NEPSE Listed Life Insurance Companies Sees Growth in Q3 of FY 2081/82

Kathmandu – Life insurance companies listed on the Nepal Stock Exchange (NEPSE) have published their third-quarter financial reports for the current fiscal year, with Nepal Life Insurance emerging as the market leader across several indicators.

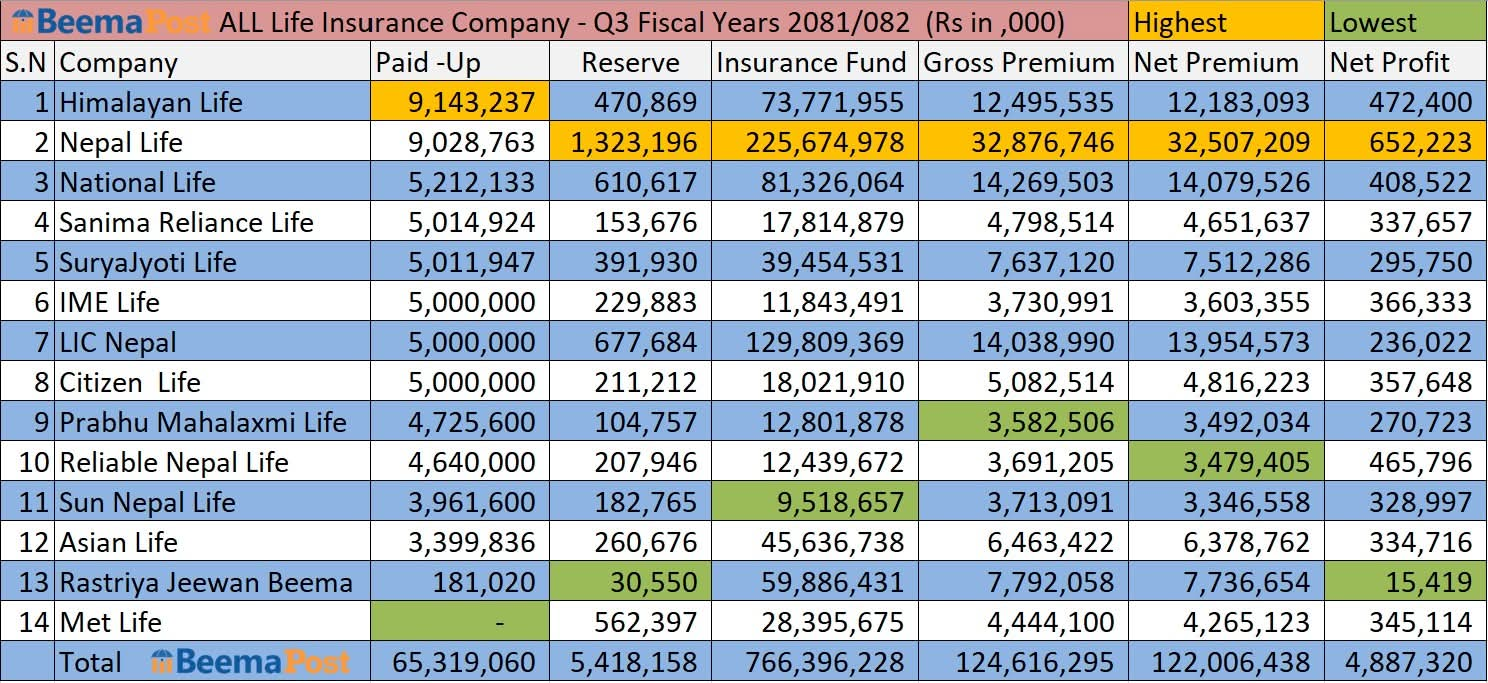

Capital and Reserves

Himalayan Life tops the list in terms of paid-up capital with Rs 9.14 billion, following the merger of Prime, Union, and Gurans Life. Nepal Life follows closely with Rs 9.02 billion, while National Life holds third place at Rs 5.21 billion. Nepal Life also leads in reserve fund accumulation with Rs 1.32 billion, ahead of LIC Nepal (Rs 677.6 million) and National Life (Rs 610.6 million).

Insurance Fund and Premiums

Nepal Life holds the largest insurance fund at Rs 225.6 billion, capturing the highest share of the industry’s Rs 766.3 billion total fund. LIC Nepal follows with Rs 129.8 billion, and National Life with Rs 81.32 billion. In terms of total insurance premiums collected, Nepal Life again leads with Rs 32.8 billion, ahead of National Life (Rs 14.26 billion) and LIC Nepal (Rs 14.03 billion).

Profit Performance

The life insurance sector saw a collective profit growth of 11.90%, with total net profit reaching Rs 4.88 billion by the end of the third quarter. Nepal Life posted the highest individual profit at Rs 652.2 million. Himalayan Life earned Rs 472.4 million, while Reliable Nepal made strong gains with Rs 465.7 million. Other key profit earners include National Life (Rs 408.5 million), IME Life (Rs 366.3 million), and Citizen Life (Rs 357.6 million).

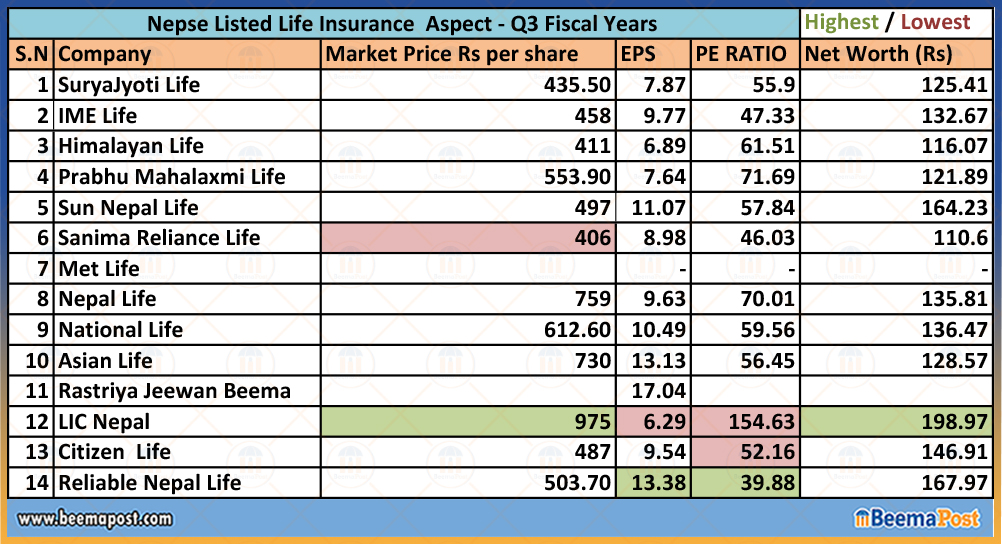

Earnings Per Share (EPS) and Net Worth

Reliable Nepal leads the listed companies in EPS with Rs 13.38, followed by Asian Life (Rs 13.13) and Sun Nepal Life (Rs 11.07). LIC Nepal has the lowest EPS at Rs 6.29. However, LIC Nepal ranks first in net worth per share at Rs 198.97, with Reliable Nepal (Rs 167.97) and Sun Nepal Life (Rs 164.23) following behind.