Motor and Property Insurance Drive Non-Life Insurers’ Growth in Nepal

Kathmandu, – Non-life insurance companies in Nepal have collected insurance premiums worth Rs 39.88 billion by the end of Jestha (mid-June) of the current fiscal year, largely driven by motor and property insurance policies made mandatory by the government.

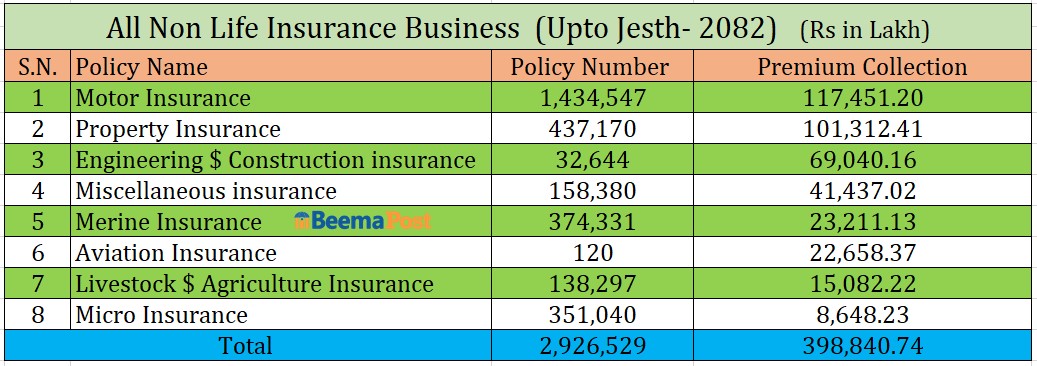

According to data published by the Nepal Insurance Authority, the 14 active non-life insurance companies in the country sold a total of 2.92 million insurance policies during the first eleven months of the fiscal year. The report highlights that third-party motor insurance and property insurance—both mandated by government regulation account for the largest share of the total insurance business.

The government’s policy requiring third-party motor insurance as a prerequisite for vehicle registration and renewal of blue books has had a direct impact on the market. During the review period, insurers earned Rs 11.74 billion from the sale of 1,434,647 motor insurance policies, marking it as the highest contributor to non-life premiums.

Property insurance also played a significant role in boosting the industry’s earnings. With 437,170 policies sold, non-life insurers generated Rs 10.13 billion in premiums from property insurance alone. This product has also benefited from government mandates for specific sectors and businesses.

Beyond these, other segments of the non-life insurance market remain relatively smaller in scale but still contribute to overall growth. Engineering and construction risk insurance accounted for Rs 6.9 billion in premiums from 32,644 policies, while marine insurance brought in Rs 4.14 billion from 374,331 policies. Aviation insurance, although limited in policy count, contributed Rs 2.26 billion from just 120 policies.

Agriculture and livestock insurance saw 138,297 policies issued, with insurers collecting Rs 1.508 billion in premiums. Similarly, microinsurance—targeted at underserved and low-income populations—generated Rs 864.8 million through 351,040 policies.