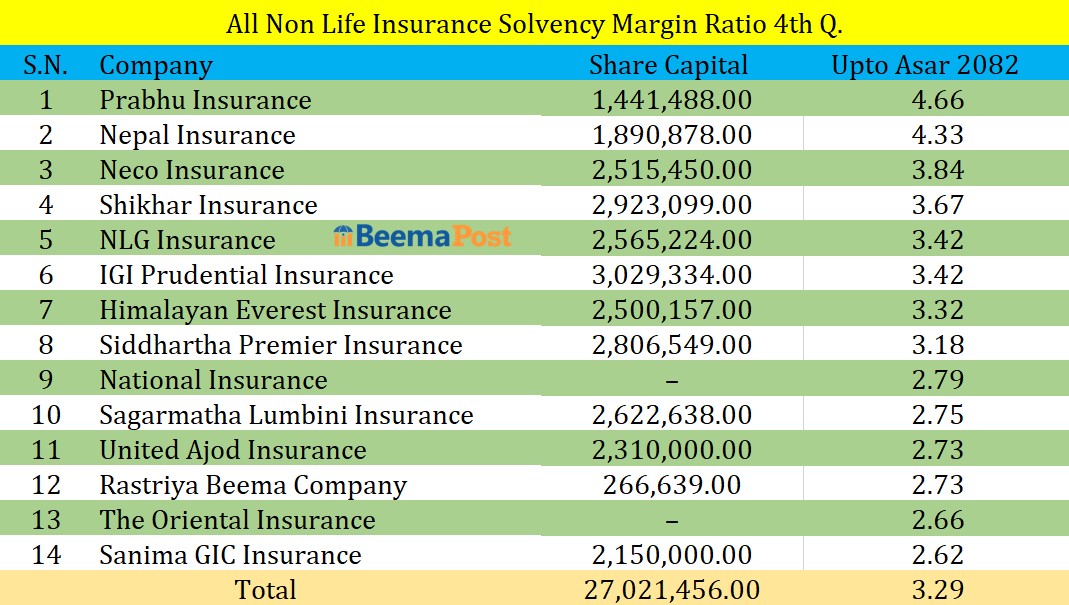

Non-Life Insurance Companies Maintain Strong Solvency Ratios, Prabhu Insurance Tops the List

Kathmandu — Non-life insurance companies operating in Nepal have maintained an average solvency ratio of 3.29, well above the minimum requirement set by the Nepal Insurance Authority. The figure, based on the financial statements of the last quarter of FY 2081/82, highlights the strong financial stability of the country’s non-life insurance sector.

Among the 14 companies, Prabhu Insurance reported the highest solvency ratio at 4.66, making it the safest company in terms of risk-bearing capacity. Nepal Insurance followed with a solvency ratio of 4.33, while Neco Insurance and Shikhar Insurance recorded 3.84 and 3.67, respectively.

Other insurers also posted healthy ratios, including NLG Insurance and IGI Prudential Insurance (3.42 each), Himalayan Everest Insurance (3.32), and Siddhartha Premier Insurance (3.18). On the lower end, National Insurance stood at 2.79, Sagarmatha Lumbini Insurance at 2.75, United Ajod Insurance and the state-owned Rastriya Beema Company at 2.73 each, The Oriental Insurance at 2.66, and Sanima GIC Insurance at 2.62.

The Insurance Authority requires insurers to maintain a solvency ratio of at least 1.5. With all companies performing significantly above this threshold, the sector demonstrates a robust capacity to meet future policyholder claims.