Global Economic Losses in Q1 Hit $83 Billion in 2025, Insured Catastrope Losses Reach $38 Billion: Aon Report

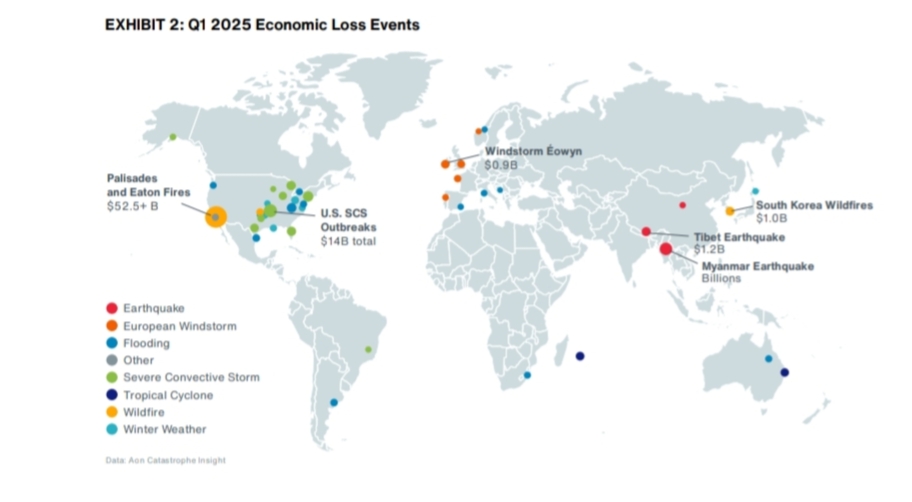

The first quarter of 2025 has seen an alarming surge in economic losses from natural disasters, with damages reaching an unprecedented $83 billion globally, according to risk and reinsurance broker Aon. The bulk of this devastation was concentrated in the United States, particularly California, where wildfires alone accounted for nearly half the global total.

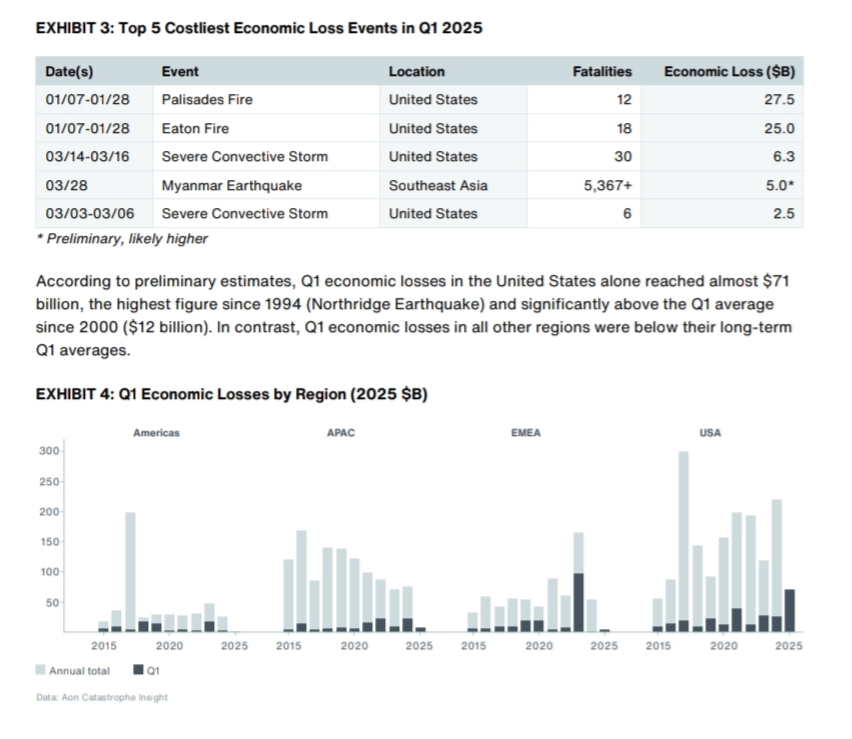

In its latest Q1 Global Catastrophe Recap, Aon revealed that the U.S. alone registered $71 billion in disaster-related economic losses—marking the country’s worst first-quarter figure since 1994. That is nearly six times higher than the long-term Q1 average of $12 billion, highlighting an intensifying trend of extreme weather and environmental volatility.

The California wildfires proved particularly catastrophic, contributing $38 billion in insured losses, or 71% of all U.S. insurance claims related to disasters in the quarter. These fires are now among the costliest in history and have drawn urgent attention to the growing financial risks tied to climate-induced catastrophes.

Source: Aon Report

“Natural catastrophes such as these underscore the urgent need for proactive risk management and mitigation planning,” said Michal Lörinc, head of catastrophe insight at Aon. “We are seeing not just higher losses, but a sharper rise in fatalities and more frequent billion-dollar events.”

Indeed, global fatalities from disasters spiked to over 6,000, a stark increase from 1,800 during the same period last year. The majority of these deaths—approximately 88%—resulted from a powerful earthquake that struck Myanmar in March. Other disaster events contributed to around 700 fatalities.

Source: Aon Report

Despite the grim economic toll, the insurance industry demonstrated strong performance. More than $53 billion of the total losses are expected to be covered by insurers, making it the second-highest Q1 insured loss on record—surpassed only by 2011. This has resulted in a historically low insurance protection gap of 36% for the quarter, reflecting robust coverage, particularly in the U.S.

Aon’s report also draws attention to the continued escalation of severe convective storms (SCS) across the United States, with average annual insured losses now reaching $33 billion—a 90% increase over the previous decade. In response, Aon has launched a new five-step risk framework aimed at helping insurers better manage exposure and reduce portfolio volatility.

Looking back at 2024, the global toll from disasters was equally daunting. When adjusted to 2025 dollars, economic losses topped $374 billion—marking the ninth consecutive year that losses have exceeded the $300 billion threshold.