Commercial Banks in Nepal Post Over Rs 71 Billion Profit in FY 2081/82

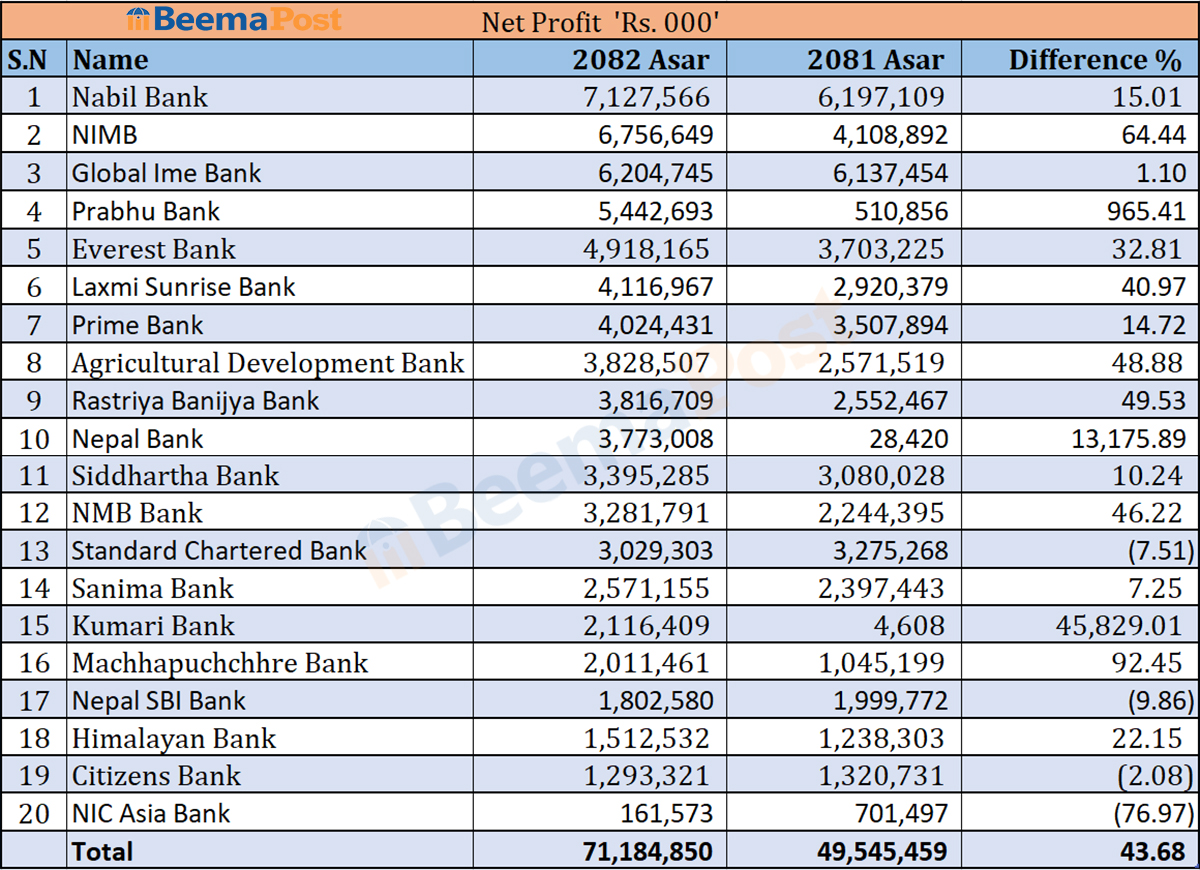

Kathmandu – Nepal’s commercial banking sector has reported a substantial increase in profitability in the last fiscal year, according to financial statements up to the fourth quarter of FY 2081/82. The total profit of the 20 banks currently operating in the country reached Rs 71.18 billion, marking a 43.68 percent increase compared to Rs 49.54 billion in the previous fiscal year.

Nabil Bank continues to lead in profitability, earning Rs 7.12 billion, a 15.01 percent growth from Rs 6.19 billion. Nepal Investment Mega Bank followed with a 64.44 percent jump in profit, reaching Rs 6.75 billion, up from Rs 4.10 billion last year.

Global IME Bank secured the third spot with profits rising slightly by 1.10 percent to Rs 6.2 billion. Prabhu Bank saw a remarkable increase of 965.41 percent, earning Rs 5.44 billion. Everest Bank and Laxmi Sunrise Bank earned Rs 4.91 billion and Rs 4.11 billion, marking growths of 32.81 percent and 40.97 percent, respectively.

Prime Bank recorded a profit of Rs 4.2 billion, up 14.72 percent, while Agricultural Development Bank and Rastriya Banijya Bank grew by 48.88 percent and 49.53 percent, earning Rs 3.82 billion and Rs 3.81 billion, respectively. Nepal Bank reported an extraordinary 13,175.89 percent increase, posting Rs 3.77 billion in profit. Siddhartha Bank and NMB Bank also saw growth of 10.24 percent and 46.22 percent, earning Rs 3.39 billion and Rs 3.28 billion, respectively.

Meanwhile, Machhapuchhre Bank’s profit surged by 92.45 percent to Rs 2.01 billion, Kumari Bank skyrocketed by an unprecedented 45,829.01 percent to Rs 2.11 billion, and Himalayan Bank recorded a 22.15 percent increase to Rs 1.51 billion. Sanima Bank’s profit rose by 7.25 percent to Rs 2.57 billion.

However, a few banks experienced a decline in profits. Standard Chartered Bank’s profit fell by 7.51 percent to Rs 3.02 billion, Nepal SBI Bank’s dropped by 9.86 percent to Rs 1.80 billion, and Citizens Bank saw a marginal decrease of 2.08 percent to Rs 1.29 billion. NIC Asia Bank, which has been struggling financially for some time, reported a steep 76.97 percent decline in profit, earning only Rs 161.5 million.