Which Are the World’s Biggest Reinsurance Companies?

Global credit rating agency AM Best has released its much-anticipated annual ranking of the world’s largest reinsurance companies—and for the first time, the list has been split in two. The cause? The uneven adoption of IFRS 17, the new international financial reporting standard that is reshaping how insurers and reinsurers disclose their results.

Traditionally, reinsurance companies were ranked based on gross premiums written (GPW). However, with IFRS 17 now in force across many jurisdictions, AM Best has introduced an additional ranking based on gross revenue, the new metric preferred under the revised accounting framework.

As a result, Swiss Re claims the top spot in the non-IFRS 17 list, while Munich Re leads among companies that have adopted the new standard, creating two distinct global leaders depending on accounting methodology.

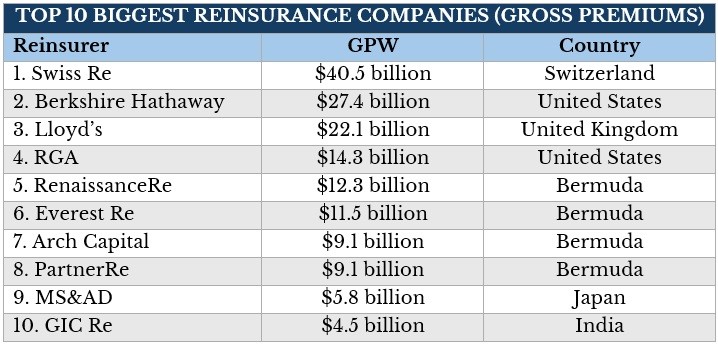

According to AM Best’s 2025 Market Segment Report, Swiss Re, headquartered in Zürich, remains the largest reinsurer globally based on GPW, reporting $40.5 billion in premiums for the 2023 financial year. The Swiss giant continues to use legacy financial reporting and has not yet transitioned to IFRS 17, though it is expected to do so in the next cycle.

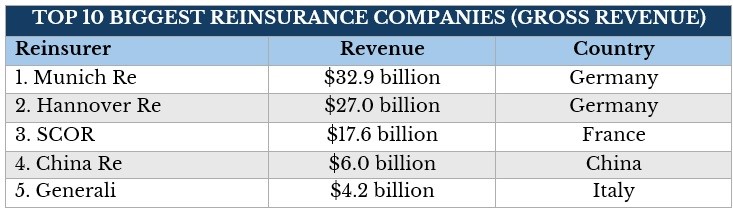

Meanwhile, Munich Re, based in Germany, tops the list of IFRS 17-compliant reinsurers with $32.9 billion in gross revenue. Despite a notable decline from the company’s previous GPW of $51.3 billion under old standards, Munich Re maintains its industry leadership within the new financial reporting paradigm.

Top 10 Reinsurers by Gross Premiums Written (Non-IFRS 17)

These companies, primarily based in North America, Bermuda, and parts of Asia, continue to report under US GAAP or local accounting standards:

Top 5 Reinsurers by Gross Revenue (IFRS 17)

Under IFRS 17, companies are required to separate reinsurance activities from direct insurance, leading to a more transparent—but not directly comparable—accounting of revenue:

The IFRS 17 Effect: Why the Rankings Split

The implementation of IFRS 17 marks a significant turning point in global insurance accounting. It aims to enhance transparency, consistency, and comparability of financial statements by requiring insurers to report the separate impacts of insurance and reinsurance contracts on profitability and risk exposure.

However, as IFRS 17 adoption varies across jurisdictions—particularly between Europe and Bermuda/US-based entities—AM Best has had to maintain two distinct sets of rankings. This shift may become a permanent feature, especially as reinsurers in Bermuda and the US are likely to continue using US GAAP, which does not currently require IFRS 17-level granularity. – Reinsurance Business