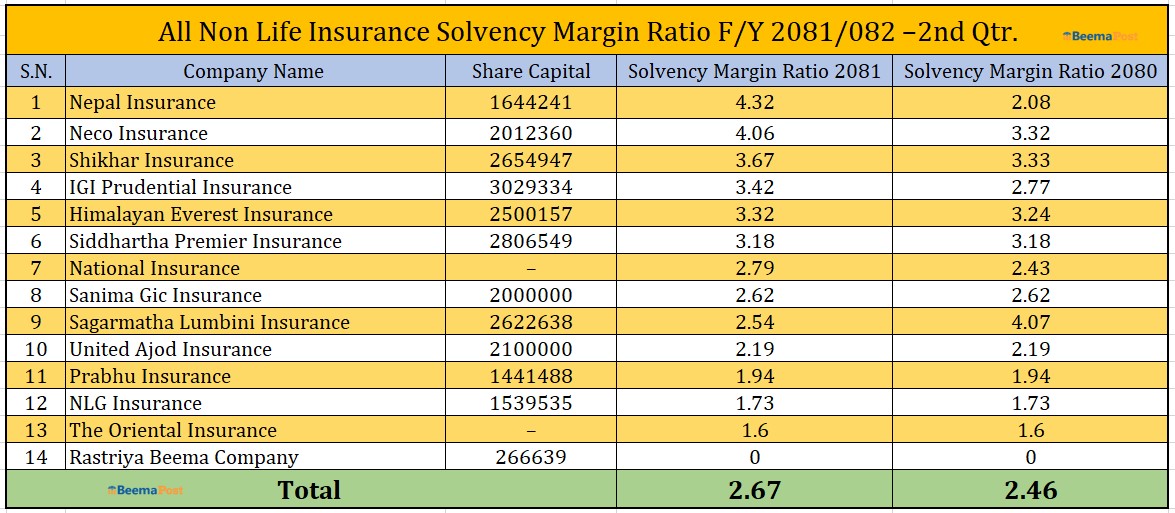

Kathmandu – The latest financial reports of Nepal’s non-life insurance companies indicate a stable and improving solvency ratio, a key measure of financial strength and risk-bearing capacity. The average solvency ratio across these companies has risen to 2.67, marking a 0.21 point increase from last year’s 2.46.

Among the 14 non-life insurance companies, Nepal Insurance leads with a solvency ratio of 4.32. Following closely, Neco Insurance ranks second with a solvency ratio of 4.06, reflecting a notable 0.74 point increase compared to the previous year. Shikhar Insurance stands third with a ratio of 3.67, slightly improving from 3.33.

IGI Prudential Insurance has also demonstrated significant growth, with its solvency ratio rising from 2.77 to 3.42. Other companies showing stable or increased ratios include Himalayan Everest Insurance (3.32) and Siddhartha Premier Insurance (3.18).

Source: According to data published by Non-Life Insurance Companies

However, not all companies have maintained an upward trend. Sagarmatha Lumbini Insurance saw a significant decline, with its solvency ratio dropping 1.53 points from 4.07 to 2.54, indicating a rise in liabilities. Meanwhile, United Ajod Insurance (2.19), Prabhu Insurance (1.94), NLG Insurance (1.73), and The Oriental Insurance (1.6) have reported comparatively lower solvency ratios, reflecting a reduced risk-bearing capacity.

Despite these variations, the overall financial health of Nepal’s non-life insurance sector remains strong. The Insurance Authority’s regulatory benchmark for solvency is 1.5, and all audited companies have exceeded this requirement. However, the government-owned Rastriya Beema Insurance Company has not disclosed its solvency ratio, as its financial audit remains pending.