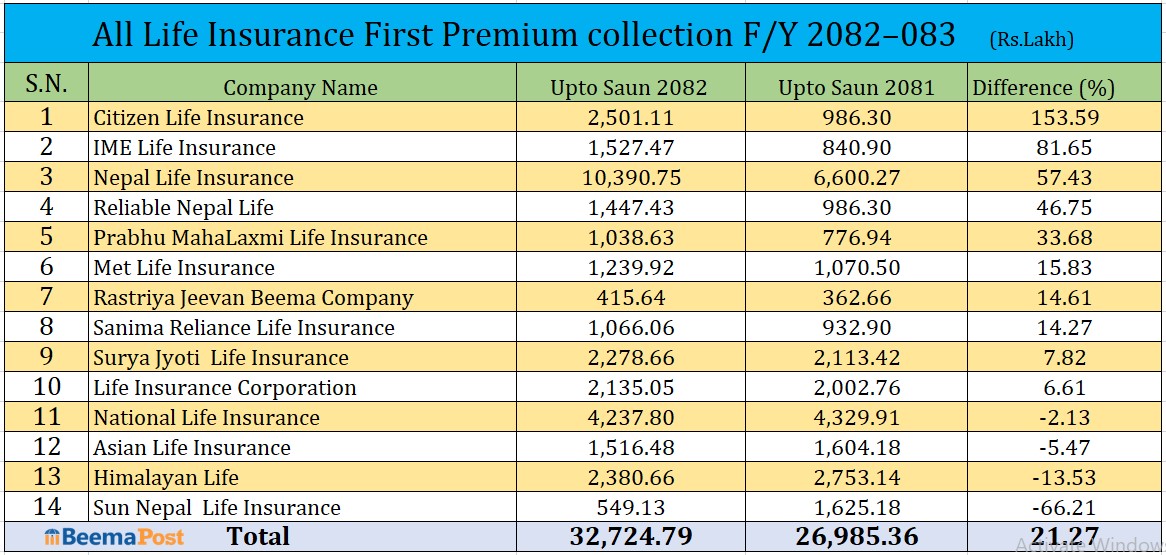

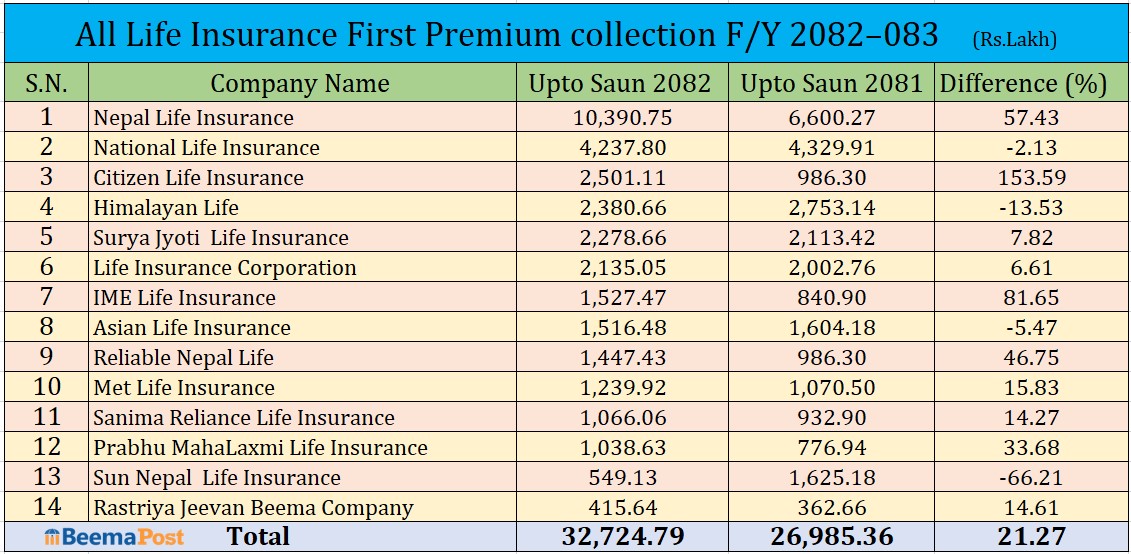

Life Insurance Companies Earn Rs 3.27 Billion in New Business in the First Month of FY 2082/83

Kathmandu – Life insurance companies in Nepal have collectively generated Rs 3.27 billion in new business during the first month of the current fiscal year, according to data published by the Nepal Insurance Authority. A total of 14 life insurance companies earned first premium income, including foreign employment insurance, during the month of Shrawan.

The figure marks a 21.27 percent increase compared to the same period last fiscal year, when the companies had earned Rs 2.69 billion. Among the companies, Nepal Life Insurance and National Life Insurance once again secured the highest premium earnings in Shrawan.

Several companies showed aggressive growth compared to last year. Citizen Life Insurance recorded the most notable rise, with its first premium income surging by 153.59 percent. IME Life Insurance followed closely, increasing its new business by 81.65 percent. Similarly, Nepal Life Insurance posted a 57.43 percent rise in first premium income, while Reliable Nepal Life Insurance and Prabhu Mahalaxmi Life Insurance grew by 46.75 percent and 33.68 percent, respectively.

Other companies also reported steady growth. MetLife saw a 15.83 percent increase, while the government-owned Rastriya Jeevan Beema Company reported 14.61 percent growth. Sanima Reliance Life Insurance posted a 14.27 percent rise, SuryaJyoti Life Insurance 7.82 percent, and LIC Nepal 6.61 percent compared to last year’s Shrawan earnings.

However, not all insurance companies experienced growth. The Authority’s data shows that the first premium income of National Life Insurance (-2.13 percent), Asian Life Insurance (-5.47 percent), Himalayan Life Insurance (-13.53 percent), and Sun Nepal Life Insurance (-66.21 percent) decreased during the review period. Sun Nepal Life, in particular, has halted its foreign employment insurance business, contributing to a modest decline in its premium income.

Shrawan holds particular significance for life insurers, as it marks the beginning of a new fiscal year and the launch of fresh strategic targets for agents. Companies often introduce new business strategies, agent incentives, and promotional activities starting from this month, making it a crucial period for shaping annual performance.