Life Insurance Companies Earn Over Rs 109 Billion in Renewal Premiums in 10 Months of the Current FY

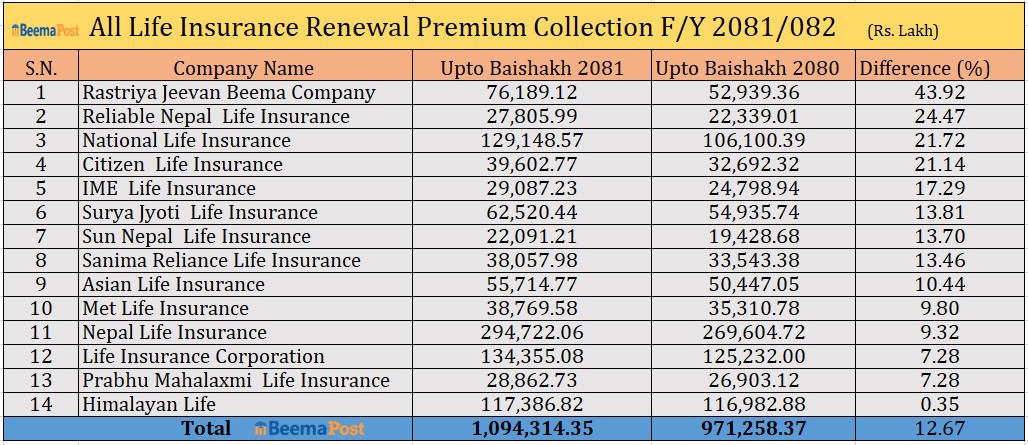

Kathmandu – Life insurance companies in Nepal have collected more than Rs 109.43 billion in renewal insurance premiums during the ten months leading up to the end of Baishakh (mid-April)) in the current fiscal year 2081/82. This marks a 12.67 percent increase compared to the same period of the previous fiscal year, during which life insurers had earned Rs 97.12 billion in renewal premiums, according to financial statements released by the Nepal Insurance Authority.

Among the 14 life insurance companies currently operating in the country, Nepal Life Insurance has secured the top position in terms of total renewal premium income. The company earned Rs 29.47 billion during the review period, reflecting a 9.32 percent increase from the previous fiscal year. However, the most notable growth was recorded by the government-owned Rastriya Jeevan Beema Company, which saw a remarkable 43.92 percent rise in renewal premium income, totalling Rs 7.61 billion.

Other major players also reported positive gains. LIC Nepal earned Rs 13.43 billion, an increase of 7.28 percent, while National Life followed closely with Rs 12.91 billion, showing a 21.72 percent growth. Himalayan Life Insurance reported Rs 11.73 billion in renewal premiums, though its growth rate remained modest at 0.35 percent.

In terms of overall collection, Suryajyoti Life Insurance brought in Rs 6.25 billion, Asian Life Insurance collected Rs 5.47 billion, and Citizen Life Insurance recorded Rs 3.96 billion in renewal premiums. Meanwhile, Met Life Insurance and Sanima Reliance Life Insurance earned Rs 3.87 billion and Rs 3.80 billion, respectively.

Further, IME Life Insurance generated Rs 2.90 billion, Prabhu Mahalaxmi Life Insurance earned Rs 2.88 billion, Reliable Nepal Life Insurance collected Rs 2.78 billion, and Sun Nepal Life Insurance brought in Rs 2.20 billion during the ten-month period.