Life Insurance Companies Fund Climbs to Rs 804.48 Billion, IME Life Records Fastest Growth

Kathmandu – The size of the insurance fund of Nepal’s life insurance companies has rose to Rs 844.48 billion by the end of the last fiscal year 2081/82, underscoring the sector’s steady expansion and growing financial strength. The figure represents an 18.35 percent increase compared to the Rs 679.77 billion recorded in the previous fiscal year 2080/81, according to the latest financial statements released by the companies.

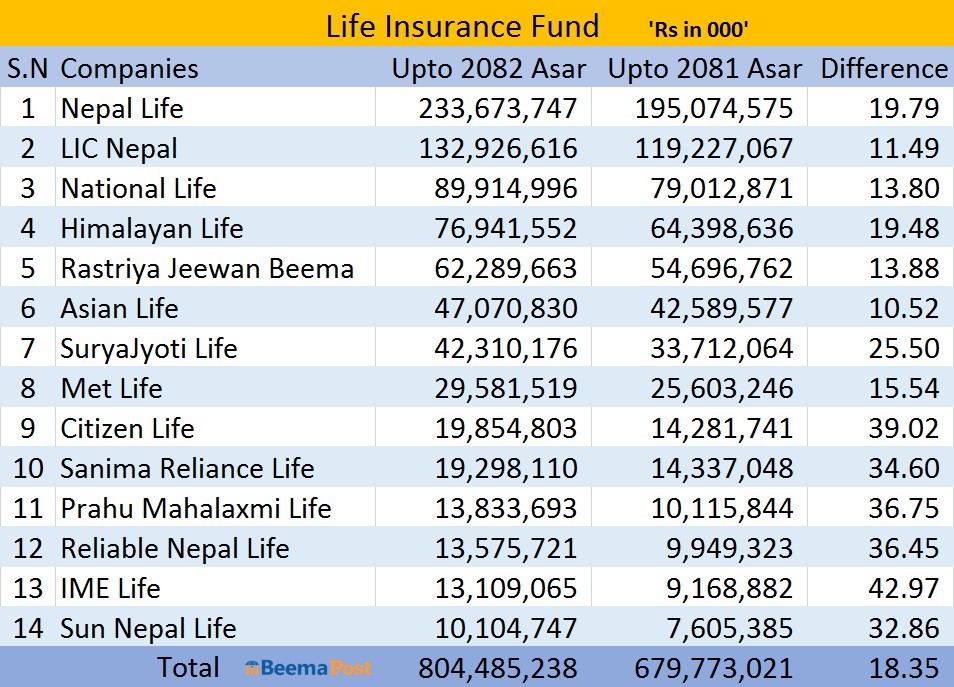

Among the insurers, Nepal Life Insurance Company tops the list with the largest fund of Rs 233.67 billion, up from Rs 195.70 billion the year before. It is followed by LIC Nepal with Rs 132.92 billion, National Life with Rs 89.91 billion, and Himalayan Life with Rs 76.94 billion. The government-owned Rastriya Jeevan Beema Company reported a fund size of Rs 62.28 billion, while Asian Life stood at Rs 47.07 billion, Suryajyoti at Rs 42.31 billion, and MetLife at Rs 29.58 billion. Citizen Life, Sanima Reliance, Prabhu Mahalaxmi, Reliable Nepal, IME Life, and Sun Nepal Life followed with funds ranging between Rs 10 billion and Rs 20 billion.

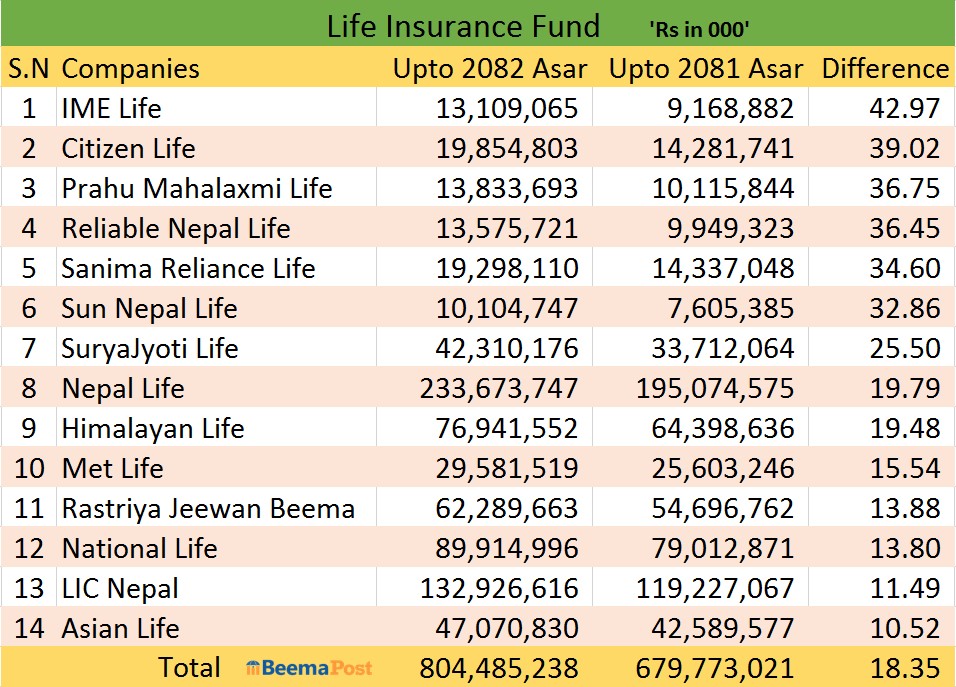

In terms of growth rate, IME Life topped the list with a remarkable 42.97 percent increase, growing its fund from Rs 9.16 billion in the previous fiscal year to Rs 13.10 billion last year. Citizen Life followed closely with a 39.02 percent rise, while Prabhu Mahalaxmi, Reliable Nepal, Sanima Reliance, Sun Nepal, and Suryajyoti also posted impressive growth rates between 25 and 37 percent.

By comparison, the industry giants saw more moderate gains, with Nepal Life’s fund growing by 19.79 percent, Himalayan Life by 19.48 percent, MetLife by 15.54 percent, Rastriya Jeevan Beema Company by 13.88 percent, LIC Nepal by 11.49 percent, and Asian Life by 10.52 percent.

By comparison, the industry giants saw more moderate gains, with Nepal Life’s fund growing by 19.79 percent, Himalayan Life by 19.48 percent, MetLife by 15.54 percent, Rastriya Jeevan Beema Company by 13.88 percent, LIC Nepal by 11.49 percent, and Asian Life by 10.52 percent.

The insurance fund is regarded as a crucial indicator of a life insurer’s financial health. It reflects not only the premiums collected from policyholders but also income generated through policy loans, fixed deposits, investment returns, and reinsurance commissions. A mandatory portion of the fund is reserved to cover future risks and claims, serving as a safeguard for policyholders and ensuring the long-term stability of the companies.