Government Amends Key Provisions of Insurance Act, Tightens Rules on Unclaimed Claims

Kathmandu – The Government of Nepal has amended three significant provisions in the Insurance Act 2079, marking a critical shift in how insurance claims, particularly unclaimed amounts, will be handled in the future. Through a bill introduced to amend various Nepal Acts, the government has revised clauses relating to company cancellation procedures, mediation mechanisms, and insurance claim settlements—paving the way for stricter oversight and enhanced policyholder protection.

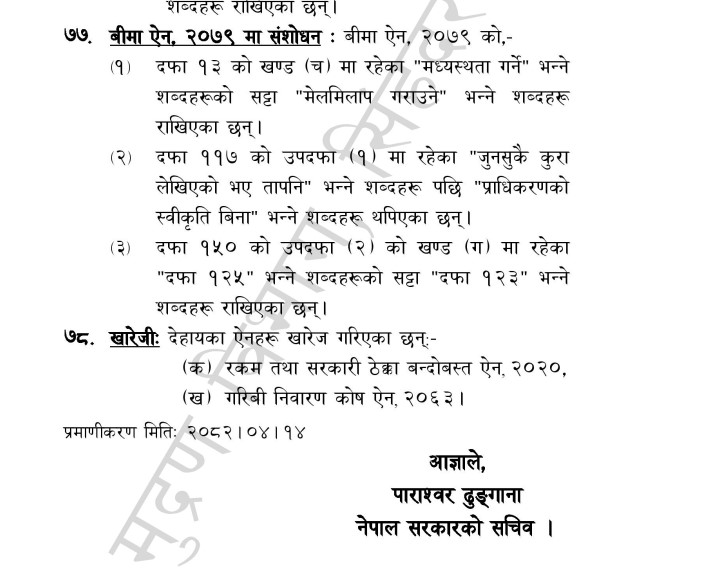

One of the major changes involves replacing the term “mediation” with “conciliation” in Clause 13 of the Act, signaling a shift toward more formalized dispute resolution processes in insurance. Similarly, Clause 117(1), which governs the conditions for cancelling an insurance company, now requires mandatory approval from the Insurance Authority, enhancing regulatory control over market exits.

However, the most far-reaching impact comes from the amendment to the provisions regarding insurance claim settlement. The government has replaced Clause 125 with an updated Clause 123, introducing stricter timelines and accountability standards for insurers. Under the revised framework, insurance companies must now assess and settle claims within a designated period once a claim is submitted, as specified in the policy. In cases where assessment is not required, the settlement must occur directly from the date of claim submission.

Further provisions require that if the insured or rightful claimant cannot be identified or contacted within the legally prescribed timeframe, the insurance amount must be deposited into a designated “Unclaimed Fund.” Insurance companies are also obligated to maintain documented evidence of all reasonable efforts made to locate the claimant. Additionally, all unsettled claims that exceed the given period must be reported to the Insurance Authority, ensuring transparency and regulatory scrutiny.

Further provisions require that if the insured or rightful claimant cannot be identified or contacted within the legally prescribed timeframe, the insurance amount must be deposited into a designated “Unclaimed Fund.” Insurance companies are also obligated to maintain documented evidence of all reasonable efforts made to locate the claimant. Additionally, all unsettled claims that exceed the given period must be reported to the Insurance Authority, ensuring transparency and regulatory scrutiny.

The amendment also empowers the Insurance Authority to implement special claim procedures in regions affected by national disasters or emergencies. In such cases, the Authority can introduce temporary measures specific to crisis-hit areas to expedite the claim process.

These legal changes come amid growing concerns over unclaimed life insurance benefits. Despite policies maturing, many policyholders or their beneficiaries fail to claim their entitlements, leading to significant sums remaining with insurers. Reports by the Office of the Auditor General have exposed how some insurance companies have been misusing these idle funds without adequate disclosure or accountability.

According to the latest audit for the fiscal year 2080/81, over NPR 1.19 billion in matured, surrendered, and death-related insurance claims remained unpaid for more than a year. This included NPR 373.79 million in matured policies alone, which companies had failed to disburse. The audit also criticized the Insurance Authority for its lack of follow-up, stating that it had neither inquired about the reasons for delays nor provided necessary directions to resolve the issues.

The amended Act also reinforces the requirement to deposit long-outstanding claim amounts into the Insured’s Interest Protection Fund, a provision already stated in the regulation but not strictly enforced. The revised law makes it clear that insurance companies must now transfer such funds after a defined period and remain prepared to release the amount to the claimant at any time. Companies must report these cases to the regulator, even if the insured party is unreachable.

Despite earlier provisions requiring companies to notify claimants before transferring funds to the unclaimed category, many had continued to use the funds arbitrarily, disregarding regulatory mandates. With the current amendment, the scope of the unclaimed fund has been broadened, and the legal framework now compels insurers to separate and safeguard such amounts, strengthening consumer protection in the insurance sector.