Spike in Suspicious Transactions Raises Money Laundering Concerns in Nepal’s Insurance Sector

Kathmandu — Suspicious transactions within Nepal’s insurance sector have more than doubled annually, raising fresh concerns about money laundering risks and exposing regulatory weaknesses in oversight mechanisms.

Despite provisions requiring insurance companies to establish dedicated departments to combat money laundering and terrorist financing, industry experts say such measures have failed to produce tangible results. The Nepal Insurance Authority, responsible for regulation and supervision, has come under scrutiny for not effectively enforcing these safeguards.

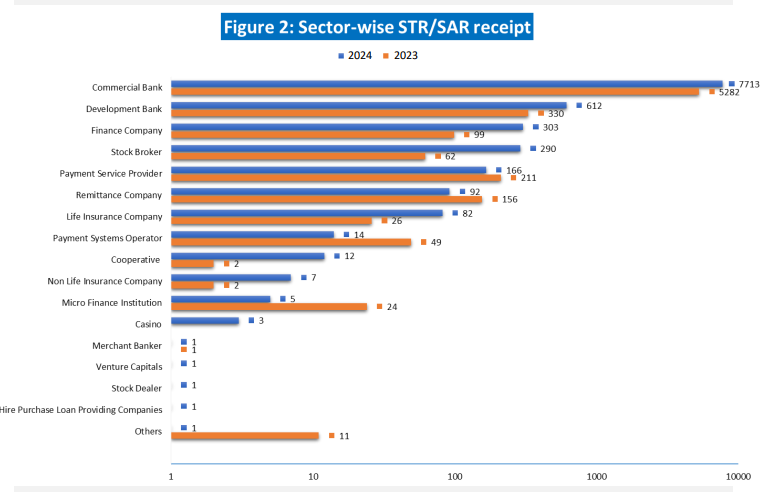

The Financial Information Unit (FIU) reported a 49 percent increase in suspicious transactions in 2024 compared to 2023. In the non-life insurance segment alone, suspicious activity surged by 250 percent—rising from 2 cases in 2023 to 7 in 2024. The life insurance sector reported 82 suspicious transactions in 2024, up from 26 the previous year.

Insiders point to structural shortcomings within the regulatory body, including limited manpower and infrastructure, as key reasons behind the weak enforcement. A former chairperson of the Insurance Authority noted that some large insurance policies are issued without adequate source verification, increasing the risk of financial crimes.

While guidelines such as the Anti-Money Laundering and Terrorist Financing Prevention Directive 2081 require companies to appoint management-level compliance officers and conduct regular training, implementation remains minimal. As a result, the FIU has forwarded hundreds of suspicious cases to enforcement agencies including Nepal Police, the Revenue Investigation Department, and Nepal Rastra Bank.

Experts stress the urgent need for robust supervision, better-trained human resources, and stricter adherence to reporting protocols such as Threshold Transactions and Suspicious Transaction Reports via the GoAML software, to curb illicit activities and strengthen the sector’s financial integrity.