Himalayan Life Insurance Reports 4.32 billion in Net Premium in Q1

Kathmandu — Himalayan Life Insurance Company Limited has published its first-quarter financial results, reporting a significant decline in profitability despite modest growth in net insurance premium income.

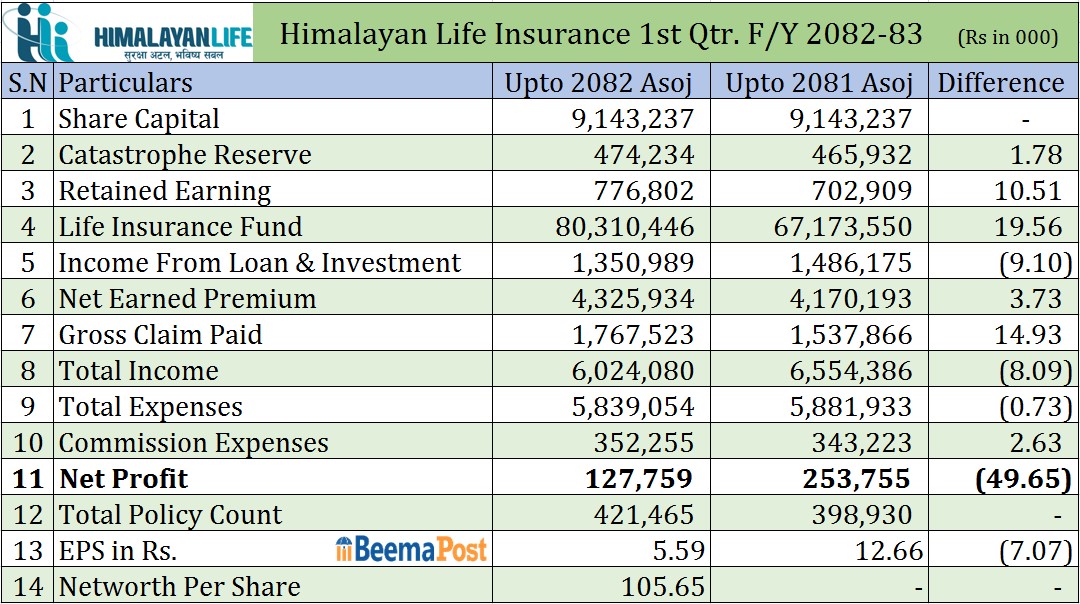

The insurer earned a net profit of Rs 127.7 million during the first quarter of the current fiscal year, a sharp 49.65 percent decrease from the Rs 253.7 million recorded in the same period last year.

Despite the decline in profit, the company’s net insurance premium income improved. Himalayan Life collected Rs 4.32 billion in net premiums, up 3.37 percent from Rs 4.17 billion in the first quarter of the previous fiscal year.

However, total income during the review period declined. The company’s total revenue fell by 8 percent to Rs 6.24 billion, compared to Rs 6.55 billion a year earlier. Total expenses also decreased slightly from Rs 5.88 billion to Rs 5.83 billion, indicating controlled expenditure despite reduced revenue.

Agent commission payouts saw a small rise. The insurer, which had paid Rs 343.2 million in commissions by the end of Ashoj month last year, increased the amount to Rs 352.2 million this fiscal year — a 2.63 percent growth.

Himalayan Life’s life insurance fund continued to expand significantly. The fund increased from Rs 67.17 billion in the corresponding period last year to Rs 80.31 billion in the current fiscal year.

The company has a paid-up capital of Rs 9.14 billion, a disaster fund of Rs 474.2 million, and a reserve fund of Rs 776.8 million. Its earnings per share (EPS) stand at Rs 5.59, while net worth per share is Rs 105.65.