US Tariffs to Slow Global Economy and Insurance Premium Growth: Swiss Re Institute

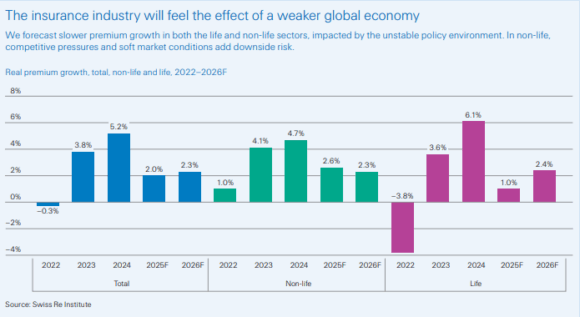

Zurich — The Swiss Re Institute has warned that recent US tariff policies are expected to slow global GDP growth to 2.3% in 2025, down from 2.8% in 2024. The resulting uncertainty is also set to dampen global insurance premium growth, forecast to decline from 5.2% last year to just 2% in 2025.

The report highlights that the US, once a post-pandemic growth leader, will see GDP growth fall to 1.5% this year, driven by higher import costs and reduced household consumption. While some rebound to 1.8% is expected in 2026, long-term global economic fragmentation may weaken insurance affordability and risk resilience.

Both life and non-life insurance sectors are slowing, with life premiums forecast to drop to 1% growth in 2025. Non-life premium growth will decline to 2.6%, with the US motor insurance sector most affected due to rising vehicle repair and replacement costs.

Despite the downturn, insurers’ profitability outlook remains positive thanks to stronger investment income. Meanwhile, opportunities may emerge in credit, surety, and marine insurance as global supply chains shift.

In 2024, the US led global premium volumes at USD 3.5 trillion, followed by China and the UK. Global insurance market growth stood at 7.2% last year, with the top 20 markets contributing over 90% of total premiums.