Gen-Z Movement Pushes Nepal’s Non-Life Insurers into Heavy Losses in Q1

Kathmandu – The Gen-Z movement on Bhadra 23 and 24 has dealt a significant blow to Nepal’s non-life insurance sector, with most companies reporting steep losses in the first quarter of the current fiscal year. Out of 14 active non-life insurers, 12 have fallen into losses as claim liabilities surged following widespread vandalism of private property during the movement.

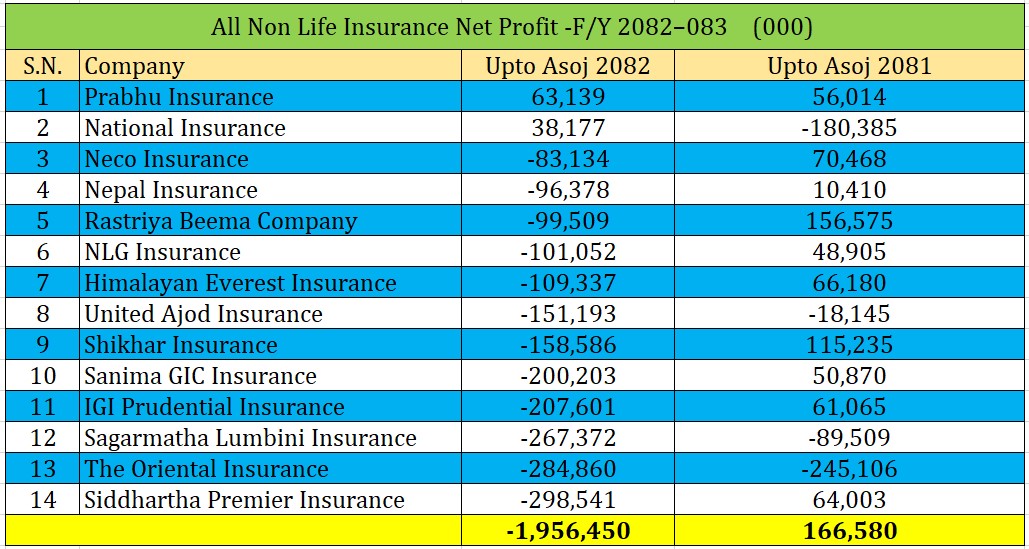

According to the financial statements, only Prabhu Insurance and National Insurance Company remained profitable. Prabhu Insurance recorded a profit of Rs 631.3 million, while National Insurance earned Rs 381.7 million. In contrast, the combined losses of the remaining insurers have reached nearly Rs 2.5 billion, pulling the overall sector into deep negative territory. The total net profit of all non-life insurance companies currently stands at a negative Rs 1.95 billion.

Industry observers note that the burden on insurers intensified because many companies failed to secure reinsurance coverage under Terrorism Insurance. The inability of the Board of Directors’ Reinsurance Department to function effectively, along with limited regulatory action from the Nepal Insurance Authority, has left CEOs and Reinsurance Chiefs facing unprecedented liabilities.

The losses span almost every major company. Siddhartha Premier Insurance posted a quarterly loss of Rs 298.5 million, while The Oriental Insurance reported a loss of Rs 284.8 million. Sagarmatha Lumbini Insurance also entered the red with Rs 267.3 million in losses. IGI Prudential Insurance, which had earned a profit in the same period last year, has now fallen to Rs 207.6 million in negative profit. Shikhar Insurance reported a loss of Rs 158.5 million, and United Ajod Insurance recorded a loss of Rs 151.1 million for the quarter.

The financial pressure continued across the sector, with Himalayan Everest Insurance showing a loss of Rs 109.3 million, NLG Insurance reporting Rs 101.1 million in losses, and Nepal Insurance posting a loss of Rs 96.3 million. Even Neco Insurance, which usually maintains a stable performance, recorded a loss of Rs 83.1 million this quarter. Meanwhile, government-owned Rastriya Beema Company reported Rs 99.5 million in subsidiary profit, though this does little to offset the wider damage in the market.