Life Insurance Premium Income Rises 12.25% in First Quarter of 2082/83

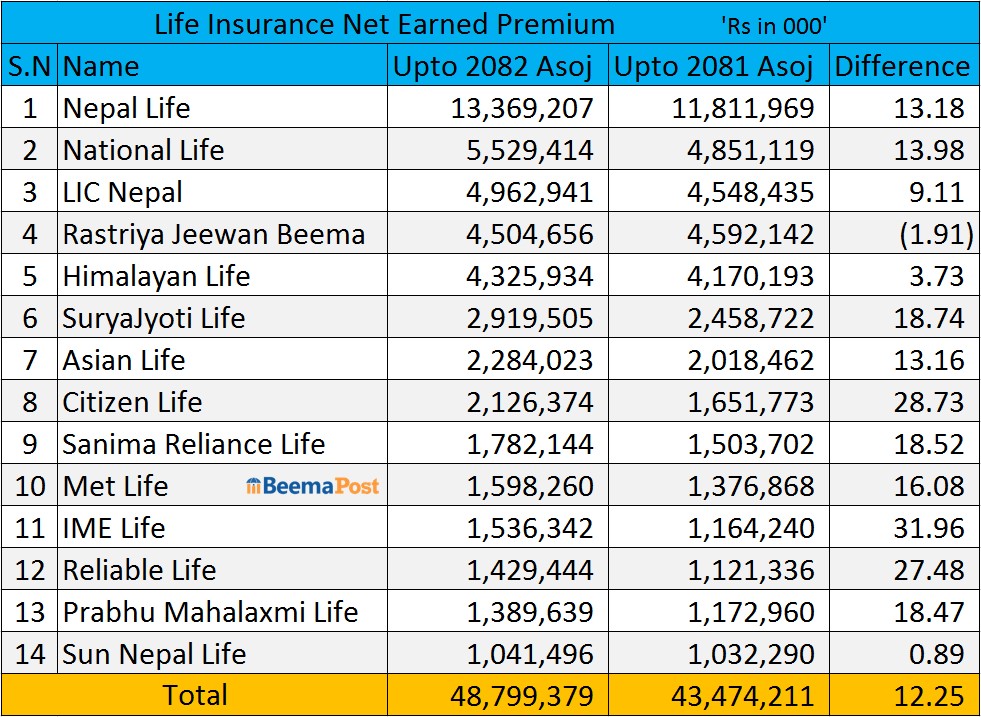

Kathmandu – All 14 life insurance companies have published their first quarter financial statements for the current fiscal year, revealing a 12.25 percent growth in total life insurance business compared to the same period last fiscal year. By the end of the first quarter, life insurance companies collectively earned a net insurance premium of Rs 48.79 billion, reflecting steady expansion in the sector.

Among the companies, Nepal Life Insurance continued to lead the market with a net premium income of Rs 13.36 billion in the first quarter. National Life secured second position with Rs 5.52 billion, while LIC Nepal followed closely with Rs 4.96 billion.

The government-owned Rastriya Jeevan Bemma Company earned Rs 4.5 billion, whereas Himalayan Life posted Rs 4.32 billion in net premium income. Suryajyoti Life recorded Rs 2.91 billion, Asian Life earned Rs 2.28 billion, and Citizen Life generated Rs 2.12 billion.

Similarly, Sanima Reliance Life posted earnings of Rs 1.78 billion, Met Life recorded Rs 1.59 billion, and IME Life earned Rs 1.53 billion. Reliable Nepal Life and Prabhu Mahalaxmi Life generated Rs 1.42 billion and Rs 1.38 billion, respectively. Sun Nepal Life accumulated Rs 1.41 billion in net premiums.

Growth rates among companies varied significantly. IME Life reported the highest expansion with a 31.96 percent increase in premium income compared to the same period of the previous fiscal year. It was followed by Citizen Life with 28.73 percent, Reliable Nepal Life with 27.48 percent, Suryajyoti Life with 18.74 percent, Sanima Reliance Life with 18.52 percent, Prabhu Mahalaxmi Life with 18.74 percent, and Met Life with 16.08 percent growth.

Other notable increases include National Life with 13.98 percent, Nepal Life with 13.18 percent, Asian Life with 13.16 percent, and LIC Nepal with 9.11 percent. Himalayan Life recorded modest growth of 3.73 percent, while Sun Nepal Life reported a slight rise of 0.89 percent. In contrast, the government-owned Rastriya Jeevan Beema Company experienced a 1.91 percent decline in net premium income.