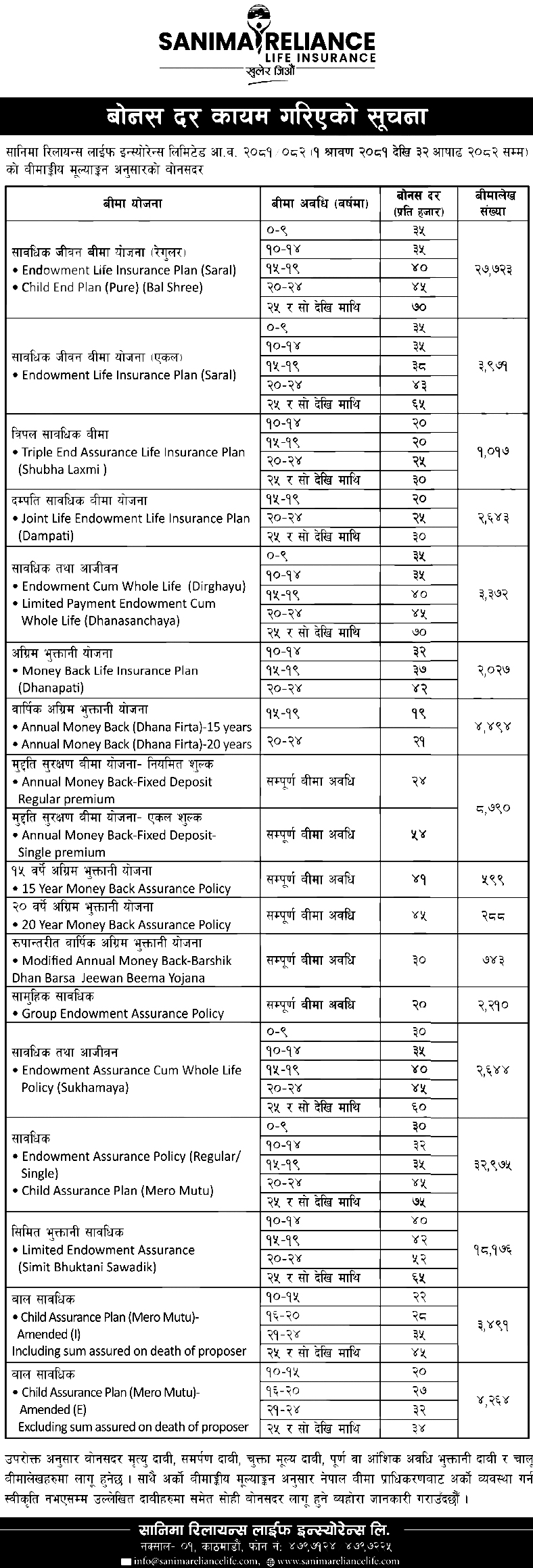

Sanima Reliance Life Insurance Announces New Bonus Rates

Kathmandu – Sanima Reliance Life Insurance Limited has made public the new bonus rates based on the actuarial valuation report of the last fiscal year. The company stated that the updated rates will apply to all eligible policies and related claims unless another arrangement is approved by the Nepal Insurance Authority.

According to the revised structure, the bonus for the Endowment Life Insurance Plan (regular) ranges from a minimum of Rs 35 to a maximum of Rs 70 per thousand, while the Endowment Life Insurance Plan (single) will receive bonuses between Rs 35 and Rs 65 depending on the insurance period. In the Triple End Assurance Plan and Joint life Endowment Insurance Plan, the bonus will be provided from Rs 20 to Rs 30. Similarly, the Endowment and Whole Life Insurance Plan will offer a bonus between Rs 35 and Rs 70.

The company has fixed the bonus between Rs 32 and Rs 42 in the Money Back Life Insurance Plan, and between Rs 19 and Rs 21 in the Annual Advance Payment Plan. The Term Security Insurance Plan (regular fee) will receive a bonus of Rs 24 for all policy periods, while the aAnnual Money Back Plan (single fee) will provide a bonus of Rs 54 for the entire duration. Likewise, the 15-year Money Back Assurance Plan carries a bonus of Rs 41, the 20-year Advance Payment Plan offers Rs 45, and the Converted Annual Advance Payment Plan provides Rs 30 across all insurance periods. The Group endowment Insurance Plan will offer a bonus of Rs 20 for the full insurance term.

For other plans, the company has set bonuses ranging from Rs 30 to Rs 60 for the Endowment and Whole Life Insurance category, Rs 30 to Rs 75 for the Endowment Insurance Plan, Rs 40 to Rs 65 for the Limited Payment endowment Plan, Rs 22 to Rs 45 for the Child Assurance Plan, and Rs 20 to Rs 34 for an additional insurance category included in the updated structure.

Sanima Reliance Life Insurance clarified that these bonus rates will also be applied to death claims, surrender claims, paid-up value claims, full or partial maturity payments, and all ongoing policies.