Ping An Insurance Retains Title as World’s Most Valuable Insurance Brand for Ninth Consecutive Year

The Brand Finance Insurance 100

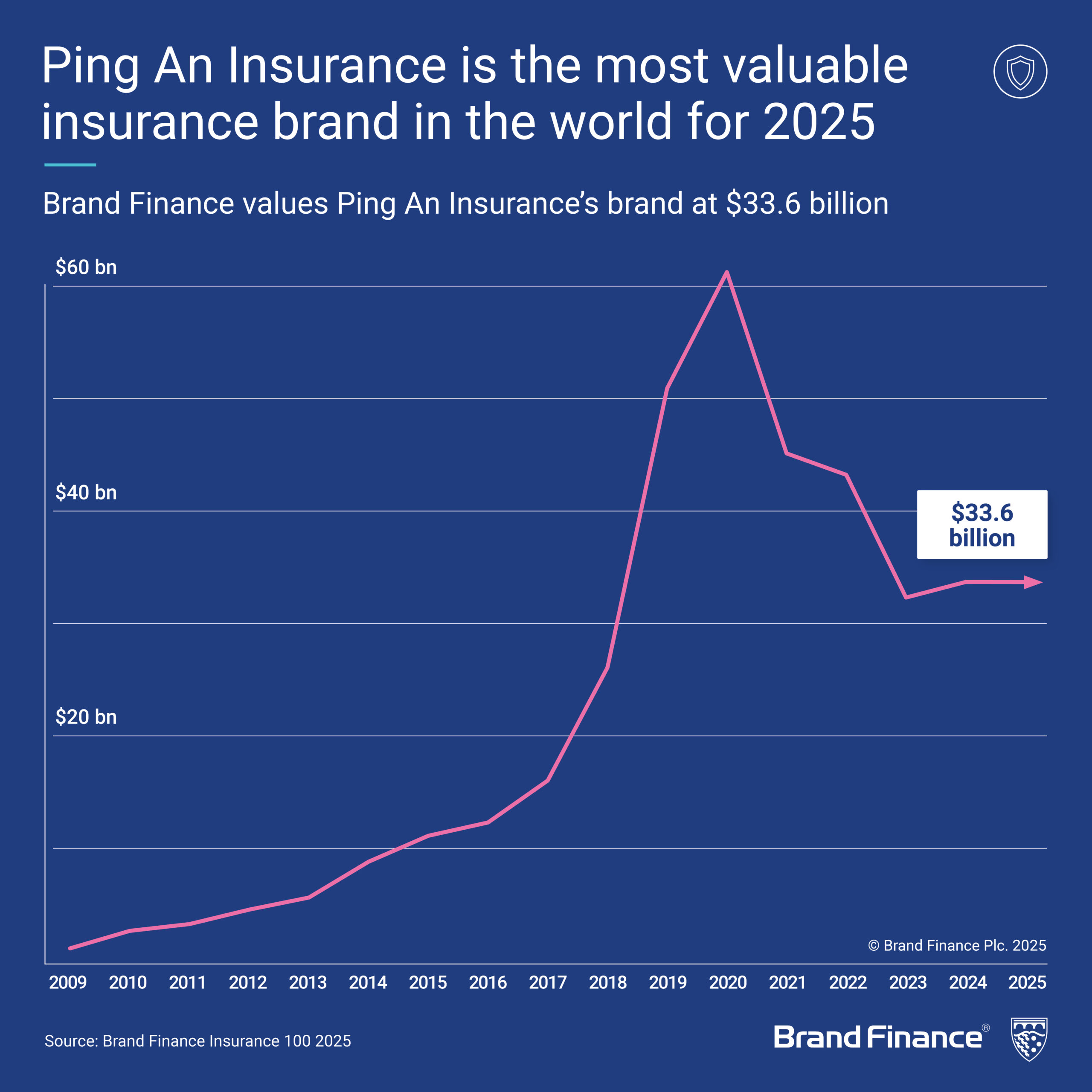

Ping An Insurance has maintained its position as the world’s most valuable insurance brand for the ninth consecutive year, according to the Brand Finance Insurance 100 2025 report released by Brand Finance, the leading global brand valuation consultancy. The report highlights that the total brand value of the world’s top 100 insurance brands increased by 9% in 2025, driven by better underwriting performance, higher investment income, rising interest rates, and improved profitability.

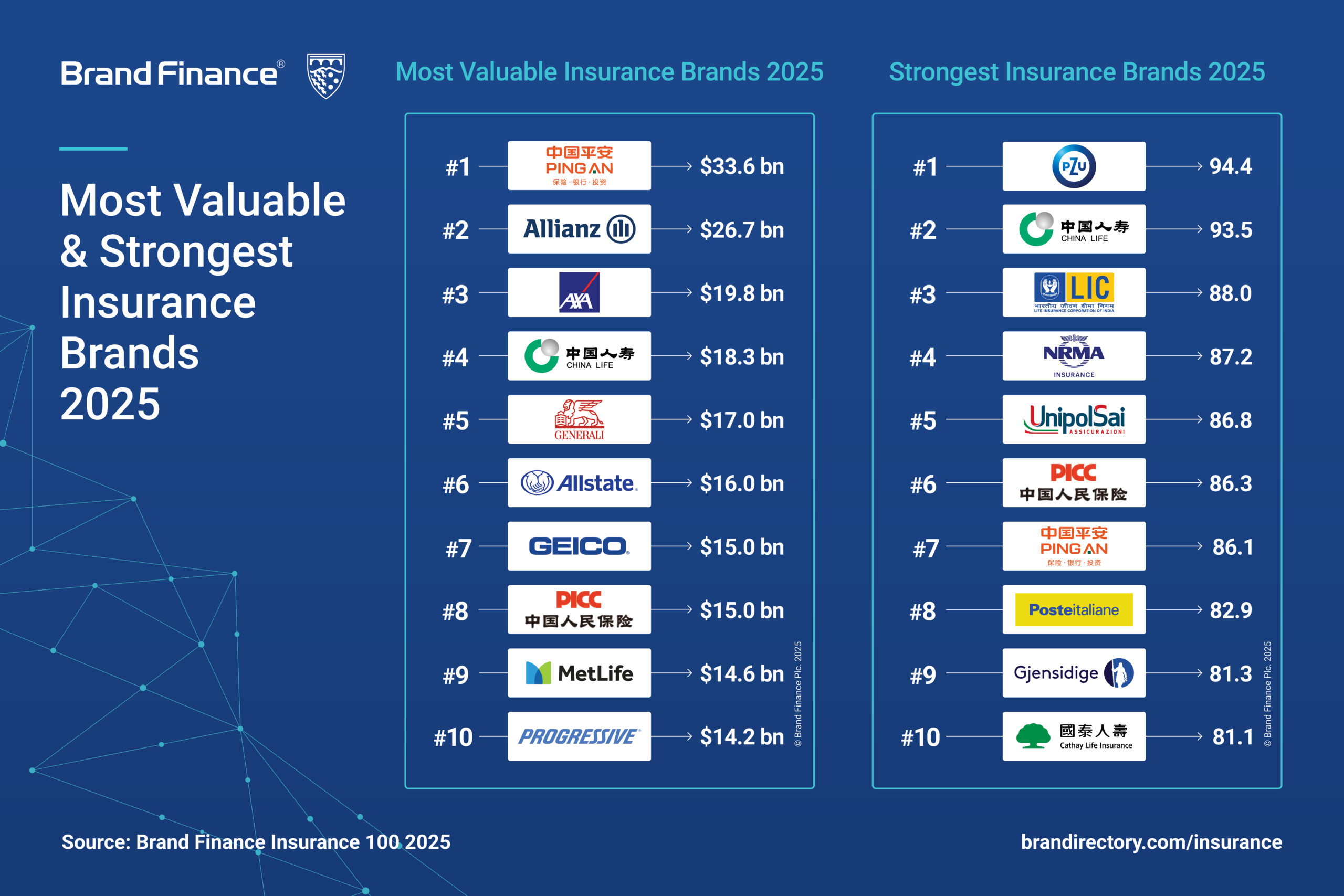

Ping An Insurance’s brand value stands at USD 33.6 billion, securing its top position despite facing profitability challenges in recent years. Its strong brand familiarity in China, coupled with consistent growth in life, health, and property and casualty (P&C) insurance, has bolstered its market dominance.

German insurer Allianz ranked second among the world’s most valuable insurance brands, with a 9% increase in brand value to USD 26.7 billion. AXA French multinational insurance cooperation ranked third with a brand value of USD 19.8 billion. China Life Insurance secured the fourth position with a brand value of USD 18.3 billion, reflecting a 5% increase from the previous year. PICC also maintained a strong position, ranking eighth globally with a 13% rise in brand value to USD 15 billion.

Nissay/Nippon Life Insurance emerged as the fastest-growing insurance brand, with its value soaring 94% to USD 9.2 billion. This surge was fueled by increased revenues and the company’s strategic expansion beyond its domestic market, including its 2024 acquisition of a 20% stake in U.S.-based Corebridge Financial.

In terms of brand strength, Poland’s PZU was recognized as the strongest insurance brand globally, with a BSI score of 94.4 out of 100 and an AAA+ brand rating, placing it among the world’s strongest brands across all sectors. China Life Insurance followed closely, securing the second position with a BSI score of 93.5 and an AAA+ brand strength rating, supported by its strong market presence and high brand familiarity within China. LIC India ranked third position with a BSI score of 88.0 out of 100.

As the three Chinese insurance brands secures the top 10 positions globally, the 2025 report highlights that the technological innovation, AI-driven services, and the expansion of 5G are the key drivers of growth in the China’s insurance market.

The Brand Finance Insurance 100 report is published annually, ranking the world’s most valuable and strongest insurance brands based on market performance and brand strength.