Swiss Re and Berkshire Hathaway Tops “World’s Largest Reinsurer” Rankings

Swiss Re has secured the top position in AM Best’s latest “World’s 50 Largest Reinsurers” rankings under IFRS 17 reporting standards, moving ahead of Munich Re. The rankings were published ahead of the Rendez-Vous de Septembre in Monte Carlo, one of the most significant annual gatherings in the global reinsurance industry.

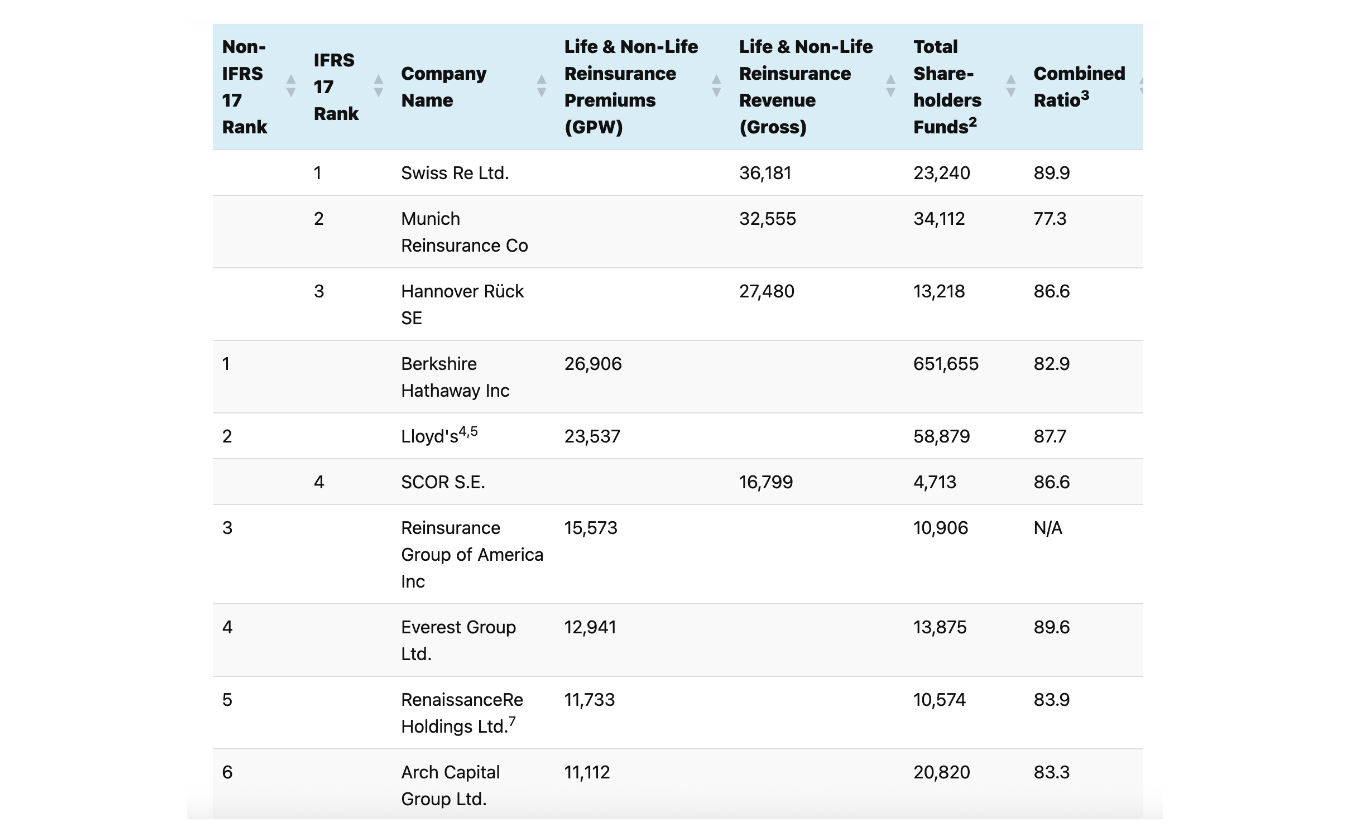

Swiss Re reported US$40.5 billion in gross premiums written in 2023 and US$36.2 billion in reinsurance revenue for 2024, earning it the number one spot among IFRS 17 reporters. Munich Re ranked second, while Hannover Rück SE took the third position. Despite the reshuffle, Munich Re maintained an edge in underwriting performance, posting a non-life combined ratio of 77.3, an improvement from 85.2 the year before.

For non-IFRS 17 reporters, Berkshire Hathaway climbed to the top with US$26.9 billion in gross premiums written, followed by Lloyd’s at US$23.5 billion. Overall, the top five IFRS 17 reinsurers recorded a weighted average combined ratio of 84.9 in 2024.

The remaining top-five non-IFRS 17 players are Reinsurance Group of America (RGA) at number three with GPW of US$15.6 billion; Everest Group (which moved up from sixth place in 2023 to fourth in 2024) with GPW of US$12.9 billion; and Renaissance Re (RenRe) at number five with $11.7 billion GPW.

This marks the second full year of separate rankings for IFRS 17 and non-IFRS 17 reinsurers. The methodology is based on reinsurance revenue for IFRS 17 reporters and gross premiums written for non-IFRS 17 reporters.

The report highlighted several risks shaping reinsurance results in 2025. According to AM Best financial analyst Chris Pennings, the California wildfires in January significantly eroded reinsurers’ catastrophe budgets early in the year. Companies with exposure to the U.S. wildfire market recorded some of their weakest underwriting results in years.

“As 2025 plays out, the market has witnessed pockets of rate softening among non-loss affected accounts, though rates modestly improved or maintained on loss-affected accounts,” Pennings said.

In 2023, Swiss Re was number one for non-IFRS 17 reporters, but has now shifted its reporting and, based on year-end 2024 revenue.