Public Property Insurance: Nepal Needs a Dedicated Risk Management Modality

Kathmandu — The recent destruction of public and private property across the country has once again raised a critical question: how should Nepal manage the risks associated with public assets? While individuals and businesses rely on commercial insurance for protection, there is currently no insurance mechanism for government-owned property or vehicles. This gap has sparked an urgent debate on what risk management model would be most suitable for Nepal.

Commercial insurance operates under the Law of Large Numbers—premiums collected from many policyholders fund the compensation of a few who suffer losses. However, when disasters strike at a national scale—whether natural calamities, conflicts, or large-scale accidents—the losses often exceed the capacity of both insurers and reinsurers. In fact, global history shows instances where reinsurance companies have collapsed under the financial strain of catastrophic payouts.

In Nepal’s context, the value of public property is immense. Covering all such assets under commercial insurance is not financially feasible for the state. Moreover, the very principles of commercial insurance—particularly the principle of indemnity (compensating equal to the loss)—do not align with the practical needs of public property reconstruction. Instead, the principle of necessity, which focuses on providing minimum but essential assistance, is more applicable.

Why commercial insurance is unsuitable for public property:

• The sheer scale of public assets makes premium payments to private insurers impractical.

• Public property reconstruction requires flexible, need-based support, not rigid indemnity-based payouts.

• Commercial policies are bound by strict conditions that may not accommodate the state’s financial realities.

For example, if a Rs. 50 million building is destroyed, the government may only need to construct a simpler building to restore functionality, rather than replicate the original structure. Similarly, a damaged luxury vehicle worth Rs. 20 million may be replaced with a more affordable alternative sufficient for official use.

The proposed solution: A Public Property Insurance Fund

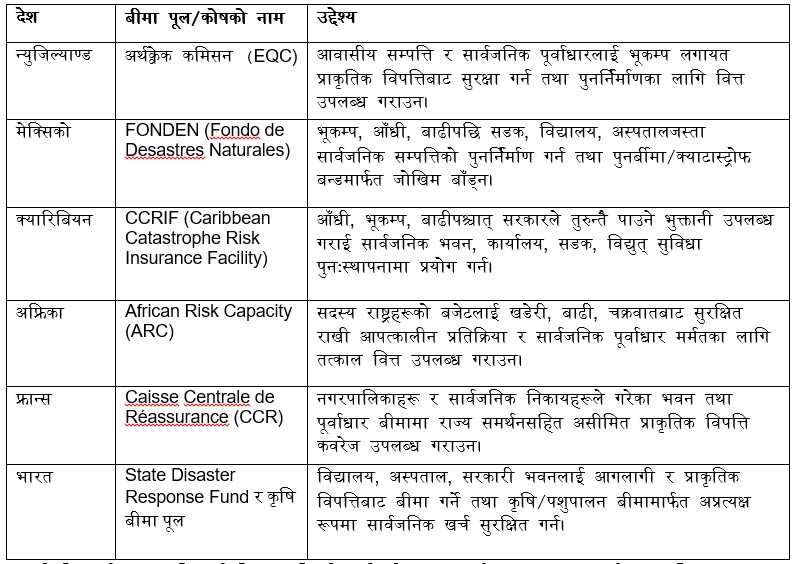

Many countries have already adopted dedicated funds to compensate for damages to public property. Nepal, too, needs to establish such a mechanism—a Public Property Insurance Fund.

Key features of the proposed fund include:

• Annual contributions from the state, with unused balances carried forward.

• Clear procedures on when and how compensation will be disbursed.

• Management under a designated government agency, without obligations for dividends or tax payments.

• Savings retained year to year, ensuring a growing reserve for times of crisis.

This model ensures that resources are available for reconstruction and relief, without over-reliance on private insurers or external aid. It prioritizes continuity of public services and infrastructure rather than strict financial equivalence of losses.

At a time when disasters—both man-made and natural—pose increasing threats, the establishment of a Public Property Insurance Fund would provide Nepal with a much-needed safety net. It would not only ensure timely relief but also strengthen the country’s resilience against future shocks.