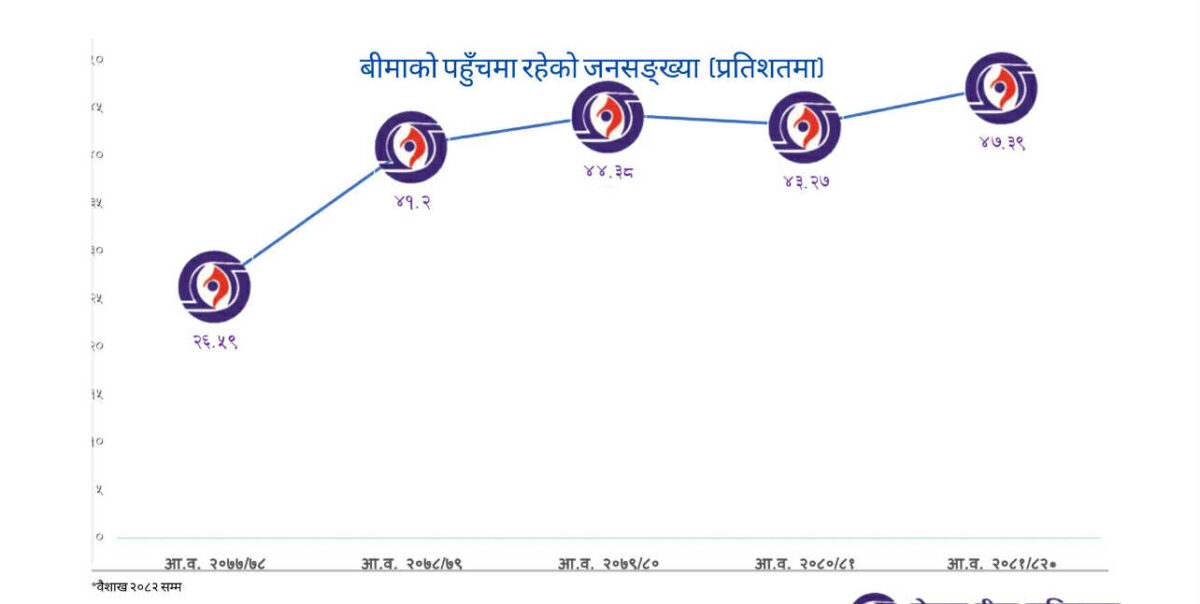

Life Insurance Coverage in Nepal Reaches Record High at 47.39 Percent

Kathmandu – Life insurance coverage in Nepal has reached an all-time high, with 47.39 percent of the population now under some form of life insurance protection, according to the latest data published by the Nepal Insurance Authority (NIA) as the end of Baisakh month 2081.

This marks the highest coverage level in Nepal’s history, surpassing previous records set in past fiscal years. The number of active life insurance policies has risen to 15.36 million, up from 13.95 million during the same period last year. Despite the possibility of individuals holding multiple policies, the Authority has adjusted the total by deducting 5 percent to more accurately estimate population coverage.

The new figure represents a significant increase from previous months. In Ashad 2080, insurance coverage stood at 44.38 percent, but it declined steadily due to economic challenges, reaching a low of 42.84 percent by Ashoj 2080. However, since Kartik month, coverage has begun to recover, climbing to 44.64 percent in Chaitra and now setting a new record in Baisakh.

Excluding term, micro-term, and foreign employment-related policies, 16.77 percent of citizens are covered. When foreign employment insurance is excluded, the adjusted life insurance coverage stands at 39.31 percent.

Despite this progress, 52.61 percent of the population remains outside the insurance net. The Authority had set an ambitious target to increase life insurance penetration to 50 percent by the end of fiscal year 2081/82.

Rise in Lapsed and Surrendered Policies

The report also highlights concerns regarding policy renewals. As of Baisakh, over 1.25 million life insurance policies are pending renewal—an 11.63 percent increase from the same period last year. In monetary terms, this represents policies worth NPR 26.86 billion that have yet to be renewed.

Life insurance policies in Nepal typically span 10 to 25 years and require annual premium payments. Failure to pay results in policy lapse, rendering the policyholder ineligible for claims during the non-renewed period.