Commercial Banks’ Base Rates Drop Amid Surplus Liquidity and Sluggish Credit Demand

Kathmandu — The base rate of commercial banks in Nepal has been steadily declining over the past year, driven by excess liquidity in the banking system and reduced demand for credit. This has led banks to lower deposit interest rates, ultimately dragging down the base rates — the benchmark used to determine lending rates.

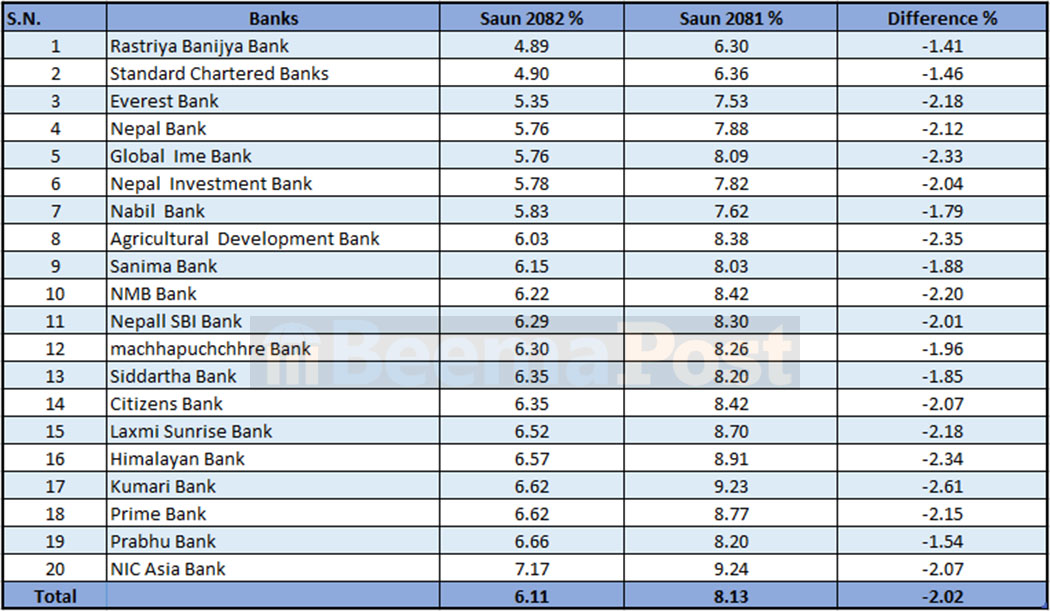

According to the latest data, the average base rate of the country’s 20 commercial banks has dropped by 2.02 percentage points in the span of one year. In the month of Shrawan of the last fiscal year, the average stood at 8.13 percent, whereas in the same month this fiscal year, it has fallen to 6.11 percent.

Among the commercial banks, Rastriya Banijya Bank posted the lowest base rate at 4.89 percent. It is closely followed by Standard Chartered Bank at 4.90 percent, Everest Bank at 5.35 percent, and both Nepal Bank and Global IME Bank at 5.76 percent.

Other banks have maintained moderate base rates. Nepal Investment Mega Bank has reported a base rate of 5.78 percent, while Nabil Bank stands at 5.83 percent. Krishi Bikas Bank has maintained 6.03 percent, Sanima Bank at 6.15 percent, NMB Bank at 6.22 percent, Nepal SBI Bank at 6.29 percent, Machhapuchhre Bank at 6.30 percent, and both Siddhartha Bank and Citizen Bank at 6.35 percent. Lakshmi Sunrise Bank reported a slightly higher base rate at 6.52 percent.

At the higher end of the spectrum, Himalayan Bank recorded a base rate of 6.57 percent, Kumari Bank and Prime Commercial Bank both posted 6.62 percent, Prabhu Bank reported 6.66 percent, while NIC Asia Bank maintained the highest base rate among all, at 7.17 percent.