Global Reinsurance Capital Surpasses $720 Billion in Q1 2025: Aon

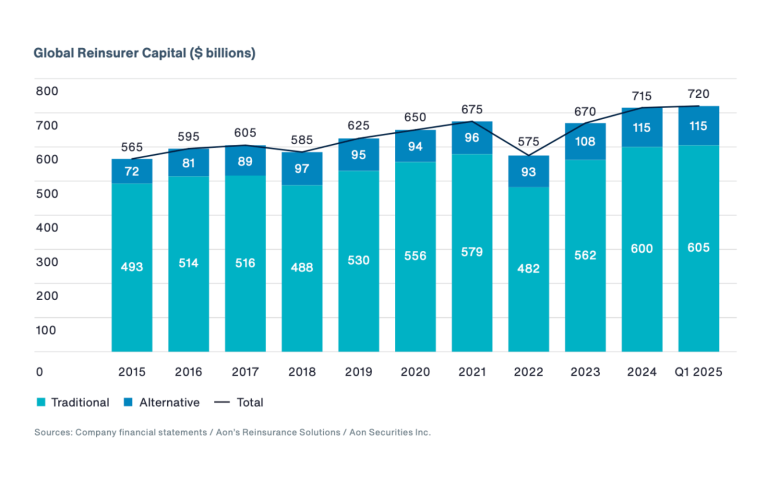

Aon’s latest midyear 2025 Reinsurance Market Dynamics report has revealed that global reinsurance capital rose to $720 billion by the end of the first quarter, up from $715 billion during the same period in 2024. The report highlights a broadly competitive environment at the June/July renewal season, despite an active first half marked by significant natural catastrophe losses.

Reinsurers, insurance-linked securities (ILS) markets, and new market entrants demonstrated a strong appetite for growth, deploying additional capacity and intensifying competition. This contributed to an acceleration in buyer-friendly conditions, including greater flexibility in terms and conditions and opportunities for insurers to secure expanded coverage.

While overall pricing continued to ease, renewal outcomes varied significantly. Reinsurers increasingly differentiated their support based on insurers’ past loss experiences and performance metrics. Despite the financial impact of the California wildfires, two-thirds of the reinsurers tracked by Aon reported double-digit annualized returns on equity in the first quarter.

The catastrophe bond market also marked a milestone, with record issuance exceeding $16.8 billion in the first half of 2025. The period featured the two largest transactions in the history of the market, each valued at over $1.5 billion.

Total global reinsurance capacity was more than adequate to meet increased demand during the midyear renewals, particularly in the U.S. A notable 10% increase in limit purchased was observed across all regions, driven by inflation, evolving catastrophe models, and a significant depopulation of Florida’s state-backed insurer, Citizens. Insurers also reassessed protection needs in response to major events, including U.S. wildfires and Brazilian floods.

The property catastrophe segment continued to benefit from rising supply, enabling more flexible contract terms, broader product offerings, and increased pricing competition globally. Reinsurers also showed a stronger willingness to provide coverage at lower levels in program structures.

Looking ahead, Aon believes that several large reinsurance firms are on pace to achieve strong results in 2025, citing the fact that Europe’s big four – Munich Re, Swiss Re, Hannover Re, and SCOR – have all maintained their full-year 2025 profit projections despite the costly wildfires in Q1.