Life and Non-Life Insurance Companies Prioritizing Different Investment Horizons

Kathmandu — Insurance companies operating in Nepal are making investments in accordance with the Nepal Insurance Authority’s guidelines, with notable differences in investment patterns between life and non-life insurers. Life insurance companies are found to be placing greater emphasis on long-term investments, while non-life insurers are largely focused on short-term instruments.

Industry officials explain that this difference stems from the nature of the insurance products. Life insurance policies generally mature only after 10 to 15 years and involve relatively fewer immediate claim payouts. As a result, life insurance companies prefer long-term investment avenues that align with the duration of their policy liabilities. In contrast, non-life insurance policies are renewed within short periods—typically within one to one-and-a-half years—making short-term investments more practical. Nepal Insurance Association President Birendra Baidwar Chhetri noted that non-life insurers prioritize short-term placements because their policies cycle quickly.

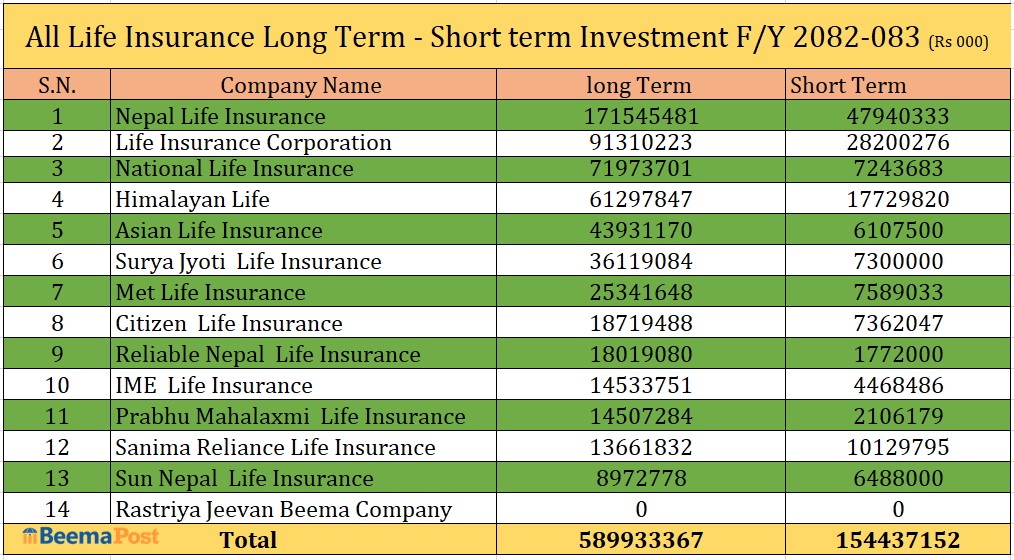

Financial statements from the first quarter of the current fiscal year show that life insurance companies have made long-term investments of nearly Rs 600 billion, while their short-term investments are limited to around Rs 150 billion. Nepal Life Insurance has the highest long-term investment, with Rs 171.54 billion, along with Rs 47.94 billion in short-term instruments. LIC Nepal follows with long-term investments of Rs 91.31 billion and short-term investments of Rs 28.20 billion. National Life Insurance has invested Rs 71.97 billion in long-term and Rs 7.24 billion in short-term placements, while Himalayan Life Insurance has Rs 61.29 billion in long-term and Rs 17.72 billion in short-term investments. Other life insurers have also increased their long-term portfolios, though the government-owned Rastr Jeevan Beema Company has not disclosed its investment breakdown this quarter.

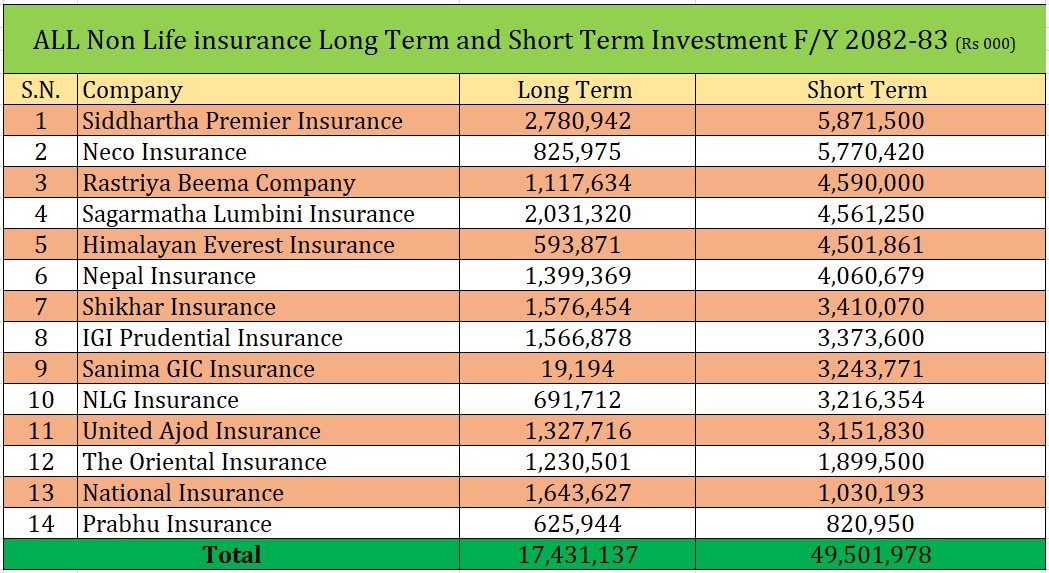

Non-life insurance companies, on the other hand, have continued to channel most of their funds into short-term options. Their short-term investments reached Rs 49.5 billion in the first quarter, nearly three times their long-term investments, which stand at Rs 17.43 billion. Siddhartha Premier Insurance leads the non-life sector with Rs 5.87 billion in short-term investments and Rs 2.78 billion long-term. Neco Insurance, the state-owned Rastriya Beema Company, Sagarmatha Lumbini Insurance, Himalayan Everest Insurance, Nepal Insurance, Shikhar Insurance, IGI Prudential Insurance, Sanima GIC Insurance, NLG Insurance, United Ajod Insurance, The Oriental Insurance and Prabhu Insurance also hold significant amounts in short-term placements, reflecting a sector-wide preference for liquidity.

Non-life insurance companies, on the other hand, have continued to channel most of their funds into short-term options. Their short-term investments reached Rs 49.5 billion in the first quarter, nearly three times their long-term investments, which stand at Rs 17.43 billion. Siddhartha Premier Insurance leads the non-life sector with Rs 5.87 billion in short-term investments and Rs 2.78 billion long-term. Neco Insurance, the state-owned Rastriya Beema Company, Sagarmatha Lumbini Insurance, Himalayan Everest Insurance, Nepal Insurance, Shikhar Insurance, IGI Prudential Insurance, Sanima GIC Insurance, NLG Insurance, United Ajod Insurance, The Oriental Insurance and Prabhu Insurance also hold significant amounts in short-term placements, reflecting a sector-wide preference for liquidity.

Both life and non-life insurers have invested across a diverse range of sectors, including balances in ‘A’, ‘B’ and ‘C’ class banks and financial institutions licensed by Nepal Rastra Bank, shares of listed companies, hydropower projects, Citizen Investment Fund instruments, and corporate debentures.

Both life and non-life insurers have invested across a diverse range of sectors, including balances in ‘A’, ‘B’ and ‘C’ class banks and financial institutions licensed by Nepal Rastra Bank, shares of listed companies, hydropower projects, Citizen Investment Fund instruments, and corporate debentures.