Life Insurance Companies Single Premium Income Soars, Nepal Life Leads the Market

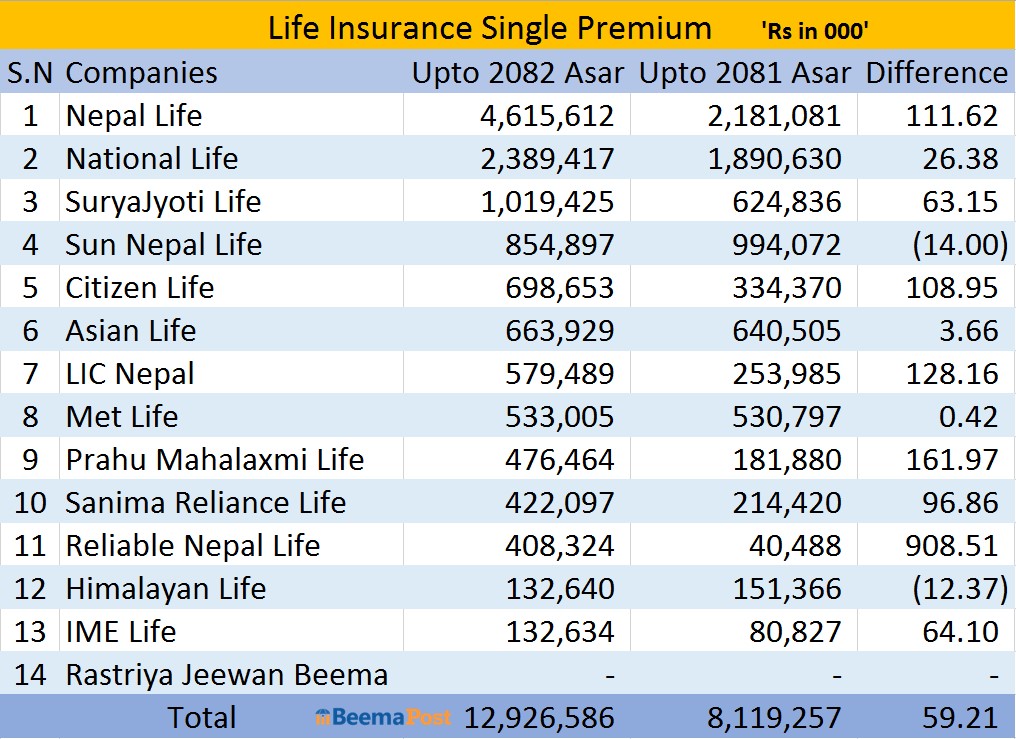

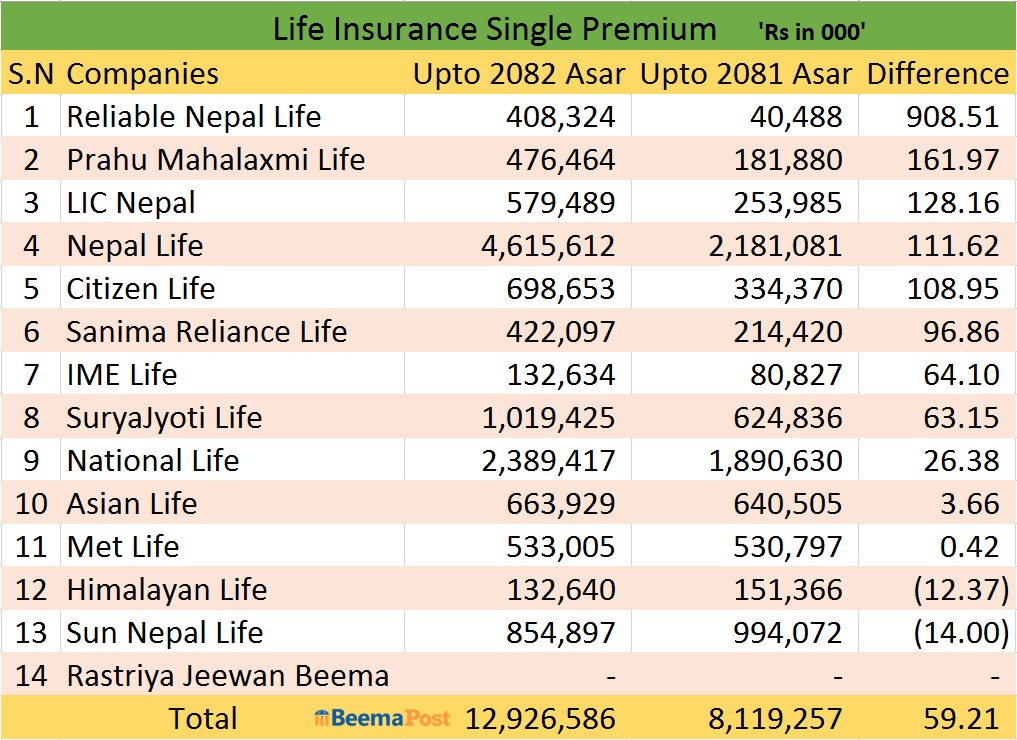

Kathmandu – The single premium income of life insurance companies has risen sharply in the last fiscal year (2081/082), marking a significant growth trend in the insurance sector. According to the fourth-quarter financial statements published by the companies, the total single premium collection stood at Rs 12.92 billion, up 59.21 percent compared to Rs 8.11 billion collected in the previous fiscal year.

Among the companies, Nepal Life Insurance emerged as the top performer, collecting Rs 4.61 billion through single premium policies. It was followed by National Life Insurance with Rs 2.38 billion and Suryajyoti Life with Rs 1.01 billion. Other significant contributors included Sun Nepal Life with Rs 854.8 million, Citizen Life with Rs 698.6 million, Asian Life with Rs 663.9 million, and LIC Nepal with Rs 579.4 million.

Meanwhile, MetLife collected Rs 533 million, Prabhu Mahalaxmi Life Rs 476.4 million, Sanima Reliance Life Rs 422 million, Reliable Nepal Life Rs 408.3 million, while Himalayan Life and IME Life each collected Rs 132.6 million.

In terms of growth rate, Reliable Nepal Life recorded the highest surge with a 908.51 percent increase compared to the previous fiscal year, followed by Prabhu Mahalaxmi Life at 161.97 percent and LIC Nepal at 128.16 percent. Nepal Life also posted strong growth at 111.62 percent, while Citizen Life rose by 108.95 percent and Sanima Reliance Life by 96.86 percent. IME Life and Suryajyoti Life saw growth of 64.10 percent and 63.15 percent, respectively, while National Life grew by 26.38 percent.

On the other hand, Asian Life registered only a marginal increase of 3.66 percent and MetLife 0.42 percent. However, two companies experienced declines: Himalayan Life fell by 12.37 percent and Sun Nepal Life by 14 percent in single premium collection.

On the other hand, Asian Life registered only a marginal increase of 3.66 percent and MetLife 0.42 percent. However, two companies experienced declines: Himalayan Life fell by 12.37 percent and Sun Nepal Life by 14 percent in single premium collection.

Notably, these details are unavailable for government-owned Rastriya Jeevan Beema Company, as the company has not yet undergone an audit

Single premium policies allow customers to pay their entire insurance premium in a lump sum instead of monthly, quarterly, half-yearly, or annual installments. This option minimizes the risk of policy lapse due to missed payments and often comes with discounts, making it increasingly attractive to policyholders.