Nepal Life Completes 24 Years, Steps into 25th Year with Focus on Service and Growth

Kathmandu — Nepal Life Insurance Company has officially entered its 25th year today, marking 24 years since its establishment on Baisakh 21, 2058 BS. To commemorate the milestone, the company is launching a nationwide celebration, including health camps, blood donation drives, awareness programs, and discounts on insurance renewal fees.

Established as a life insurance provider in 2058 BS, Nepal Life has grown into one of the leading players in the country’s insurance sector. The company has expanded its reach across all seven provinces, with thousands of active agents and a strong branch network ensuring access to life insurance services in both urban and rural areas.

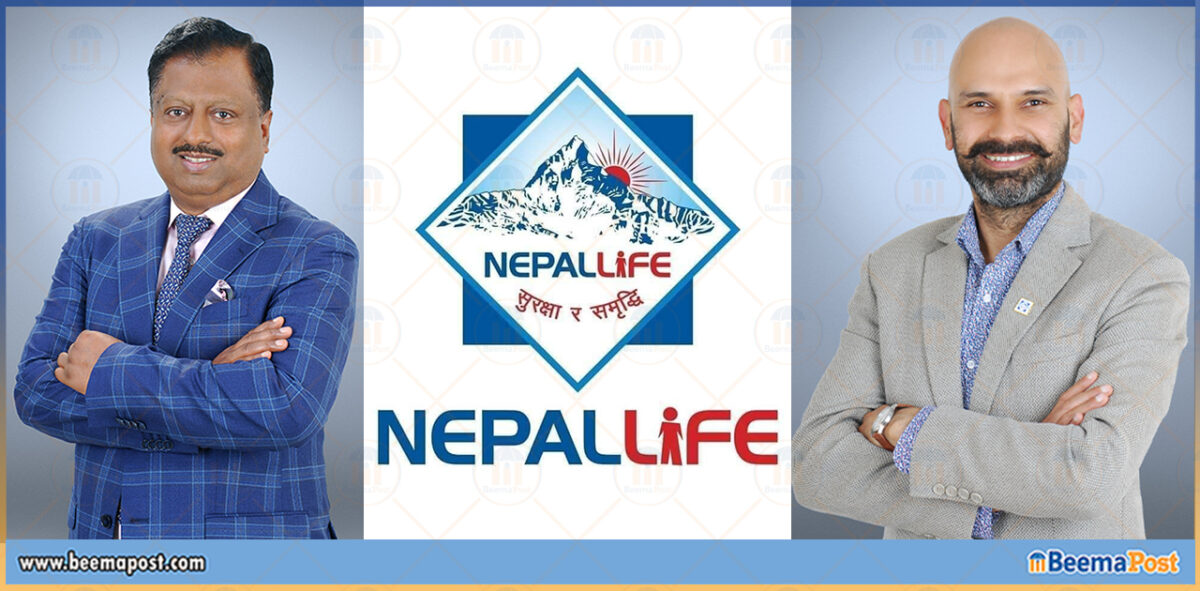

On the occasion, CEO Pravin Raman Parajuli extended gratitude to policyholders, staff, agents, shareholders, and regulators. “This journey would not have been possible without the trust and support of our customers and partners,” said Parajuli. He emphasized that the company’s financial foundation remains strong and expressed confidence in its future growth.

Nepal Life’s life insurance fund has reached Rs 217 billion as of the second quarter of the current fiscal year, with total insurance premium income recorded at Rs 22 billion. The company has maintained its leading position in financial indicators, supported by a paid-up capital of Rs 8.2 billion.

Chairman of the Board Govind Lal Sanghai leads the board alongside directors Kamlesh Kumar Agrawal, Shakti Kumar Golyan, Bimal Prasad Dhakal, Krishnaraj Lamichhane, and Sharmila Shrestha Maharjan. The executive leadership includes Deputy CEO Amit Kumar Kayal and department heads Umapati Pokharel (Sales), Om Prakash Pudasaini (Business Operations), Prem Prasad Regmi (Finance), Binod Kumar Bhujel (Legal), Sunita Pokharel (Agency and Policy Servicing), and Sharad Chandra Pyakurel (IT).

Looking ahead, the company reaffirmed its commitment to protect and support the lives of its customers, promising to continue improving services while contributing to Nepal’s growing insurance landscape.