General Insurance Association of Nepal Urges Review of Share Trading Ban for Directors

Kathmandu – General Insurance Association of Nepal (GIAN) has officially called on regulatory bodies to amend the rule that restricts company directors from trading shares during their tenure and for one year after leaving office, terming it impractical and unfair.

As per Rule 38 (1A) of the Securities Registration and Issuance Regulations, 2079, directors of listed companies are prohibited from buying or selling shares of their company while in office and for a year after stepping down. The association argues that this restriction is unrealistic and creates unnecessary obstacles for businesspersons and investors.

In a formal statement issued Thursday, the association stated, “The arrangement related to share sales is extremely impractical. Directors, like other shareholders, are investors. Preventing them from selling shares simply because they represent shareholders on the board is unjust.”

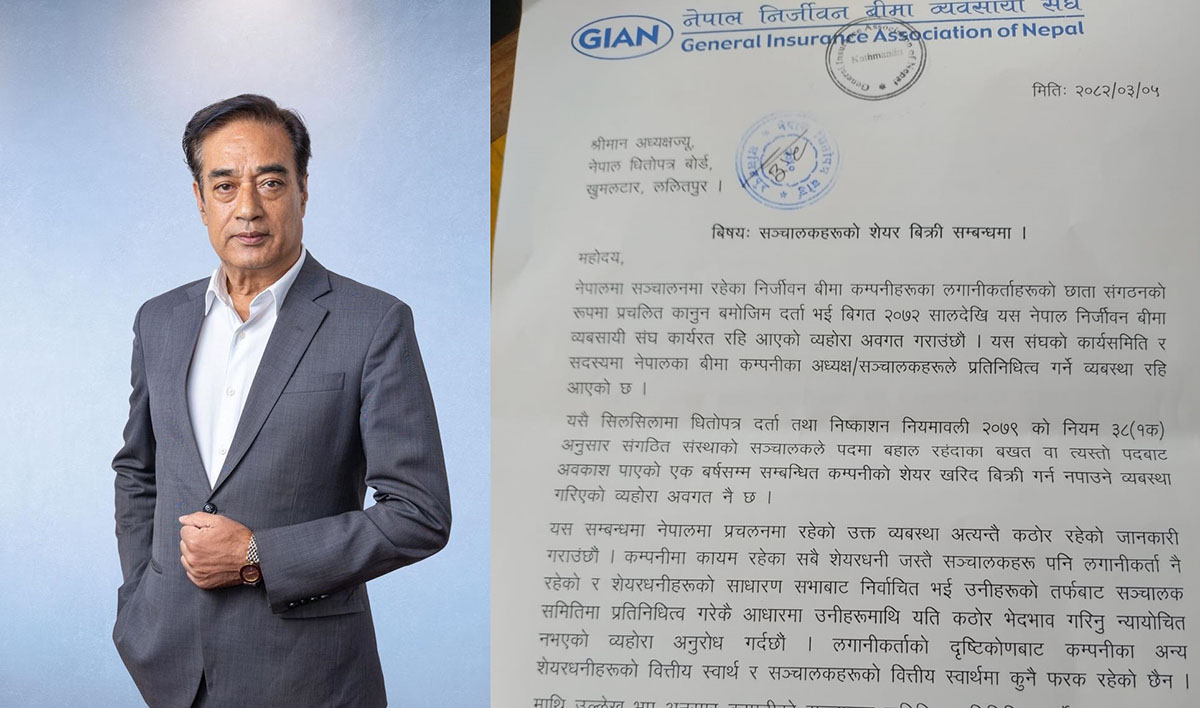

Association President Rajendra Malla, who also serves as the president of the Nepal Chamber of Commerce, emphasized that this provision unfairly limits directors’ financial freedom. He added that limiting a businessperson’s ability to sell movable assets like shares can even hinder basic household financial planning, in addition to curbing business expansion efforts.

The association has submitted its concerns to the Securities Board of Nepal (SEBON), the Insurance Authority, and other relevant institutions. It has requested an amendment to allow directors to sell up to 50 percent of their shareholding with prior notification to regulatory bodies, even while serving on the board.

The association further warned that the current rule could create roadblocks in Nepal’s investment environment and discourage foreign investors.