Non-Life Insurance Companies Strengthen Capital, Reserves Despite Profit Variation in Q4 of FY 2081/82

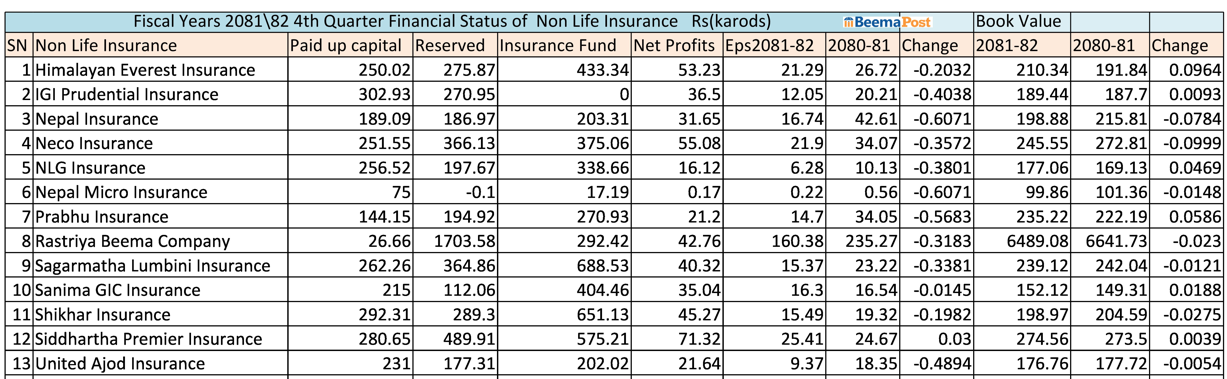

Kathmandu – The overall financial condition of Nepal’s non-life insurance sector weakened in the last fiscal year, with profits falling sharply due to a surge in flood-related claims. According to the financial statements of 13 listed non-life insurers, aggregate profits decreased by 28.43 percent compared to the previous fiscal year.

Out of the 13 companies, only Sanima GIC Insurance and Siddhartha Premier Insurance managed to increase their net profits, while the remaining 11 insurers recorded significant declines. Siddhartha Premier Insurance emerged as the most profitable company, posting a net profit of Rs 713.2 million, up from Rs 692.3 million a year earlier. In contrast, Prabhu Insurance saw the steepest fall, with profit plunging by 56.82 percent to Rs 212 million from Rs 499 million in the previous year. Shikhar Insurance recorded the smallest decline at 11.75 percent.

Earnings per share (EPS) also dropped sharply across the sector, with an average decline of 33.68 percent. Nepal Micro Insurance experienced the steepest fall of 60.71 percent, as its EPS slid from Rs 0.56 to Rs 0.22 following its IPO. Similarly, Nepal Insurance reported a 60.71 percent decline in EPS, dropping from Rs 42.61 to Rs 16.74. The only exception was Siddhartha Premier, whose EPS rose by 3 percent.

In terms of net worth, Himalayan Everest Insurance recorded the highest growth, with a 9.64 percent increase from Rs 191.84 to Rs 210.34 per share. NLG Insurance and Sanima GIC Insurance also saw gains of 4.69 percent and 1.88 percent, respectively. However, the sector’s overall net worth declined by 1.80 percent year-on-year.

Despite the drop in profitability, non-life insurers strengthened their financial base. On average, their paid-up capital rose by 6.38 percent, following directives from the Nepal Insurance Authority to raise capital to Rs 2.5 billion. Most companies met this requirement by issuing bonuses and rights shares, though a few are still awaiting regulatory approval.

Reserves across the sector grew by an average of 2.27 percent. Himalayan Everest Insurance recorded the highest reserve growth of 20.15 percent, increasing from Rs 2.29 billion to Rs 2.75 billion. Rastriya Beema Company, despite having the lowest paid-up capital, maintained the largest reserve at Rs 17.35 billion.

Similarly, insurance funds expanded by an average of 7.47 percent. Notably, National Insurance Company’s insurance fund surged by 207 percent, reaching Rs 2.92 billion from Rs 942.3 million in the previous fiscal year. Sagarmatha Lumbini Insurance held the largest insurance fund in the industry at Rs 6.88 billion.