Nepal Life Announces New Bonus Rates, Insured to Receive Up to Rs 85

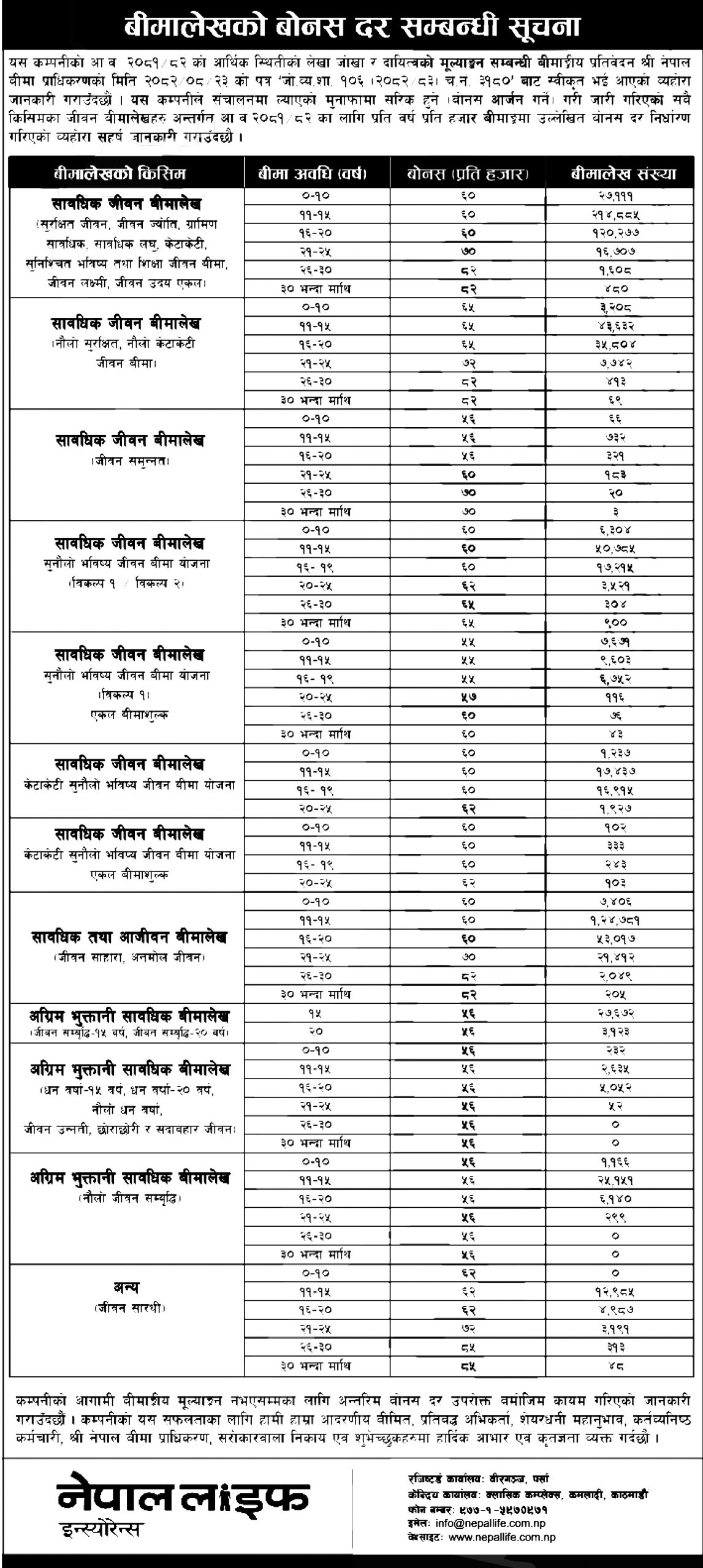

Kathmandu – Nepal Life Insurance Company Limited has announced new bonus rates after the Nepal Insurance Authority approved the actuarial valuation report on the company’s financial position and liabilities for the last fiscal year on Mangsir 23. With the approval, the company has revised the bonus amounts for a wide range of insurance plans, with policyholders now eligible to receive bonuses of up to Rs 85 per thousand.

According to the updated structure, the company will provide a bonus ranging from Rs 60 to Rs 82 per thousand on term life insurance plans including Suraksha Jeevan, Jeevan Jyoti, Gramin Endorsement Life, Endowment Mini, Children plans, Sure Future, Education Life Insurance, Jeevan Laxmi and the single-premium Jeevan Udaya policy. Similarly, the bonus rate for Naulo Suraksha and Naulo Ketaketi Life Insurance has been set between Rs 65 and Rs 82, while Jeevan Samunnat Bima Yojana will receive bonuses from Rs 56 to Rs 70.

Under the Sunaulo Bhavishya Jeevan Bima Yojana (Option 1 and Option 2), policyholders will receive bonuses ranging from Rs 60 to Rs 65. Children’s Sunaulo Bhabishya Jeevan Bima Yojana will carry a bonus between Rs 60 and Rs 62 for all insurance periods. The company has also set the same bonus range for other child-focused plans under the same category.

Meanwhile, endowment and whole life insurance plans such as Jeevan Sahara and Anmol Jeevan Beema Yojana will provide bonuses from Rs 60 to Rs 82 per thousand. For advance-payment insurance policies like Jeevan Samvriddhi (15-year and 20-year terms), the company has fixed a uniform bonus of Rs 56. The same bonus applies to Dhan Barsha (15-year and 20-year), Naulo Dhan Varsha, Jeevan Sambriddhi and Children Sadabahar Jeevan plans. In addition, the bonus rate for other plans under the Jeevan Sarathi category ranges from Rs 62 to a maximum of Rs 85, the highest among the newly announced rates.

Nepal Life stated that these revised bonus rates will be applicable to all eligible policies and associated claims as per the actuarial valuation, providing clarity and consistency for policyholders across its insurance portfolio.