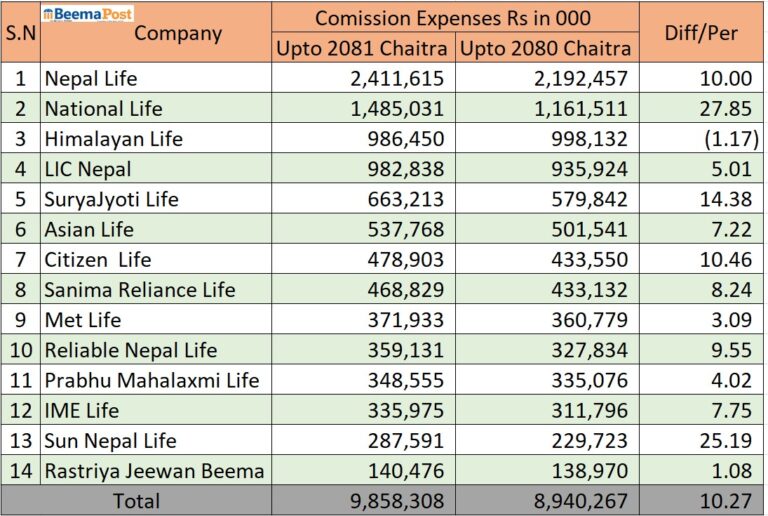

Life Insurance Companies Spend Nearly Rs 10 Billion on Agent Commissions in Q3

Kathmandu — Life insurance companies operating in Nepal have collectively spent Rs 9.85 billion on agent commissions in the third quarter of the current fiscal year. This marks a 10.27 percent rise compared to the same period last year, when the figure stood at Rs 8.94 billion.

According to financial statements published by the insurance companies, Nepal Life Insurance paid the highest commission, totaling Rs 2.41 billion. The company had spent Rs 2.19 billion in the same period last year, reflecting a 10 percent increase year-on-year.

National Life Insurance Company followed in second position, having paid Rs 1.48 billion in agent commissions. The company had spent Rs 1.16 billion in the corresponding period last year. Himalayan Life Insurance secured third place in total commissions paid, disbursing Rs 986.4 million in the third quarter. This marks a marginal decrease of 1.17 percent from last year’s Rs 998.1 million, making it one of the few companies to reduce commission payouts.

Other life insurance companies also reported significant outflows. LIC Nepal spent Rs 982.8 million, SuryaJyoti Life paid Rs 663.2 million, and Asian Life disbursed Rs 537.7 million. Citizen Life followed with Rs 478.9 million, while Sanima Reliance Life spent Rs 468.8 million, and Met Life allocated Rs 371.9 million to agent commissions. Reliable Nepal Life, Prabhu Mahalaxmi Life, and IME Life reported expenditures of Rs 359.1 million, Rs 348.5 million, and Rs 335.9 million respectively. Sun Nepal Life spent Rs 287.5 million, and the government-owned Rastriya Jeewan Beema Company reported the lowest commission spending at Rs 140.4 million.

As for growth rate, National Life led the pack with a 27.85 percent increase in agent commissions compared to the previous year. Sun Nepal Life followed closely with a 25.19 percent rise, while SuryaJyoti Life and Citizen Life registered increases of 14.38 percent and 10.46 percent, respectively.