Loan Disbursement in Commercial Banks in Nepal Reached Rs 485.5 Billion in FY 2081/82

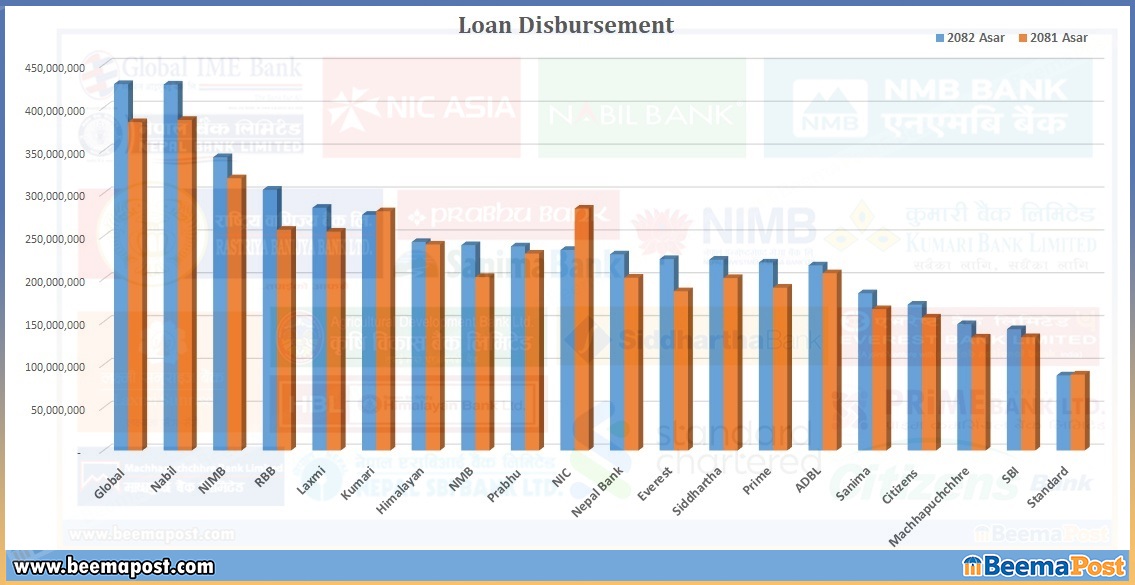

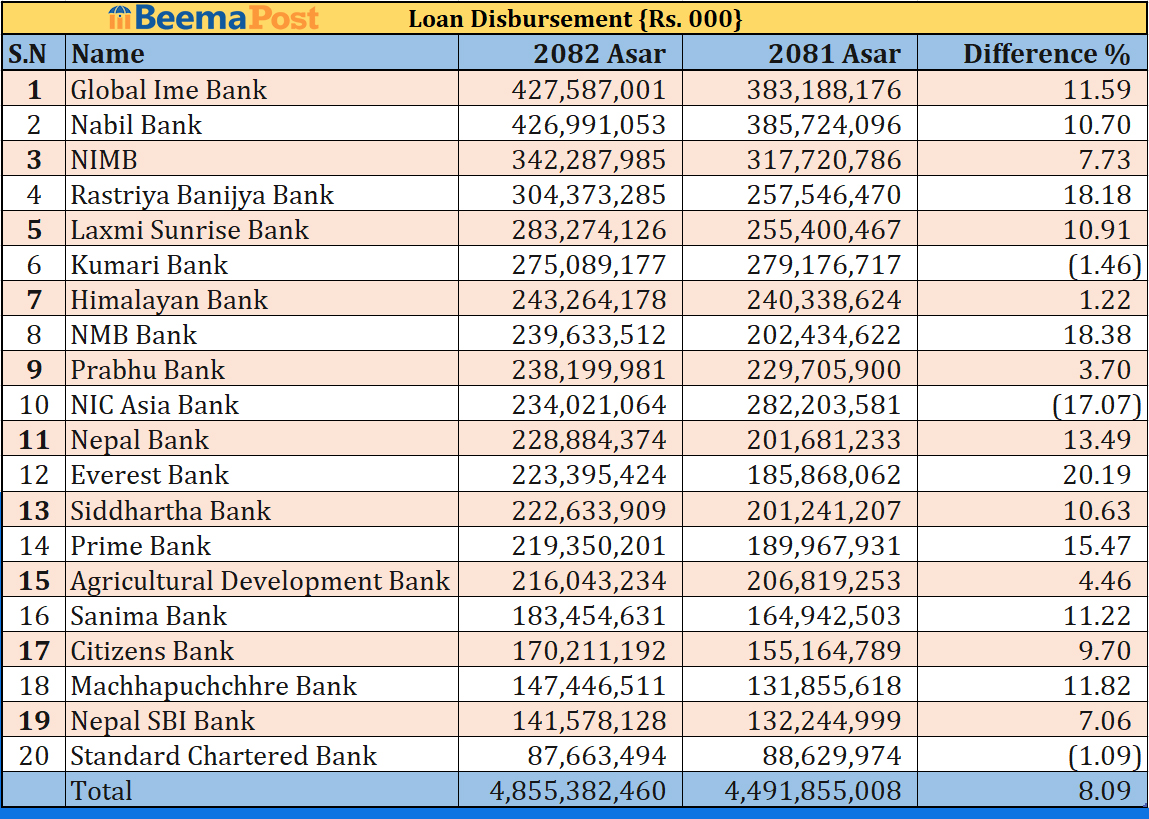

Kathmandu – Despite economic slowdown and multiple challenges, commercial banks in Nepal have accelerated credit expansion. According to the latest figures, the 20 commercial banks currently in operation disbursed loans worth Rs 485.5 billion in fiscal year 2081/82, marking an 8.09 percent rise compared to the previous year. In FY 2080/81, total credit investment stood at Rs 449.1 billion, showing an additional flow of Rs 363.52 billion this year.

Global IME Bank topped the list in terms of lending, expanding its credit portfolio by 11.59 percent to Rs 427.58 billion, up from Rs 383.18 billion a year earlier. Close behind, Nabil Bank secured the second position with a 10.70 percent growth, reaching Rs 426.99 billion compared to Rs 385.72 billion in the previous fiscal year.

In third place, Nepal Investment Mega Bank recorded a 7.73 percent increase with credit flow totaling Rs 342.28 billion. Rastriya Banijya Bank followed, expanding by 18.18 percent to Rs 344.37 billion. Laxmi Sunrise Bank, ranked fifth, saw lending rise by 10.91 percent to Rs 283.27 billion, while the bank placed sixth reported a slight decline of 1.46 percent, reducing its credit flow to Rs 275.8 billion.

Other banks also showed varying trends. Himalayan Bank’s loan portfolio increased by 1.22 percent to Rs 243.26 billion, while NMB Bank registered a sharp rise of 18.38 percent to Rs 239.63 billion. Prabhu Bank expanded by 3.70 percent to Rs 238 billion, whereas NIC Asia Bank saw a significant decline of 17.07 percent, bringing its lending down to Rs 234 billion. Nepal Bank posted a healthy growth of 13.49 percent, reaching Rs 228.8

billion.

Everest Bank stood out as one of the most aggressive lenders, expanding its credit flow by 20.19 percent to Rs 223.39 billion, the highest growth rate among the banks.

Meanwhile, Siddhartha Bank posted loans worth Rs 222.63 billion, Prime Bank Rs 219.35 billion, Agricultural Development Bank Rs 216.44 billion, Sanima Bank Rs 183.45 billion, Citizens Bank Rs 170 billion, Machhapuchhre Bank Rs 147 billion, Nepal SBI Bank Rs 141.5 billion, and Standard Chartered Bank Nepal Rs 87.66 billion in credit flow during the review period.