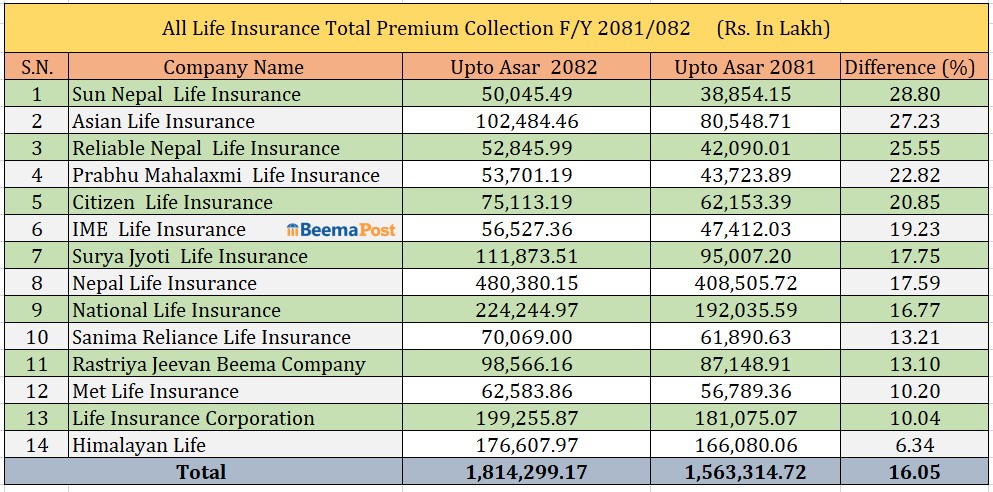

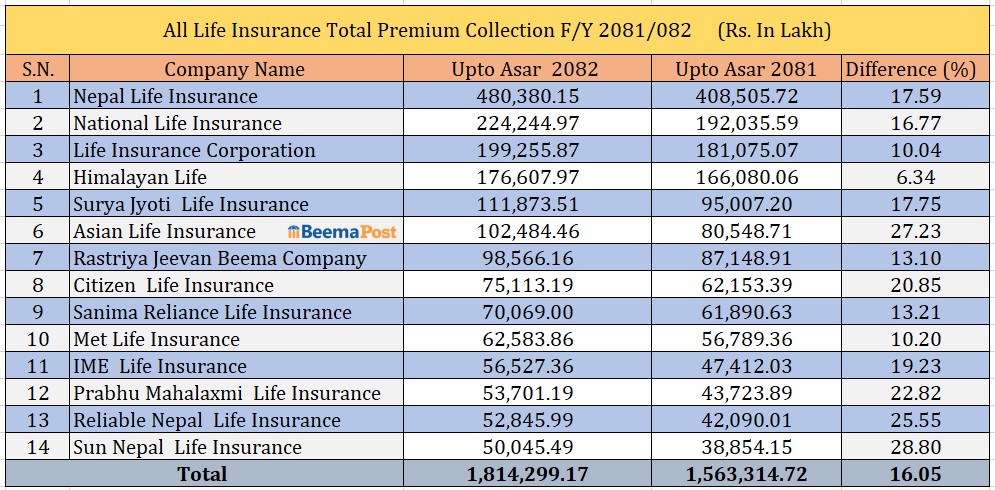

Life Insurance Sector Sees Robust Growth, Premiums Reach Rs 181.42 Billion

Kathmandu — Nepal’s life insurance sector has recorded significant growth in the last fiscal year, with total premiums collected reaching Rs 181.42 billion by the end of Ashar, according to the financial statements published by the Nepal Insurance Authority on Friday.

The 14 life insurance companies operating in the country collectively saw their business expand by 16.05 percent compared to the previous fiscal year, when premiums totaled Rs 156.33 billion.

Nepal Life Insurance retained its top position, earning total premiums of Rs 48.03 billion, marking a 17.59 percent increase from the previous year. National Life Insurance followed with Rs 22.42 billion in premiums, up 16.77 percent from Rs 19.20 billion in the prior period.

LIC Nepal also reported steady performance, with premiums rising 10.04 percent to Rs 19.92 billion. Similarly, Himalayan Life’s premium income grew by 6.34 percent to Rs 17.66 billion, while Suryajyoti Life posted a 17.75 percent increase to Rs 11.18 billion. Asian Life recorded one of the strongest expansions, with premiums climbing 27.23 percent to Rs 10.24 billion.

Source: Nepal Insurance Authority

During the review period, the government-owned Rastriya Beema Company achieved premiums of Rs 9.85 billion, while Citizen Life generated Rs 7.51 billion. Sanima Reliance Life and IME Life collected Rs 7.0 billion and Rs 5.65 billion, respectively. Prabhu Mahalaxmi Life and Reliable Nepal Life followed closely, earning Rs 5.37 billion and Rs 5.28 billion, while Sun Nepal Life recorded Rs 5.04 billion.

Sun Nepal Life Insurance emerged as the fastest-growing insurer, with its premiums surging 28.80 percent compared to the previous fiscal year. Asian Life Insurance ranked second in growth with a 27.23 percent increase, followed by Reliable Nepal Life, which expanded by 25.55 percent.