Life Insurers Yet to Recover Over Rs 700 Million in Agent Loans

Kathmandu – Life insurance companies in Nepal are still struggling to recover more than Rs 700 million in loans disbursed to their insurance agents, raising concerns about compliance with regulatory directives and financial discipline within the industry.

According to the latest data from the insurance sector, a total of Rs 710 million remains unrecovered across 14 life insurance companies. Despite clear instructions from the Nepal Insurance Authority (NIA), many companies are suspected of continuing to disburse new loans under various pretexts.

On 12th Jestha 2079 BS, the Authority had explicitly instructed all life insurers to recover outstanding agent loans and prohibited the issuance of any new loans to insurance agents. However, progress has been slow. By mid-Ashar 2080 BS, the outstanding loan amount stood at Rs 957 million. In the two years since, companies have managed to recover only about Rs 200 million, reflecting minimal enforcement and delayed action.

Insiders claim that some companies have issued new loans under different headings, despite the ban. Although the total outstanding loan amount has decreased, sources within the sector confirm that fresh disbursements have occurred in certain cases.

Insurance companies have typically provided these loans to agents for vehicle purchases—especially motorcycles and cars—under the justification of enhancing agents’ mobility and outreach, particularly in rural and remote areas. These loans are usually extended to agents who have met certain performance targets, and the vehicles themselves are often used as collateral.

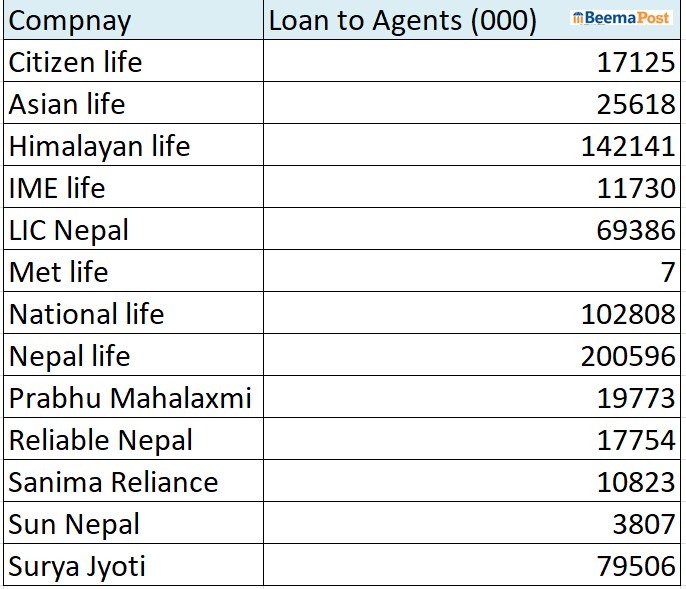

As per company-wise statistics, Nepal Life Insurance tops the chart with Rs 200.5 million yet to be recovered from its agents. Himalayan Life follows with Rs 142.1 million, National Life with Rs 102.8 million, and Suryajyoti Life with Rs 79.5 million. LIC Nepal has Rs 69.3 million pending, Asian Life Rs 25.6 million, and Prabhu Mahalaxmi Life Rs 19.7 million.

As per company-wise statistics, Nepal Life Insurance tops the chart with Rs 200.5 million yet to be recovered from its agents. Himalayan Life follows with Rs 142.1 million, National Life with Rs 102.8 million, and Suryajyoti Life with Rs 79.5 million. LIC Nepal has Rs 69.3 million pending, Asian Life Rs 25.6 million, and Prabhu Mahalaxmi Life Rs 19.7 million.

Similarly, Reliable Nepal Life has yet to recover Rs 17.7 million, Citizen Life Rs 17.1 million, IME Life Rs 11.7 million, Sanima Reliance Life Rs 10.8 million, Sun Nepal Life Rs 3.8 million, and MetLife Rs 7 thousand.

Previously, life insurers were allowed to offer cash loans to their agents under provisions set by the Authority, including loans for real estate purchases. However, with this avenue now closed, agents have increasingly called on regulators to revisit and revise the institutional governance guidelines that restrict such financial support.