Endowment Insurance Leads Nepal’s Life Insurance Market with 38% Business Share

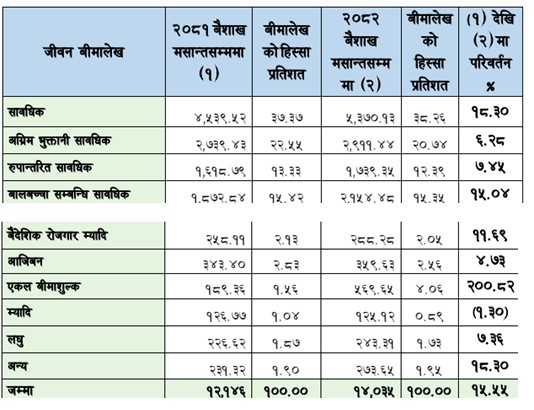

Kathmandu – Endowment insurance policies have taken the lead in Nepal’s life insurance sector, contributing the largest share of premium collection, according to the latest data published by the Nepal Insurance Authority. As of the end of Baisakh (mid-May) in the current fiscal year 2081/82, these policies accounted for 38.26 percent of the total life insurance business—a significant indicator of evolving customer preferences in the market.

Life insurance companies in Nepal collected Rs 53.7 billion in premiums, marking an 18.30 percent increase from the Rs 45.39 billion recorded in the same period last fiscal year. Among the various types of life insurance products, endowment policies that provide both life coverage and maturity benefits have seen the strongest performance.

Advance payment endowment policies follow closely, contributing significantly to the total premium amount. Child endowment policies have also seen notable uptake, reflecting growing interest among families in securing future financial support for their children.

In addition, converted endowment policies, single-premium life insurance, whole life policies, and foreign employment-related policies have also contributed to the overall premium volume. However, policies like term life insurance, which offer only risk coverage without maturity benefits, continue to hold the smallest share of the market.