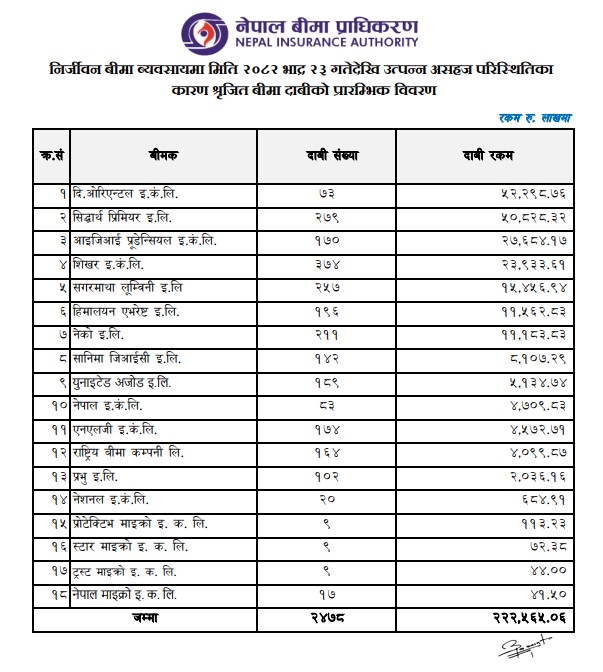

Insurance Claims from Gen Z Protest Reach Rs 22.2 Billion

Kathmandu – The initial insurance claims arising from the Gen Z protest that began on Bhadra 23 last month have reached Rs 22.2 billion, according to the Nepal Insurance Authority (NIA). As of Ashoj 5, a total of 2,478 claims have been registered across the country.

Among insurers, The Oriental Insurance Company reported the highest total claims amounting to Rs 5.22 billion from 73 claims nationwide. Following closely, Siddhartha Premier Insurance received Rs 5.82 billion in claims from 279 incidents, ranking second in terms of the number of claims.

IGI Prudential Insurance secured third place with 170 claims totaling Rs 2.73 billion, while Shikhar Insurance recorded 374 claims amounting to Rs 2.39 billion. Sagarmatha Lumbini Insurance received claims worth Rs 1.54 billion for 257 cases, Himalayan Everest Insurance Rs 1.15 billion for 196 cases, and Neco Insurance Rs 1.11 billion for 211 cases.

Other insurers reporting significant claims include Sanima GIC Insurance (Rs 810.7 million, 142 claims), United Ajod Insurance (Rs 485.1 million, 170 claims), Nepal Insurance (Rs 479 million, 83 claims), and NLG Insurance (Rs 457.2 million, 174 claims). The government-owned Rastriya Beema Company received Rs 409.9 million from 164 claims, Prabhu Insurance Rs 203.6 million from 102 claims, and National Insurance Rs 68.4 million from 20 claims.

Other insurers reporting significant claims include Sanima GIC Insurance (Rs 810.7 million, 142 claims), United Ajod Insurance (Rs 485.1 million, 170 claims), Nepal Insurance (Rs 479 million, 83 claims), and NLG Insurance (Rs 457.2 million, 174 claims). The government-owned Rastriya Beema Company received Rs 409.9 million from 164 claims, Prabhu Insurance Rs 203.6 million from 102 claims, and National Insurance Rs 68.4 million from 20 claims.

Microinsurance companies have also been active in processing claims. Protective Micro Insurance received nine claims worth Rs 11.1 million, Star Micro Insurance nine claims worth Rs 7.2 million, Trust Micro Insurance nine claims worth Rs 4.4 million, and Nepal Micro Insurance 17 claims totaling Rs 4.1 million.

The Nepal Insurance Authority has emphasized speedy claim processing to provide prompt relief to affected individuals and businesses.