Ten Commercial Banks Report Strong Growth; Nabil, Everest, and Agricultural Development Bank Lead Performance

Kathmandu — Nepal’s commercial banking sector has reported strong financial results for the fiscal year 2081/82, with most banks reporting improved profitability, stronger balance sheets, and healthier financial indicators. According to the latest disclosures, 10 out of 20 commercial banks have published their annual financial statements, with nine recording a profit growth.

Analysts attribute the improvement to a combination of reduced non-performing loans, balanced credit expansion, and favorable regulatory policies from Nepal Rastra Bank. The central bank’s more accommodative monetary stance in recent years, including measures to facilitate earnings growth, has helped banks improve their dividend-paying capacity, with a positive ripple effect on share prices.

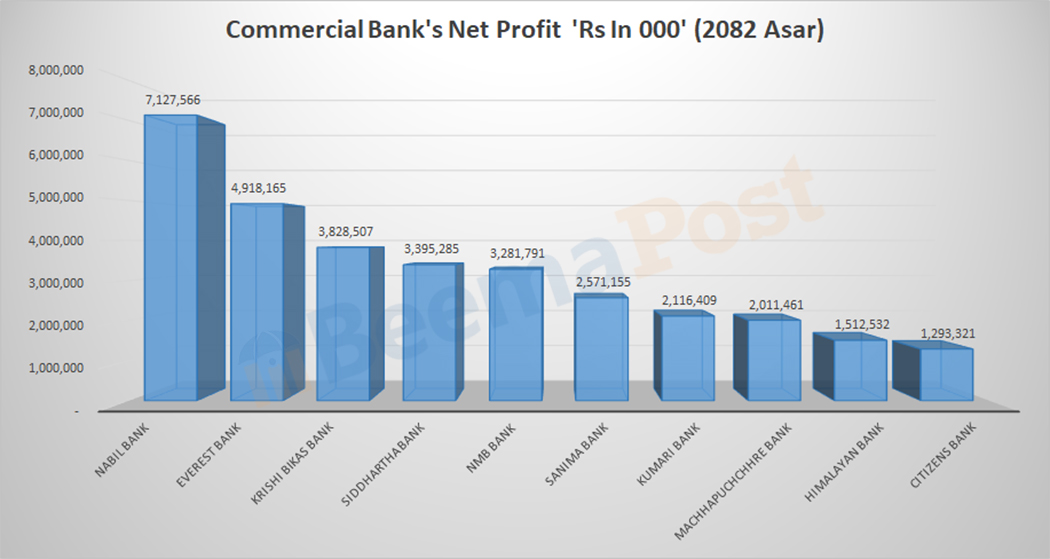

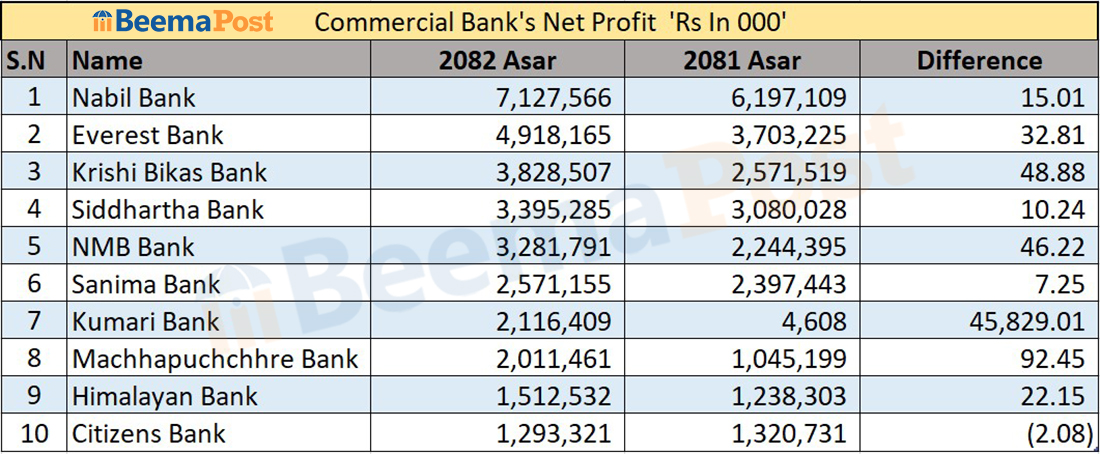

Profit Leaders and Market Trends

Nabil Bank maintained its long-held position as the most profitable commercial bank, recording a 15.01 percent rise in net profit to Rs 7.12 billion, up from Rs 6.19 billion in the previous fiscal year. Everest Bank secured second place with a 32.81 percent increase in profit to Rs 4.91 billion. Agricultural Development Bank saw a robust 48.88 percent growth to Rs 3.82 billion, closely followed by Siddhartha Bank and NMB Bank, each posting profits of Rs 3.39 billion and Rs 3.28 billion with growth rates of 10.24 percent and 46.22 percent, respectively.

Sanima Bank’s profit rose from Rs 2.39 billion to Rs 2.57 billion, while Kumari Bank reported one of the most dramatic turnarounds in recent memory — a staggering 45,829.01 percent jump in profit from Rs 46.08 million to Rs 2.11 billion. Machhapuchhre Bank posted a 92.45 percent rise to Rs 2.01 billion, and Himalayan Bank reported a 22.15 percent increase to Rs 1.51 billion. Citizens Bank was the only one among the 10 to post a decline, with profits falling 2.08 percent to Rs 1.29 billion.

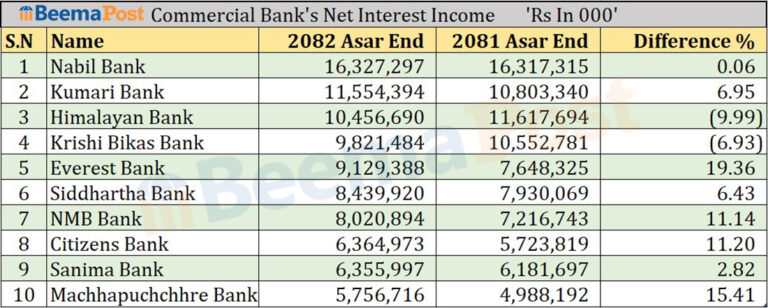

Net Interest Income and Earnings Per Share

Nabil Bank also topped the chart in net interest income with Rs 16.32 billion. Kumari Bank followed with Rs 11.55 billion, and Himalayan Bank came third with Rs 10.45 billion despite a year-on-year decline. Other notable performers included Everest Bank (Rs 9.12 billion), Siddhartha Bank (Rs 8.43 billion), NMB Bank (Rs 8.02 billion), Citizens Bank (Rs 6.36 billion), Sanima Bank (Rs 6.35 billion), Machhapuchhre Bank (Rs 5.75 billion), and Agricultural Development Bank (Rs 9.82 billion).

In earnings per share (EPS), Everest Bank led with Rs 37.99, up from Rs 31.47 a year ago. Agricultural Development Bank’s EPS rose from Rs 18.56 to Rs 27.63, while Nabil Bank’s climbed from Rs 22.90 to Rs 26.34. Siddhartha Bank, Sanima Bank, NMB Bank, and Machhapuchhre Bank also posted improvements, while Citizens Bank recorded a slight decline.

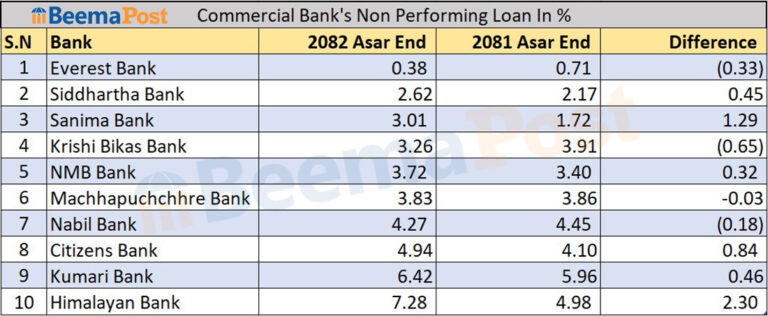

Asset Quality and Risk Management

Everest Bank demonstrated the strongest asset quality with the lowest non-performing loan (NPL) ratio of 0.38 percent, improving further from the previous year. Nabil Bank reduced its NPL ratio to 4.27 percent, while Agricultural Development Bank, NMB Bank, Sanima Bank, and Machhapuchhre Bank also reported stable or improved loan books. Citizens Bank and Kumari Bank recorded higher NPL levels, and Himalayan Bank had the highest ratio at 7.28 percent, indicating continued asset quality challenges.