Policy-Backed Loans Surge as Life Insurance Companies Invest Over Rs 95 Billion

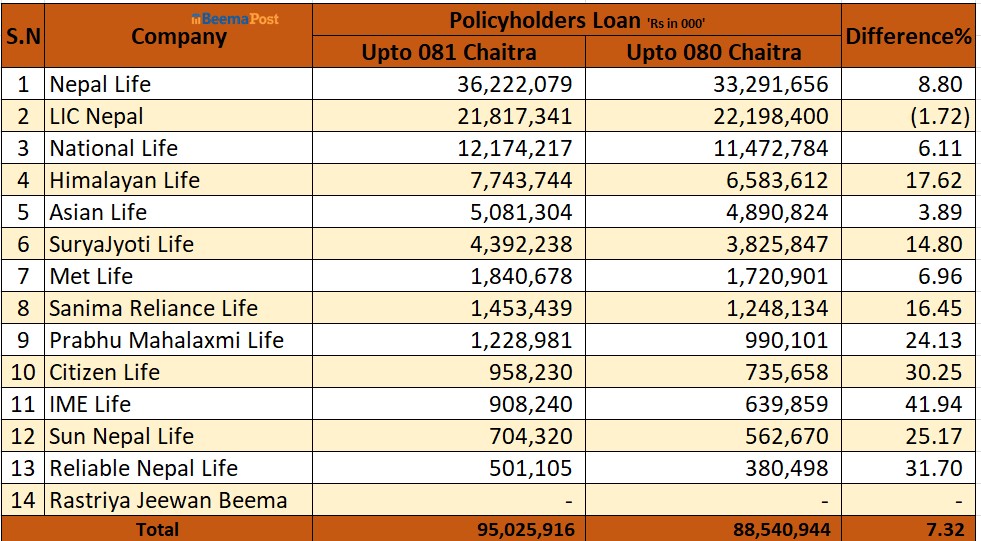

Kathmandu – Life insurance companies in Nepal have disbursed over Rs 95.02 billion in loans against insurance policies in the third quarter of the current fiscal year, marking a significant 7.32 percent increase compared to the same period last year. During the same period in the previous fiscal year, insurance companies had issued loans worth Rs 88.54 billion under this scheme.

Out of the 14 life insurance companies currently in operation, 13 have actively provided loans against policy collateral. The government-owned Rastriya Jeewan Beema Company remains the only insurance company not involved in this segment. Industry experts note that the share of such loans has surged between 3 percent and 41 percent over the past year.

Nepal Life Insurance Company stands at the forefront, having issued the highest volume of loans totaling Rs 36.22 billion which is 8.80 percent rise from the same period last year. LIC Nepal follows in second position with Rs 21.81 billion in loans, despite a slight year-on-year decline. National Life has emerged as the third-largest lender this fiscal year, investing Rs 12.17 billion in policy loans.

Other companies have also made notable investments in this area, including Himalayan Life (Rs 7.74 billion), Asian Life (Rs 5.08 billion), SuryaJyoti Life (Rs 4.39 billion), MetLife (Rs 1.84 billion), Sanima Reliance Life (Rs 1.45 billion), Prabhu Mahalaxmi Life (Rs 1.22 billion), Citizen Life(Rs 958.2 million), IME Life (Rs 908.2 million), Sun Nepal (Rs 704.3 million), and Reliable Nepal Life (Rs 501.1 million),

The growing appeal of loans against insurance policies stems from their relative ease, lower service fees, and more flexible interest rates compared to conventional bank loans. Bhojraj Sharma, an insurance analyst, notes that many policyholders now prefer borrowing from insurers as the interest rates and terms vary by company, often making them more accessible than commercial banks.