Commercial Banks’ Non-Banking Assets Surge by 80 Percent in First Eight Months of FY

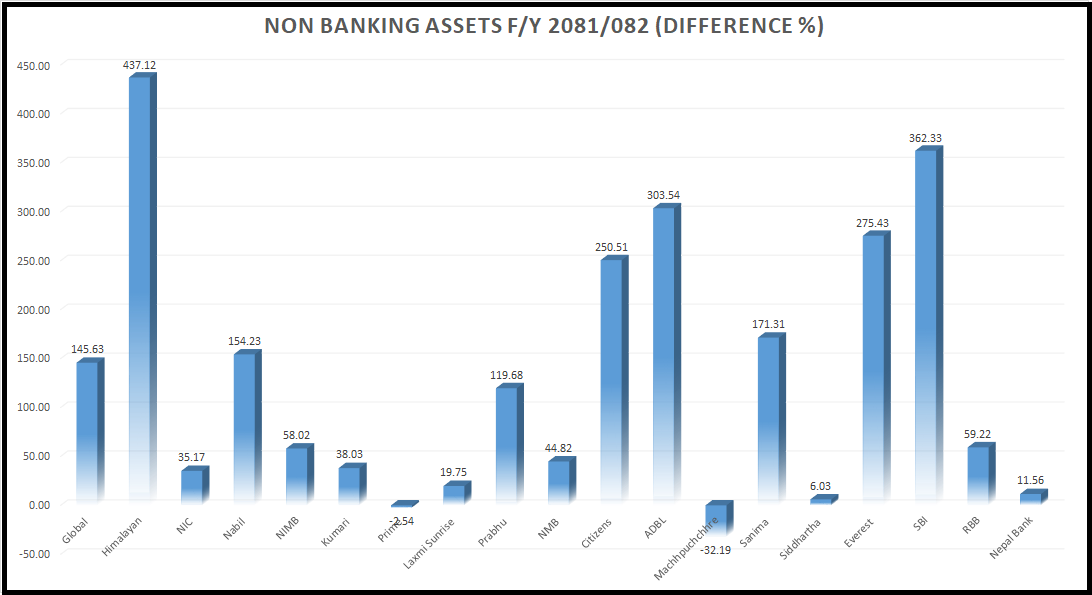

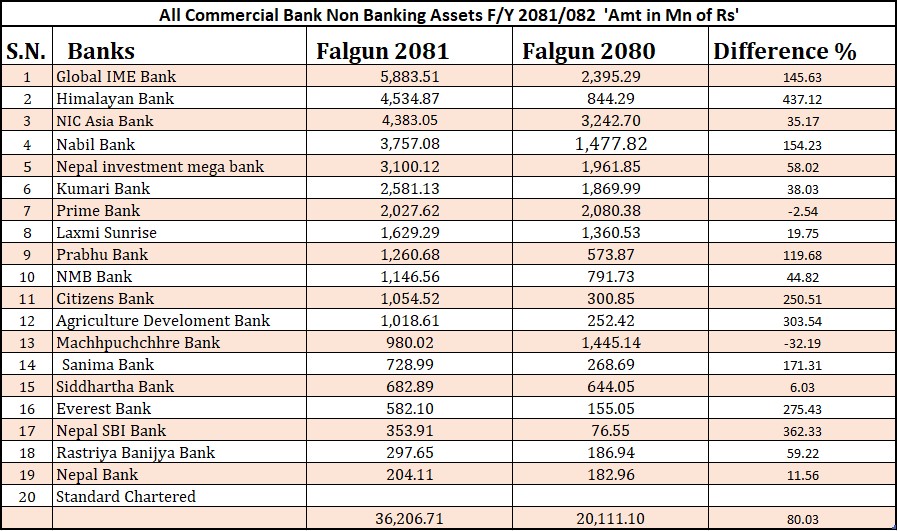

Kathmandu — Non-banking assets of commercial banks in Nepal have surged by 80.03 percent in the first eight months of the current fiscal year, according to the data published by Nepal Rastra Bank.

The Non-banking assets held by operating commercial banks reached Rs 36.20 billion as of end of month of Falgun. This marks an increase of Rs 16.95 billion compared to the same period last fiscal year, when it stood at Rs 20.11 billion.

Global IME Bank currently tops the list with the highest non-banking assets, which have jumped by 145.63 percent to Rs 5.88 billion from last year’s Rs 2.39 billion. Himalayan Bank follows closely with Rs 4.53 billion, a rise of 437.12 percent compared to the previous year.

NIC Asia Bank reported a 35.17 percent increase to Rs 4.38 billion, while Nabil Bank’s assets soared by 154.23 percent to Rs 3.75 billion. Nepal Investment Mega Bank recorded a 58.02 percent rise to Rs 3.10 billion, and Kumari Bank’s non-banking assets rose by 38.03 percent to Rs 2.58 billion.

Meanwhile, Laxmi Sunrise saw a 19.75 percent increase to Rs 1.62 billion, Prabhu Bank’s climbed 119.68 percent to Rs 1.26 billion, and NMB Bank reported a 44.82 percent rise to Rs 1.14 billion. Citizens Bank experienced a significant 250.51 percent surge to Rs 1.05 billion, while Agriculture Development Bank shot up by 303.54 percent to Rs 1.1 billion.

Notably, Prime Bank was the only one among major banks to witness a decline, with its non-banking assets dropping by 2.54 percent to Rs 2.2 billion and the remaining seven commercial banks each reported non-banking assets of less than Rs 1 billion.

Non-banking assets typically consist of assets acquired by banks after failing to recover non-performing loans through auctioned collateral. The persistent inability to recover loans through sales has led financial institutions to take ownership of pledged properties—raising questions about banks’ efficiency in credit risk management.